KUALA LUMPUR: Hong Leong Investment Bank Bhd research believes the diesel subsidy rationalisation will help boost the stock market as it signals yo investors that the Madani government is pushing through with its economic reforms.

In a note today, it said the move could also be a tailwind for Malaysia's sovereign rating.

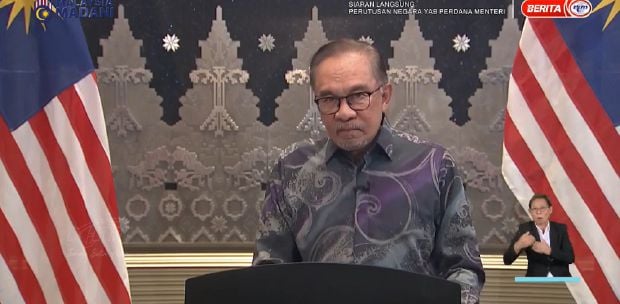

On Tuesday, Prime Minister Datuk Seri Anwar Ibrahim announced that the cabinet gave the greenlight for targeted fuel subsidies, first for diesel and then followed by RON95, with no timeline provided.

For now, these fuel subsidy reforms will only involve Peninsular Malaysia and not Sabah and Sarawak.

HLIB research estimates that the expected RM 4 billion annual savings from targeted diesel subsidies translates to 0.2 per cent of gross domestic product (GDP) versus the government's fiscal deficit target of -4.3 per cent for 2024 and -3.5 per cent to -3.0 per cent for 2025, based on the 12th Malaysian Plan Mid Term Review, and 29 per cent of total diesel subsidies.

"While the quantum of subsidy removal wasn't stated, we reckon that the inflationary impact should be manageable as diesel only accounts for 0.2 per cent of the Consumer Price Index (CPI) basket and logistics and public transport sectors will continue to be subsidised under subsidised diesel control scheme (SKDS). We estimate that every RM0.10 increase in diesel price would raise the CPI by more than 0.01percentage point on a full year basis.

Diesel subsidies will continue to be provided to businesses that use diesel motored commercial vehicles involving 10 types of public transport vehicles and 23 types of goods transport vehicles under the SKDS.

This will include bus and taxi operators, while selected categories of fishermen will also receive it.

Apart from that, the government will also offer cash assistance to private owners of diesel vehicles that qualify – including small farmers, paddy farmers and small traders.

The firm said while consumer discretionary spending might be affected by the increase in fuel prices, this impact is expected to be temporary, as seen in previous instances.

Additionally, it said there could be a mitigating effect from the Employees' Provident Fund (EPF) Account 3 and the upcoming salary increase for civil servants.

"Though data from the pre-pandemic decade did not show any inverse relationship between fuel consumption and price, it could be different this time around given the wider public transport network available (e.g. completion of MRT1&2, LRT extension), potentially softening volumes for Petronas Dagangan Bhd.While we see higher fuel prices having limited impact on auto sales (if any), this should encourage the adoption of electric vehicles (EV)," it said.