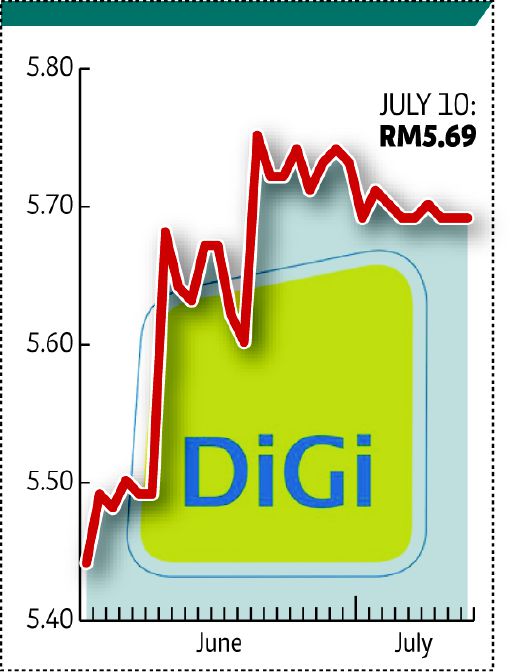

RHB Research remains “neutral” on the telecommunications sector, with DiGi as its Top Pick for its above-industry revenue and earnings growth.

“Despite increased competitive activity from Maxis and Celcom in the postpaid space, we believe mobile data pricing remains rational, which should bode well for data monetisation. DiGi intends to grow its postpaid subscriber base and we believe it is still on track to do so despite rising competition”, said RHB in its research note yesterday.

RHB noted that it expects industry financial year 2014 revenue growth to pick up marginally to 5.2 per cent, due to expected recoveries at Axiata Group and Maxis.

“Looking ahead, we expect the industry to see better earnings growth in financial year (FY) 2015. We believe Maxis may have seen an earnings trough in FY2014 following adjustments in its data pricing for roaming and pay-per-use charges, while Telekom Malaysia (TM) could see earnings growth return in FY2015 as we expect its EBIT (earnings before interest and tax) margins to remain stable in FY 2015.

“We remain bullish on DiGi.Com, which we think is monetising data most effectively by encouraging data usage adoption among its prepaid users. DiGi delivered the strongest earnings growth among the telcos.

RHB said DiGi expects to see a greater push in postpaid, and thinks this is still achievable despite refreshed plans from Maxis and most recently, Celcom.

“While Celcom’s postpaid plan is cheaper than DiGi’s, we note that DiGi offers a significantly higher quota of voice and SMS. In order to better monetise data, Maxis appears to be making an effort to keep data prices steady by not bundling too much data quota on its new postpaid plan — ONEplan, which was launched on May 30.

“While Celcom has responded quickly by refreshing its postpaid plans, we believe that competition is still rational and there are ongoing efforts to monetise data.

“Notwithstanding charges on additional data, we think the telcos are maintaining efforts in monetising data by not pricing data below RM15 per gigabyte.

“Competition in the fibre market will likely remain low key, which should allow TM to continue enjoying its dominance.”

RHB remains “neutral” on the sector due to continued challenges in monetising data, pronounced cannibalisation of SMS revenue by over-the-top usage, and valuations that do not look attractive.