HONG Leong Investment Bank (HLIB) advises investors to take some profit off the table and downgrade Uzma Bhd to “hold”.

“Uzma is one of our small to mid-cap top picks in the beginning of the year and fits into one of our favourable micro themes, namely risk service contracts (RSC). We recognised the strong share price rally was due to its ability to secure Tanjung Baram RSC contract and grow inorganically through merger and acquisitions (M&As),”it said.

Uzma has acquired MMSVS Group Holding Co Ltd, a Thailand company with seven modern Hydraulic Workover Units and Premier Enterprise Corp (oilfield chemicals), for a total value of RM114 million.

HLIB said both acquisition will expand Uzma’s product offering and complement its existing services.

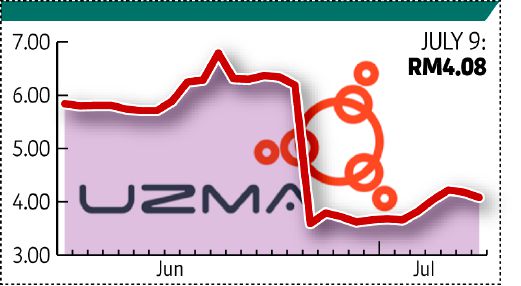

“Share price continued to perform strongly after the stock went ex for its right issue on June 24 and exceeded our target price of RM4.19. As there is no change to the company’s underlying fundamental, share price has run ahead of fundamental in short run. We advise investors to take some profit off the table and downgrade the stock to ‘hold’,” it said in its note.

HLIB said in the long run, Uzma has a long-term strategy to further grow the business through expanding product range, M&As and overseas expansion. It downgraded its call from “buy” to “hold” with unchanged target price of RM4.19, based on unchanged 16 times of financial year 2015 earnings per share of 26.2 sen.