KUALA LUMPUR: MCA Youth has urged the government to adopt a more proactive approach to revitalise the economy and strengthen the ringgit, rather than simply passing the responsibility to Bank Negara Malaysia (BNM).

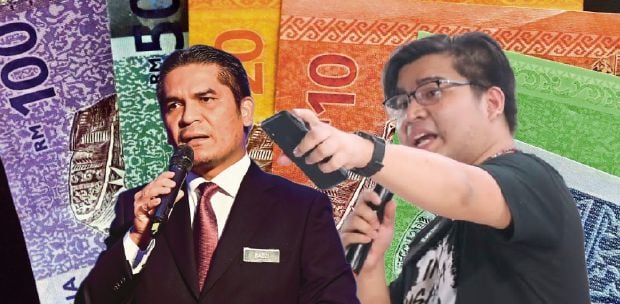

Its secretary-general, Saw Yee Fung, also questioned former Finance Minister Lim Guan Eng, who suggested that BNM intervene and prop up the currency, regarding his understanding of the associated costs.

Saw said that BNM intervention is not novel, as they have already implemented measures to address currency fluctuations, particularly during instances of excessive daily exchange rate volatility.

However, she said, the intent of this move is not to artificially shift the ringgit's trend from depreciation to appreciation, nor does it chase specific exchange rate targets.

"Instead, BNM's role is focused on stabilising the exchange rate to prevent undue fluctuations.

"BNM's ability to directly manipulate the exchange rate is limited, and outright 'rescuing' the ringgit is unfeasible," she said in a statement today.

She said excessive intervention could backfire, leading to further depreciation of the ringgit.

Saw said Malaysia's monetary policy focuses on domestic economic factors like growth and inflation, which determine interest rates.

She said the exchange rate itself floats freely in the market along with the interest rate and other economic variables.

"BNM's most direct intervention method involves utilising foreign exchange reserves to purchase ringgit and prop up the exchange rate.

"However, the critical question remains: how much US dollars and foreign exchange can we realistically expend on such an intervention?

"As of Sep 29, 2023, Malaysia's foreign exchange reserves stood at US$110.1 billion, while the daily trading volume of the ringgit is around US$15 billion. This means significant dollar sales to prop up the ringgit could quickly deplete our reserves," Saw said.

Saw said BNM intervention may act as a band-aid, but it is not a permanent solution.

Hence, she called on the government to tackle the underlying issues causing the ringgit's weakness through comprehensive, targeted policies.

"To ease the immediate burden, targeted subsidies can help offset import inflation, particularly on essential food items.

"Long-term solutions lie in economic transformation, attracting foreign investment and boosting export trade, all crucial for a stronger ringgit," she said.