MALAYSIA and other Asian exporters stand to benefit the most when the United States Federal Reserve embarks on a rate hike cycle.

Economist Dr Chua Hak Bin said Asian exports and growth typically strengthened during the past three episodes of US Fed rate-hike cycles.

“The Fed tightening periods are associated with firmer US growth, which benefits ‘Asian exporters’ — South Korea, Taiwan, Malaysia and Singapore.”

Chua described the Asian export growth as visibly improving in recent months, although the recovery has been somewhat weaker than expected.

His observation is based on previous times when the Fed rate was raised from February 1994 to July 1995, June 1999 to January 2001 and June 2004 to September 2007.

“Our US team expects the first Fed rate hike in June next year, with a hike at every other meeting in 2015 and 2016, bringing the funds rate target to 1.75 to two per cent by end-2016.”

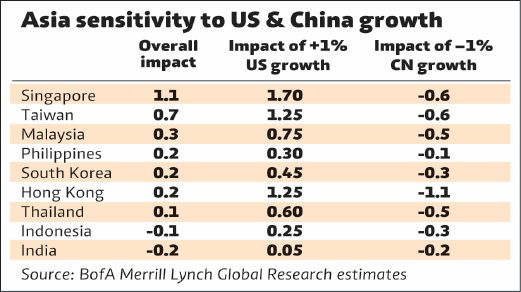

Asia’s beta or the sensitivity to US gross domestic product (GDP) growth appears to have fallen, compared to the past.

One reason, he said, is the US economy’s declining weight of global GDP versus China’s growing weight.

Global share of US GDP has fallen from its peak of 33 per cent in 2001 to about 23 per cent, while China’s share has climbed to about 12 per cent.

A slowdown weakens imports and commodity prices, hurting Asian commodity exporters disproportionately, including Indonesia (coal, palm oil), Thailand (rubber, food) and to some extent, Malaysia (palm oil).

However, he noted that although China imports are flat, the US imports have been strengthening in recent months.

“We describe 2014 as a ‘US +1 per cent, China -1 per cent’ year, with the divergent US-China growth as a baseline for thinking about the impact on the rest of Asia. The positive impact from firmer US growth (which benefits manufacturing exporters) is partly negated by weaker China growth (which hurts commodity exporters).”

On discernible pattern for Asian currencies and markets during the past Fed rate-hike cycles, Chua said the last three episodes show a mixed picture.

“How Asia fares will largely depend on how strong the US economic recovery will be in the coming years as the Fed normalises interest rates, whether the positive impact from a US recovery will be offset by the risk of slowing China and Europe.”

The research house is pencilling in a modest export recovery in most Asian economies next year, providing some support to Asian growth, trade balances and currencies.

This is based on the stronger US GDP growth of 3.3 per cent next year, although China’s slowing and weak commodity prices may persist into 2015.