MOST millennials invest in exchange traded funds (ETFs) and cryptocurrencies while their parents had invested in bonds, shares and real estate.

Have you wondered how a tech whiz would invest to grow his wealth?

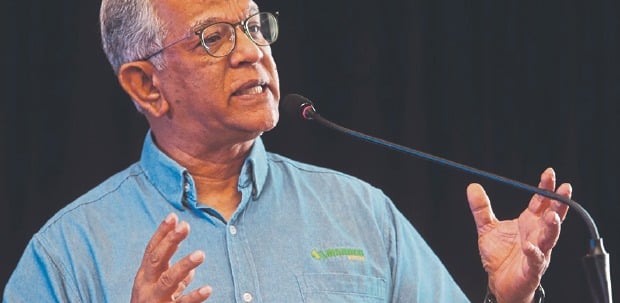

Timothy Teoh is the interview-shy tech guy who was instrumental in building and designing successful platforms such as #pulangmengundi, #kitajagakita and Nuffnang, to name a few.

He co-founded pulangmengundi.com in 2018 as an initiative to help Malaysians get home to vote in the 14th General Elections. The initiative made it easy for those who needed to crowdfund for their plane and bus tickets, or carpool to get home.

Kitajagakita.com was another social movement that he co-founded last year at the start of the Covid-19 pandemic to help the underprivileged who found themselves in need of food aid or other assistance.

In fact, Teoh started off his career with Nuffnang, which was founded in 2007, as its technical director and initial web developer.

While some people may find the tech sector challenging as it is constantly evolving, Teoh said he was always eager to "sharpen his saw" and stay in the forefront of web development.

This can be seen during the country's AstraZeneca first opt-in registration exercise fiasco in May, when the public crashed the server of the government portal vaksincovid.gov.my.

Teoh's blog post dissecting the issue caught media attention and went viral.

"When I started my career, Amazon, Facebook and Google were not as dominant as they were today. The bar was lower for smaller players, both in terms of technological standards and finding a business model."

You would expect a techie to say there is a key to unlocking limitless wealth. On the contrary, Teoh does not believe in infinite prosperity and abundance.

"A person who has made US$10 million should get a medal for winning the game of capitalism and stop there. The world doesn't need billionaires and we should all be concerned about the impact of inequality."

He believes in diversification and that is why his portfolio comprises domestic stocks as well as passive investment.

He parks the bulk of his money in a robo-advisory wealth management platform.

When he can find the time, he invests in the stock market on his own.

"Active investing is interesting and there is a lot to learn about the companies around you. Sometimes during conversations, local brands or products would come up and I find myself recalling trivia about the inner workings of these companies.

"There's no easy solution or shortcut to doing well in the stock market as investing takes time and effort. Be it stocks, ETFs, or cryptocurrency, you need to do your homework. Don't depend on luck or follow the crowd.

"Beginner investors tend to focus on big, risky 'wins' or past performances. I have learnt it's just as important to make sure compounding works in your favour, not against.

"As for cryptocurrencies, as a believer of fundamental investing, I do echo some of the concerns. It is not like equities, which may have dividend yield that acts as a natural 'floor'. It is more like a digital commodity with exciting — but as yet unknown — potential for mainstream adoption.

"While valuations may be uncertain, the principles are the same as investing in any company: only put in your hard-earned money if you can describe exactly what it does, why you are buying at a certain price, and what would cause you to sell," Teoh added.

The writer was a journalist with The New Straits Times before joining a Fortune Global 500 real estate company. This article is a collaboration between the New Straits Times and Tradeview, the author of 'Once Upon A Time In Bursa'.