DIGITALISATION has been the keyword in most industries in recent years and many are embracing it, including the banking industry.

The rapid digital adoption has led to a boom in online banking transactions. For better implementation, a comprehensive approach to digitalisation across multiple levels is required, including technology transformation, digitising customer and internal journeys and driving customer-centricity.

As one of the leading banking institutions in the country, CIMB is leading the new banking landscape by offering complete solutions to all levels of customers.

We talked to its chief executive officer for group consumer banking, Samir Gupta.

Q: What does digital banking mean to CIMB and what is the game plan?

Samir: Here at CIMB, we have continued to invest in and build technology resilience, developing new and advanced digital capabilities to increase productivity and improve customer experience. Our Forward23+ strategic plan also focuses on user experience. Our online services are more than creating accounts online, but include online services across the board that are robust, rapid, straightforward and convenient. There is no final destination when it comes to customer experience, so we never stop.

Q: Is digital banking really for everyone?

Samir: Over the past two years, the entire world had to quickly adapt to contactless services. The increased adoption of digital services by customers for their day-to-day banking needs has propelled digital banking growth and brought banks' digital capabilities to the forefront.

Customers have become more accustomed to performing banking transactions digitally, and expect to see more services and features available digitally. We expect this shift to continue even as we move towards pandemic endemicity. The sharp acceleration cuts across all consumer segments, including affluent clients who were previously less digitally inclined. According to McKinsey's latest Affluent and High-Net-Worth Consumer Insights Survey, digital is now the most preferred channel for clients, closely followed by remote.

In terms of our products, digital sales also grew significantly over the past year. Last year, we recorded a 77 per cent year-on-year growth in digital unit trust sales and 44 per cent growth in remittance transactions, so yes, it is safe to say that it is for everyone.

Q: CIMB Clicks has undergone several changes throughout the years to fit the needs of its customers in today's mobile-first lifestyles. What's new?

Samir: During the pandemic, we introduced our first end-to-end fully digital account opening process via OctoSavers Account-i and sent customers their debit card through mail.

This seamless online account opening procedure is made possible by leveraging Bank Negara Malaysia's electronic Know-Your-Customer facial recognition due diligence guidelines, coupled with digitalisation in a series of backend processes, aiming to offer the best-in-class and contactless onboarding experience. Since its launch, we've recorded a 363 per cent year-on-year increase in eCASA (e-current account savings account) acquisition.

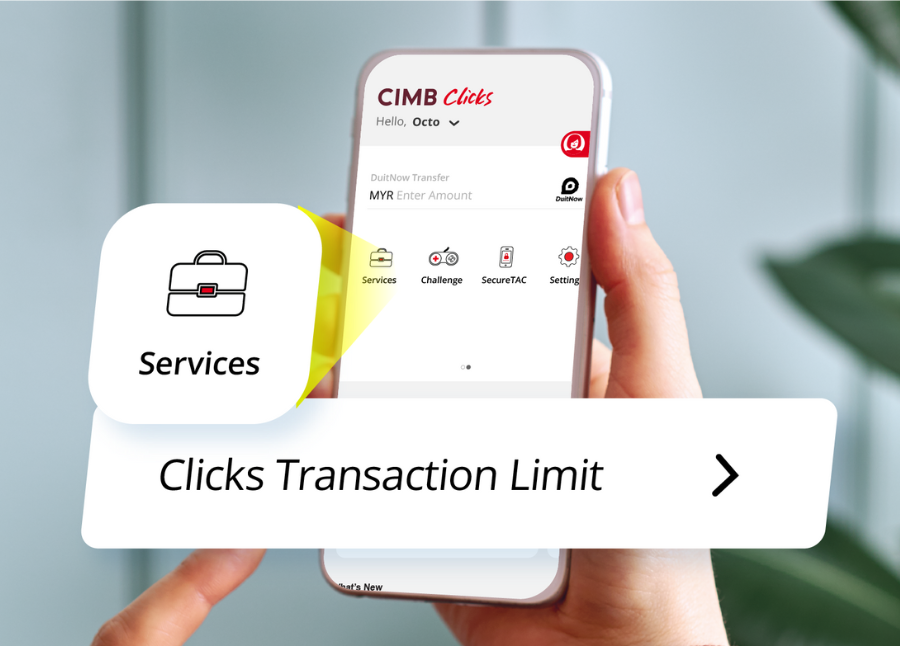

To meet the rising needs and demands surrounding digital banking, we have also enhanced the CIMB Clicks App and website with new functionalities and services to help customers take control of their finances remotely. This includes transaction limits control for local transfer and overseas remittance, ATM withdrawal limit, DuitNow QR peer-to-peer transfer, Islamic eFixed Deposits placement and Tabung Haji integration.

Q: Are there any changes in user behaviour and the type of service that is preferred by CIMB customers?

Samir: Before the pandemic, the top three most used services on CIMB Clicks were fund transfer, FPX and prepaid top-up service. As consumers shifted to e-commerce, we saw a surge in digital payments, such as FPX and Instant Transfers. FPX transactions have grown 50 per cent year-on-year in 2021 and Mobile Fund Transfers surged 105 per cent in the same year.

On top of that, with the introduction of DuitNow QR, we've also noticed a healthy adoption of QR transactions in the market. Since June last year, our QR transactions have grown 60 times year-on-year.

Today, eight out of 10 CIMB digital banking customers are active mobile app users.

Q: Earlier, you mentioned the Next Gen digital banking app. Can you elaborate on what this app is?

Samir: At CIMB, we instituted top-down internal reforms to address digital reliability and digital availability while preserving and enhancing customer experience. Essentially, our customers play an important part to help define the solution and process, as well as determine the appropriate and optimal digitalisation approach for our Next Gen platform.

By listening to the feedback we have collected over the years, in a sense, we are working with our customers to design their Next Gen banking experience and incorporate personalisation to suit their banking as well as lifestyle needs.

For example, with CIMB Clicks, we have been improving the app iteratively through enhancements and upgrades over the years, based on feedback from our customers. With our Next Gen platform, our aim is to take all that we have learned, as well as the latest developments from the digital banking landscape, and incorporate them into the app from the ground up.

Q: What can CIMB customers expect from this Next Gen banking platform?

Samir: Today's customers prefer digital banking — a shift that was already happening pre-pandemic but was rapidly accelerated due to the pandemic. There are some enhancements that are already in CIMB Clicks that we intend to incorporate into the Next Gen banking app. These include preemptive reminders where we look at customers' past transaction patterns to predict future recurring payments such as bill payments, loan payments or fund transfers for rental payments. If our customers miss the payment, the system will trigger a reminder.

Q: Security will always be a hurdle in banking. What is CIMB's security promise?

Samir: We upgrade our infrastructure periodically with the latest encryption technology to enhance app performance. As such, security remains a high priority to ensure a safe and secure banking experience at all times.

As online fraudsters and scammers continue to find new and more sophisticated ways to trick customers, we will continue to educate and equip our customers with informative content to build awareness.