KUALA LUMPUR: Banks are now busy preparing notice advertisements to inform customers of their new interest rates following the 0.25 per cent increase in Overnight Policy Rate (OPR).

A number of sources in banks, when contacted, said it is pointless to speculate on, for example, housing loans and the rate increases that the banks will impose.

“There is no point in speculating as each bank will announce its rate in a notice advertisement to keep customers informed.

“The deposit rates will be dependent on the bank’s discretion as each would want to remain attractive, while the Base Lending Rate (BLR) will be tagged onto the OPR,” one source said.

On the matter of deposit rates, she said customers are always shopping for the best rates in town and the banks are expected to remain competitive on that front.

Meanwhile, Malayan Banking Bhd (Maybank) said yesterday it will revise upwards its BLR by 25 basis points from 6.60 per cent per annum to 6.85 per cent per annum, effective next Wednesday.

Its deposit rates will be revised upwards by up to 15 basis points.

The Base Financing Rate (BFR) of Maybank Islamic Bhd will similarly be revised upwards by 25 basis points to 6.85 per cent.

The last revision in Maybank’s BLR and Maybank Islamic’s BFR was on May 11 2011, when they were revised from 6.30 per cent per annum to 6.60 per cent per annum.

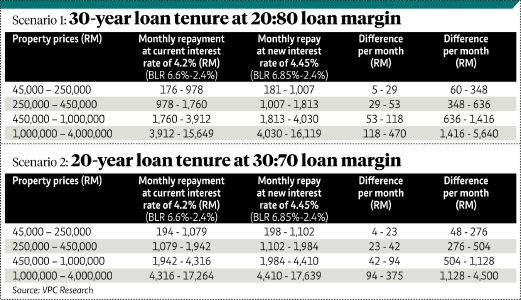

James Wong Kwong On, managing director of property consulting firm VPC Malaysia, said the interest rate hike will not affect high-end residential market.

However, the middle- to low-range residential market will be immediately impacted and a slowdown in sales is imminent.

“The initial jerk may affect new launches because when the buyer reads the market, there is possibly more increase (in OPR) on the way and their tendency is to be cautious,” he added.

Wong reckons that the OPR increase is not a one-off thing and over the next 1½ years, the rate can even go up to the level of 1.5 per cent.

“The good old days of people buying houses under a low interest regime are over. This is not just happening in Malaysia but also all over the world,” he pointed out.

Wong said his reference point for low-end housing sector is those units below the RM200,000 price range and the mid-range segment refers to those between RM200,000 and RM700,000 in the Klang Valley.

Going back to Bank Negara Malaysia’s announcement that is rattling consumers, the OPR has changed 25 basis points and that translates to a 0.25 per cent hike.

Online site Investopedia.com explained OPR best, saying: “Because the amount of money a bank has fluctuates daily based on its lending activities and its customers’ withdrawal and deposit activity, the bank may experience a shortage or surplus of cash at the end of the business day.

“Those banks that experience

a surplus often lend money overnight to banks that experience a shortage, so that the banking system remains stable and liquid. The overnight rate provides for an efficient method for banks to access short-term financing from central bank depositories.”