KUALA LUMPUR: CIMB Group Holdings Bhd may have to pay more than RM36 billion for its potential mega-merger with RHB Capital Bhd (RHBCap) and Malaysia Building Society Bhd (MBSB) to create Malaysia's largest banking group.

Analysts at MIDF Research and PublicInvest Research have estimated a combined price tag of RM36.7 billion, based on CIMB paying for all the shares in RHBCap and MBSB at a price-book multiple of 1.75 times, albeit in a share-swap deal.

On Bursa Malaysia yesterday, RHBCap and MBSB rose following the merger news, but CIMB headed south, although it was among the most active stocks.

RHBCap gained 46 sen to close at RM9.18, while MBSB edged up 12 sen to RM2.46. CIMB eased 24 sen to settle at RM7 with 34.94 million shares traded.

The three financial institutions announced on Thursday that Bank Negara Malaysia has given them six months to discuss and seal a merger.

They also signed a 90-day exclusivity agreement to negotiate and finalise the pricing, structure and relevant terms for the proposed merger and the formation of a mega Islamic bank.

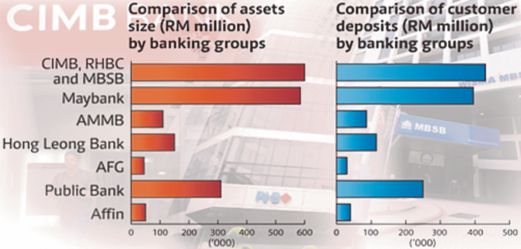

If it pans out, the merged entity will have total assets, loans and customer deposits of RM613.7 billion, RM388.7 billion and RM434.4 billion, respectively.

"Based on our calculations, at a price-book multiple of 1.75 times, the target companies' book value of equity per share as at end-March 2014, this will derive a pricing of RM11.80 and RM2.55 per share for RHBCap and MBSB, respectively.

"Hence, it will translate into a combined total valuation of RM36.7 billion for RHB Capital and MBSB, with the former being worth RM30 billion," said MIDF Research in a note yesterday.

PublicInvest, however, doubts the possible deal would be straightforward, but said assuming shares are swapped at 1.75 times book value, RHBCap will be worth RM30.09 billion, or RM11.81 per share.

MBSB, on the other hand, will cost CIMB another RM6.69 billion, or RM2.55 per share. Overall, the transactions would result in the new issuance of 4.86 billion CIMB shares at RM7.56 each.

Hong Leong Investment Bank Bhd (HLIB) expects the merger deal to be in the lower range of 1.5 to 1.6 times book value (versus EON Bank Bhd's 1.4 times via an all-cash acquisition).

It said given 2014 price-book differences (CIMB: 1.6 times, MBSB consensus: 1.5 times and RHBCap: 1.2 times) and Aabar Investments PJSC's (which owns 21.6 per cent of RHBCap with entry cost of RM10.80, which implies book value of 1.51 times) buy-in, the merger will likely be via share swaps with some element of cash.

HLIB sees potential synergy via economies of scales and streamlining of shared services in the longer term from the possible merger.

The investment bank, however, said like other mergers, there will be a drag in the short term due to duplications, integration cost and time, as well as impact of share issuance on return on equity.

The possible merger also provides opportunity to resolve RHBCap's low liquidity, Employees Provident Fund's large stakes in MBSB and RHBCap, and trapped values in RHB Cap's OSK Investment Banking Group.

Meanwhile, commenting on the possible merger, former prime minister Tun Dr Mahathir Mohamed said anything "big" is beautiful.

"In 1998, we did mergers due to the recession and currency crisis... small banks were absorbed by big banks and (this) reduced the number (of banks) from 53 to 10.

"When banks become big, they don't really care about the small ones. In other words, small businesses or individuals will find it difficult to borrow," he said after receiving a RM500,000 donation for the Palestine Emergency Fund, on behalf of the Perdana Global Peace Foundation, from Media Prima Bhd, here, yesterday.

Dr Mahathir added that as long as banks reached a certain quota for loans, which are usually given to big companies, it would be better if they had small windows for small borrowers.

"So, it won't be good news for the small borrowers," he said.