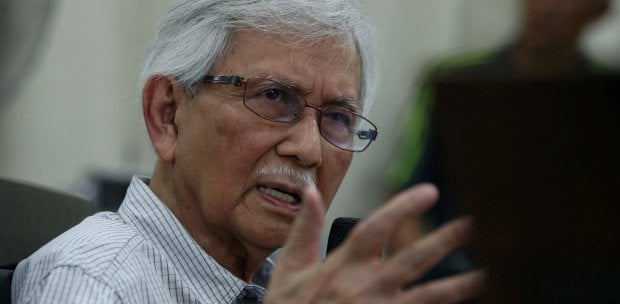

KUALA LUMPUR: The Malaysian Anti-Corruption Commission's probes into financial crimes and terror financing are complicated by mule accounts and integrity issues of some financial institution personnel.

The agency's Anti-Money Laundering and Asset Forfeiture Division director, Datuk Mohamad Zamri Zainul Abidin said other challenges they faced included obtaining documents that no longer need to be kept.

By law, companies and individuals are only required to keep their documents for seven years.

He also said a lack of suspicious transaction reports (STRs) from reporting institutions and customer due diligence on the part of financial institutions led to an excess of mule accounts and loans to unqualified customers.

"These are among the main challenges faced during investigations involving issues within financial institutions or what are referred to as reporting institutions themselves.

"The lack of integrity among certain officials within financial institutions is also a cause of this problem," he told BH.

On the STRs, Zamri said reporting institutions, including lawyers, money changers, accountants, real estate agents, and company secretaries among others are supposed to file STRs in line with the Anti-Money Laundering, Anti-Terrorism Financing, and Proceeds of Unlawful Activities Act (AMLATFPUAA).

He said this was crucial as the people in these professions are on the "front lines" and can detect suspicious activities early on and report them to the authorities.

Recently, Bank Negara Malaysia highlighted the failure of financial institutions to conduct customer due diligence and sanctions screening of customers.

This, the central bank said, led to increased exposure and prevalence of money laundering and terrorism financing activities in the country.

Zamri said the failure to conduct customer due diligence opened the doors to crime, including in the opening of mule accounts.

He said recent probes found that dummy accounts were being used to channel bribes to various enforcement agency personnel.

"This issue is not only limited to dummy account issues but is also linked to approval of financial loans to unqualified individuals and companies.

"In return for approving these loans, these officials will receive commissions paid through third parties managing the loans.

"This action directly leads to losses for financial institutions when loan repayments fail to be settled by unqualified borrowers," he said.

Zamri said financial institutions and reporting agencies must cooperate with MACC and other enforcement agencies to obtain information for investigations.

In this regard, Mohamad Zamri emphasized that cooperation by the Compliance Division of financial institutions and reporting institutions needs to be improved to assist the MACC and enforcement agencies in obtaining information during investigations.

"These reporting institutions are not only focused on financial institutions but also involve other institutions as listed in the First Schedule of the AMLATFPUAA," he said.