WEAK SENTIMENT: FBM KLCI may stay under pressure as market players remain sidelined or reduce exposure

BURSA Malaysia shares stayed largely in consolidation last week, with trading momentum dwindling to a minimum with market players mostly sidelined due to school holidays and absence of any significant domestic market catalysts.

The blue-chip benchmark FTSE Bursa Malaysia KLCI (FBM KLCI) was also stuck in choppy trade with alternating profit-taking activities offsetting bargain-hunting gains.

Week-on-week, the FBM KLCI slipped 10.68 points, or 0.57 per cent, to 1,862.7, dragged down mostly by losses on Public Bank (-82 sen), Tenaga Nasional Bhd (-36 sen), CIMB Bhd (-13 sen) and PPB Group (-90 sen). Average daily traded volume and value last week was lower at 1.26 billion shares and RM1.72 billion, compared with 1.51 billion shares and RM2.72 billion average, respectively, the previous week, following the huge surge in traded value caused by a spike in portfolio rebalancing transactions.

With lack of strong catalysts, start of Fifa World Cup on Thursday and technical indicators flashing continued weakness, investors may continue to stay on the sidelines during this school holidays. Malaysia’s stronger-than-expected exports growth of 18.9 per cent year-on-year (YoY) last month, which was released last Friday, and the two-day Invest Malaysia 2014 event starting today could act as strong support should selling gain momentum.

It was surprising to see muted reaction in the local scene after the European Central Bank (ECB) announced last Thursday to lower the benchmark interest rate to 0.15 per cent and deposit rates to -0.1 per cent.

These actions should assuage the fears of most investors about the impact of continued monetary tightening in the United States subsequent to the stronger payroll numbers for last month, which was reported last Friday.

With China leaning towards more fiscal measures to sustain economic growth trajectory and pursuing targeted easing to help its rural borrowers and small firms (this could be a necessary precaution to avoid trust defaults as well with more than five trillion worth of trust products maturing this year), there is some sense of security that the world economic growth would not be jeopardised and there would still be plenty of liquidity in the global financial system.

Malaysia’s stronger-than-expected April exports, with growth seen in shipments to key economic blocs, or nations like Europe, the US and China, led by the sub-segment of electrical and electronics that advanced by +22 per cent YoY to RM21.6 billion, were in line with the upward trend of global semiconductor sales.

With key global economies reporting continued growth in their manufacturing activities, it seems optimistic that Malay-sia’s exports growth could last in the subsequent months of this year, albeit at a softer pace, on the back of higher base effect. Note that the average monthly value of exports stood at RM56.3 billion in the first half of last year and rose to RM63.7 billion in the second half. Year-to-date April 2014, the average was RM63.6 billion.

So, as far as the local market is concerned, the positive external undertone and inflow of foreign funds since late April suggest that investors should buy-on-weakness undervalued blue chips to sell into a potential rebound post-World Cup. To recap, historical data in the last 37 years showed that the probability of the benchmark index’s quarter-on-quarter (QoQ) outperformance in the second quarter (Q2) is lesser than the first quarter (Q1) at 62.2 per cent and 64.9 per cent but the average gain is much higher at 5.3 per cent versus 4.3 per cent, respectively. A notable contrast is that it usually closes higher in Q2 if Q1 underperformed QoQ basis (which was the case this year) as there were only five incidents of consecutive QoQ underperformance (mostly during World Cup) in the first two quarters during the period.

Technical Outlook

Core index heavyweights slipped for profit-taking correction on Monday, with Public Bank (-46 sen), Axiata (-13 sen) and Petronas Gas (-68 sen) leading falls, as they eased for further price corrections following last Friday’s portfolio rebalancing action. The FBM KLCI slumped 9.13 points to close at 1,864.25, off an early high of 1,876.17 and low of 1,861.48, as losers beat gainers 515 to 297 on slower trade totalling 1.33 billion shares worth RM1.95 billion.

Blue chips staged rebound the subsequent day, as gains on IOI Corp (+22 sen), Axiata (+10 sen) and Genting Bhd (+10 sen) helped the index recoup the previous day’s losses, while lower liners and small caps extended low-volume congestion phase.

