KUALA LUMPUR: A PKR lawmaker has called out the false message that went viral for comparing the dividend payouts between Employees Provident Fund (EPF) and Permodalan Nasional Bhd (PNB) with inaccurate figures.

Petaling Jaya MP Lee Chean Chung said EPF had announced its highest dividend payout for 2023 of RM57.8 billion, a jump from RM51.9 billion paid for 2022.

He noted that the EPF had seen a steady rise in its total payout for the last 13 years.

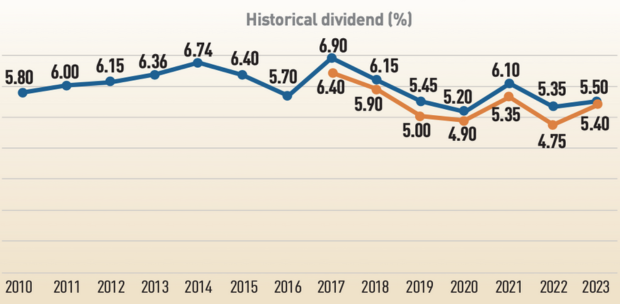

"Despite multiple withdrawal schemes from the previous administration, EPF is still able to maintain its dividend rate around 5.2-6.1 per cent for the last five years, showcasing consistency in performance of the EPF investment team to safeguard the pension of many of its members to compound it return further," he said in a Facebook post.

The viral message claimed that EPF invested almost RM367 billion of its funds "yet only declared 5.5 per cent" of dividend while claiming the PNB invested RM120 billion of total funds and and declared a dividend of 7.5 per cent.

"The fact is, PNB has not outperformed EPF since 2020. The factually erroneous and ill intended message aim to play into the Malays versus non-Malays sentiment of the English readers, and clearly to divide Malaysians.

"Worse, it is humiliating thousands of hardworking EPF employees by accusing that 'EPF channeled the money elsewhere'," said Lee.

He added that most of EPF portfolio allocation goes to both bonds and public equities in Malaysia and overseas stock market, which are secondary investments.

"Therefore, due recognition should be given to EPF by doing an excellent job in securing a good return for all pensioners," he said.

EPF announced a dividend of 5.5 per cent for conventional savings and 5.40 per cent for Simpanan Shariah for financial year 2023.