MAYBANK Investment Bank Bhd (Maybank IB) has maintained its “buy” recommendation on AirAsia Bhd with an unchanged target price of RM2.65.

This is based on AirAsia’s financial year 2014 price-to-earnings ratio target of 10.5 times, which is on par with the global low-cost carrier average.

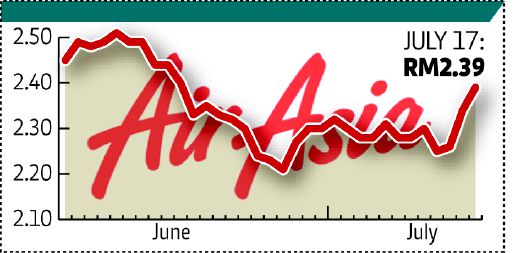

“The current share price is close to its three-year low of RM2.20, which trades at only

1.02 times financial year 2015 price-to-book value.

“Suffice to say that the stock is trading at deep value and the market has not priced in an improving business landscape,” Maybank IB said in a research report yesterday.

It said AirAsia should see a modest passenger traffic growth of three per cent to four per cent year-on-year in the second quarter in line with capacity deployed, with prospect for higher y-o-y yields.

The challenges faced by its rival Malaysia Airlines should enable AirAsia to gain some market share and support on some key routes, the company added.