The FBM KLCI gained 8.3 points to end at the day’s high of 1,872.55, off a low of 1,866.37, as gainers edged losers 395 to 369 on subdued trade totalling 1.2 billion shares worth RM1.97 billion.

The FBM KLCI resumed correction on Wednesday, dampened by losses on Public Bank (-16 sen), PPB Group (-14 sen) and Tenaga (-14 sen), while lower liners and small caps fell on weak buying momentum. The index slipped 7.35 points to settle at 1,865.2, off an early high of 1,869.6 and low of 1,862.84.

The local market extended sideways trading the next day, as local funds returned to lift blue chips such as YTL Corp (+9 sen), Petronas Gas (+48 sen) and Genting Bhd (+17 sen) higher while lower liners consolidated. The FBM KLCI rose 3.8 points to settle at 1,869, off an early high of 1,870.6 and low of 1,863.11, as gainers edged losers 380 to 361 on improved trade totalling 1.49 billion shares worth RM1.86 billion.

Stocks extended profit-taking consolidation on Friday, with most market players sidelined ahead of the weekend in the absence of any catalyst to boost local sentiment. At the close, the index lost 6.3 points to end at 1,862.7, off an opening high of 1,870.61 and low of 1,860.2, as losers beat gainers 397 to 323 on cautious trade totalling 1.27 billion shares worth RM1.4 billion.

Trading range for the local blue-chip benchmark index slimmed to 15.97 points last week, compared with the 18.57 points range the previous week, as blue chips extended their profit-taking consolidation mode. The FBM-Emas Index slid 47.63 points, or 0.37 per cent, last week to 12,898.12, but the FBM-Small Cap Index climbed 42.49 points, or 0.24 per cent, to 17,494.78.

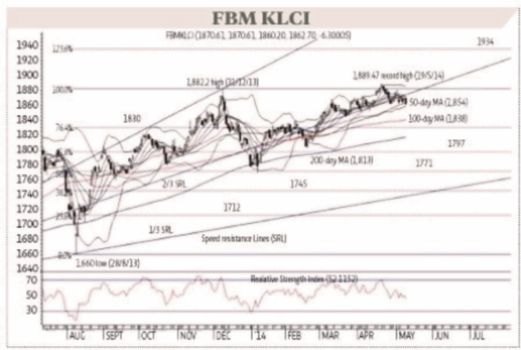

Following last week’s correction, the daily slow stochastic indicator for the FBM KLCI has weakened to the mildly oversold area, while the weekly indicator turned bearish with a hook-down after flashing a sell signal the previous week. The 14-day Relative Strength Index (RSI) indicator slid below the 50 neutral mark to flash a bearish reading at 46.32, while the 14-week RSI turned lower for a weak reading at 58.21 as of last Friday.

On trend indicators, the daily Moving Average Convergence Divergence (MACD) signal line slipped lower to reinforce the bearish trend reading, while the weekly MACD indicator’s signal line has hooked down, suggesting renewed bearish momentum. The +DI and -DI lines on the 14-day Directional Movement Index (DMI) trend indicator expanded negatively after triggering a sell early last week on a declining ADX line.

Conclusion

Sadly, the local stock market failed to react favourably to positive external catalysts after the ECB moved to cut interest rates, taking deposit rates for banks below zero, and as US stock markets climbed to record highs on healthy monthly jobs growth. With further deterioration on technical momentum indicators, the local benchmark index should stay under pressure this week as market players remain sidelined or reduce exposure amid weakening trading sentiment. Trading momentum is likely to stay muted due to the extended school holidays and ahead of the World Cup.

Given the weak position on the index, there could be near-term downside risk to better uptrend supports from the 100-day and 200-day moving averages at 1,840 and 1,817, respectively. Immediate resistance remains at the June 2 high of 1,876, followed by the May 19 record high of 1,889, with next significant hurdles at 1,900 and 1,934, the 123.6 per cent Fibonacci Projection of the rally from 1,660 low of August 28 last year to the 1,882 high of December 31.

The subject expressed above is based purely on technical analysis and opinions of the writer. It is not a solicitation to buy or sell.