Search results

KUALA LUMPUR: RAM Rating Services Bhd believes the 25 basis points increase in the Overnight Policy Rate is timely as it is an opportune monetary policy action to keep financial imbalances in check. RAM said yesterday the rate hike was to ensure the sustainability of economic growth without the threat of inflationary pressures destabilising its momentum. It said as of May, headline inflation stood at 3.4 per cent, which was in line with its forecast of 3.5 per cent for this year.

He also said local buyers remained on the sidelines due to a lack of fresh direction.

KUALA LUMPUR: Malaysia Petroleum Resources Corp (MPRC) has launched its inaugural corporate report for 2013. The report provides an overview of activities and achievements since its establishment in 2011. “After two years in operation, it is timely for the organisation to document its progress and strategic thrusts in fulfilling its mandates,” MPRC said yesterday.

KUALA LUMPUR: The Securities Commission has approved Northport Holdings Bhd’s proposed issuance of up to RM500 million sukuk. Proceeds of the sukuk issuance will be used to finance its capital expenditure requirement, existing bridging financing and general working capital, Northport said in a filing yesterday.

KUALA LUMPUR: Industronics Bhd has signed an exclusive agency contract with Dragonway Group Holdings Ltd. Industronics will be Dragonway’s sole agent in Malaysia and Thailand and one of its authorised agents in Hong Kong to distribute and market stylus signature board and the likes.

THE hike in the Overnight Policy Rate to 3.25 per cent will not jeopardise economic growth, said analysts.

“Phillip Futures Sdn Bhd Derivative Product Specialist David Ng said the depreciation of the ringgit against the dollar and positive demand-supply fundamentals are expected to give underlying support,” he said.

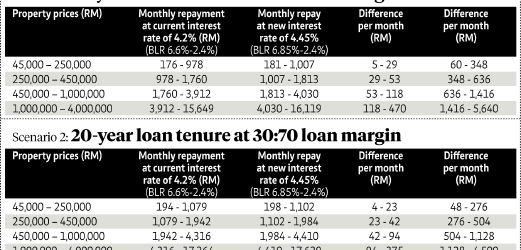

KUALA LUMPUR: Banks are now busy preparing notice advertisements to inform customers of their new interest rates following the 0.25 per cent increase in Overnight Policy Rate (OPR).

BANCO Espirito Santo (BES) steadied market jitters about its vulnerability to the troubled business empire of its founding family yesterday but investors are still in the dark about the size of any potential losses.

SEATTLE: Microsoft Corp chief executive officer Satya Nadella deferred any comment on widely expected job cuts at the software company on Thursday, after circulating a memo to employees promising to “flatten the organisation and develop leaner business processes”.

LONDON: The European Central Bank’s (ECB) newest stimulus package has had an impact on markets and there is no urgency to take additional steps, according to governing council member Ewald Nowotny.

NEW YORK: Billionaire activist investor Carl Icahn said on Thursday that it is time for United States stock market investors to tread carefully after the run-up on Wall Street.

PRIME Minister Narendra Modi’s first budget since his election win was seen as a missed chance to take tough measures on subsidies by economists at banks including Deutsche Bank AG and Nomura Holdings Inc.

TOKYO: Economics Minister Akira Amari warned that it would be premature for the Bank of Japan (BoJ) to consider an exit strategy from its massive stimulus programme, voicing hope instead for further monetary easing if achievement of its inflation goal falls behind schedule.

MANILA: The Philippine central bank expects the country’s current account and balance of payments (BOP) surpluses to be narrower than previously estimated due to higher import requirements, its governor said yesterday.