PUTRAJAYA: The Inland Revenue Board (IRB) filed a RM1.69 billion tax arrears suit against Datuk Seri Najib Razak and his son Datuk Mohd Nazifuddin, with the aim of bankrupting them, the Federal Court heard.

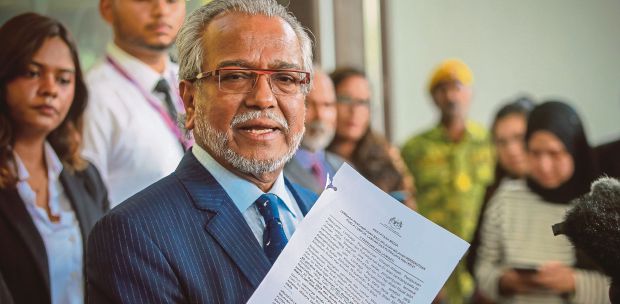

Counsel Tan Sri Muhammad Shafee Abdullah who appeared for the former prime minister said the respondent had brought this action with an ulterior motive and or mala fide intention.

"It was clear that the respondent was seeking to bankrupt my client even before the Special Commissioners of Income Tax (SCIT) can hear the merit of our defence to the additional tax assessment raised against Najib.

"If the respondent succeeds in bankrupting the appellant even before the SCIT can proceed or conclude, this would mean that the respondent's entire argument of the SCIT being the proper forum is academic or redundant.

"The SCIT hearing will only take place after the case management fixed for tomorrow (June 15)," he said in his submission to appeal against the summary judgements obtained by the IRB against the appellants at the High Court three years ago.

Shafee said it was a clear case of abuse of powers and oppressive exercise of powers by the appellant against the father and son.

The senior lawyer also said Section 106 (3) of the Income Tax Act 1967 (ITA) infringes Article 121 of the Federal Constitution.

Section 106(3) provides that the courts cannot entertain any plea when it is argued that the amount of tax sought to be recovered is an excessive one, incorrectly assessed, under appeal or incorrectly increased while Article 121 deals with the judicial power of the federation.

"The applicability of Section 106(3) is a relevant factor to the respondent's case as it purports to restrict in a civil suit any pleading that the tax sought is misconceived.

"This means that the respondent can raise any tax assessment regardless if the said assessment is wholly misconceived and get an order in their favour as the court does not have any power to entertain significant aspects of the appellant's plea," he said.

Shafee said IRB had been relying to this provision for more than five decades.

"This is the first time a challenge has been mounted (on the provision)," he said, adding that this case is not one suitable for summary judgment.

A summary judgment is obtained when the court decides on a case, through written submissions, without a full trial and calling witnesses.

Meanwhile, IRB solicitor Dr Hazlina Hussain argued that the appellants should wait for the decision from the SCIT proceedings which is a tribunal with quasi-judicial power.

"He can make an arrangement to pay the amount in instalments.

"We (IRB) were entrusted to collect taxes so that the government can assist the underprivilege people, fund development and sustains its operating expenditures.

"Section 106(3) ITA 1967 does not violate the basic structure of the Federal Constitution," she said.

Hazlina expressed concern that allowing the appellants' appeal would prejudice the public interest.

"This appeal is filed by the appellants to evade the tax that is due and payable at the first place," she added.

On July 22, 2020, the High Court allowed the IRB's application for a summary judgment to be entered against Najib in its suit to recover RM1.69 billion in taxes from the latter for the period between 2011 and 2017.

Najib was ordered to pay the sum.

The government, through IRB, filed the suit against Najib on June 25, 2019, asking him to settle the unpaid tax with interest at 5 per cent, a year from the date of judgment, as well as costs and other relief deemed fit by the court.

On July 6, the same year, the High Court ordered Nazifuddin, 38, to pay RM37,644,810.73 in unpaid taxes to the IRB.

This was after a summary judgment order was entered in the IRB's tax arrears suit seeking to recoup the unpaid amount from Nazifuddin between 2011 and 2017.

The suit was filed against him on July 24 last year.

On Feb 4, the board issued bankruptcy notices against the former Pekan member of parliament and his son following their failure to pay the sums.