GEORGE TOWN: Overspending has driven youths to the brink of bankruptcy and this is seen with their unsustainable lifestyles when they spend as much as they have and use credit cards when their money runs out.

Statistics of youths in debt are shocking.

Last year's UCSI Poll Research Centre revealed that 73 per cent of Malaysian youths are in debt and that they also do not have sufficient funds to meet their financial commitments.

Against the backdrop of this scenario, the Consumers' Association of Penang (CAP) has called on Malaysians to face the reality of the global economic downturn in the midst of geopolitical uncertainties.

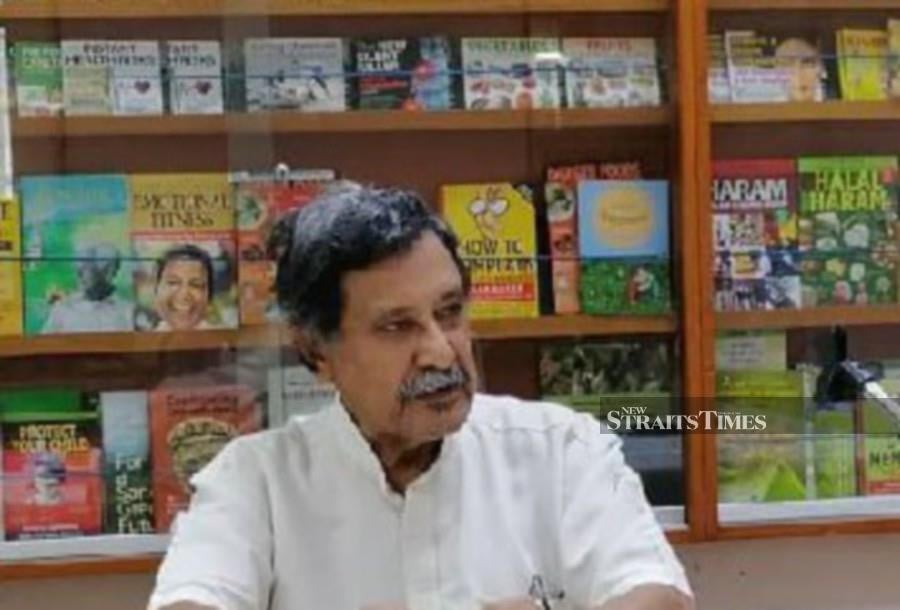

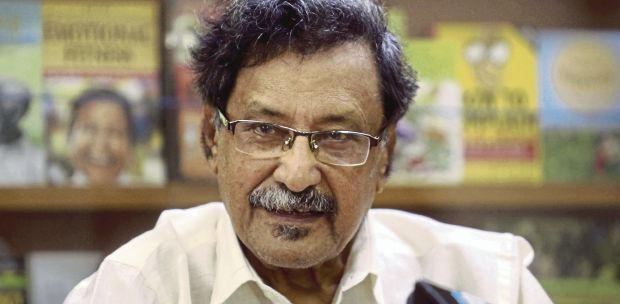

CAP president Mohideen Abdul Kader said youths should learn to watch their budget closely and should not indulge in impulse buying, particularly with the ease of using credit cards and credit facilities such as Buy Now, Pay Later (BNPL).

The reason, according to him, is many people do not keep track of their expenditures on their credit card or any credit facility until the end of the month when they receive their bills.

"By then, they would have accrued a debt they find difficulty in settling. They seldom consider the effects of compound interest charged on the amount they owe. Besides accruing compound interests, debtors may not be able to obtain bank loans in the future when they have a record of poor repayment history with a credit reporting agency such as CTOS or CCRIS.

"Other youths fall for fads and get into financial problems. Business sectors have no qualms about starting a commercial fad arising from a combination of psychological, social and economic factors. Fads help to fuel enormous expenditures, distorting a person's budget and better judgement.

"People tend to look to others for cues on how to behave, especially in ambiguous situations. When they see others adopting a product or trend, they're more likely to follow suit.

"This creates a snowball effect as more people join in, further validating the trend. Limited availability or the perception of scarcity can drive an increased desire to buy a product. People often fear missing out on something that others are enjoying, leading them to jump on the bandwagon before it is too late," he said today.

One such example, Mohideen noted, was the launch of a new product whereby people would even camp outside stores to make sure that they do not miss the "opportunity of a lifetime" to purchase something that they can do without.

He said another psychological effect of a fad was that of herd mentality — the tendency for individuals to conform to the behaviours and opinions of the majority.

"People may feel pressure to participate in a fad simply because 'everyone else is doing it'.

"Humans are drawn to novelty and new experiences. Fads often promise something fresh and exciting, providing a break from the routine and monotony of everyday life. One example of this is participating in cosplay whereby they can identify with one another at the events held.

"Successful fads often tap into people's emotions, whether it is through humour, nostalgia or a sense of belonging. Emotional resonance can create strong connections with consumers, driving them to embrace the trend.

"This is the role of influencers in social media in particular," he added, pointing to the fact that products associated with a particular fad could serve as symbols of identity and belonging.

Mohideen said the global craze for dietary supplements with unproven benefits was one example whose market size was estimated at RM832.298 billion in 2023.

He said rather than eating nutritious food, people are willing to spend on expensive supplements.

"Fads that are easy to adopt and integrate into everyday life are more likely to spread quickly.

Whether it's a simple product like a fidget spinner or a catchy dance craze, accessibility and simplicity are key factors.