KUALA LUMPUR: The Malaysian semiconductor sector is expected to pick up in the second half (2H) of 2024, despite facing significant challenges including geopolitical tensions, supply chain disruptions and national security concerns.

Malaysia Semiconductor Industry Association (MSIA) president Datuk Seri Wong Siew Hai said the local semiconductor companies had seen lower' profits in the first quarter of this year.

"However, we see that this demand will pick up again by the second half of the year," he told the media at Nomura Asset Management Malaysia Breakfast Conference 2024 here today.

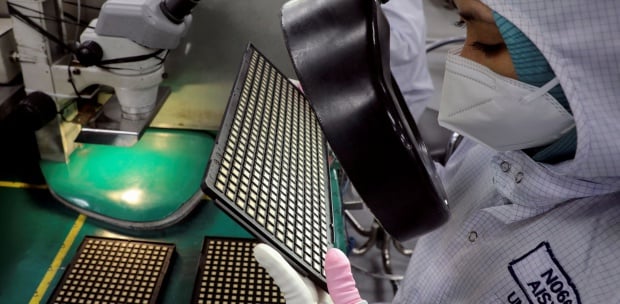

According to Wong, Malaysia needs to further enhance the value chain in integrated circuit (IC) design and attract foreign direct investment (FDI) in wafer fabrication and advanced packaging to remain competitive in the global semiconductor market.

He said the long-term prospects for the semiconductor market will continue to be driven by artificial intelligence (AI), cloud computing and other technologies.

"Malaysia is a key participant in the global semiconductor supply chain, with seven percent of global semiconductor trade flowing through Malaysia.

"The nation needs to enhance the value chain in IC design, FDI in wafer fabrication, advanced packaging, smart automation, and advanced equipment. Malaysia is also focused on producing leading global companies," he added.

Nomura Asset Management Malaysia managing director and country head Leslie Yap remains bullish on the long-term growth potential of Malaysia's semiconductor industry.

Yap said key sectors driving this growth will include AI, personal computing, smartphones, memory, data centers, Internet of Things, electric vehicles and semiconductor capital equipment.

"These would potentially offer opportunities amid continued advancement of technology. We has identified quality companies to invest in by narrowing down on those that have intellectual property that competitors cannot match.

"It gives them a competitive advantage that leads to market share gains. We focus our research efforts on companies that can grow faster than the industry over the long term and tend to outperform.

"As the investment landscape evolves, we remain at the forefront, committed to uncovering these investment opportunities to ensure our clients stay ahead of the curve and are well-positioned to capitalise on emerging trends," he added.