THE Asian Development Bank (ADB) has upgraded its growth forecast for Malaysia in 2014 and 2015, based on the unexpected strong outcome in the first half and “good prospects” for the second half of the year.

It is the only country in the Southeast Asia region which has revised upwards in its latest update in Hong Kong yesterday.

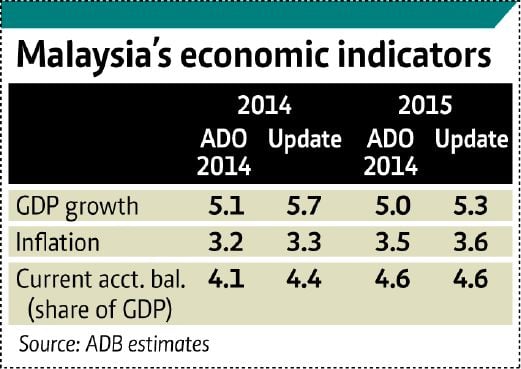

The Malaysian economy is likely to grow 5.7 per cent this year (from 5.1 per cent previously) and 5.3 per cent next year ( from five per cent)

Moderating domestic demand in the larger Southeast Asian economies — Singapore, Malaysia, Indonesia, Thailand and the Philippines has slowed growth.

But the sub-region is expected to rebound in 2015, said ADB president Takehiko Nakao in the report.

The Manila-based bank described the

“rebounding exports by 8.3 per cent joined by buoyant private consumption and investment” driving strong economic growth for Malaysia in the first half of this year.

It also revised the forecast for this year’s current account surplus.

In its latest assessment, ADB said private consumption made the biggest demand-side contribution to gross domestic product (GDP) growth as it rose slightly more quickly than a year earlier.

Malaysia’s local currency bond market has grown to become the biggest in Southeast Asia on the strength of significantly greater participation by non-resident investors.

Its external debt was at 67.9 per cent of GDP at mid-2014, with just over half of the external debt being long-term while the short-term portion is covered 1.2 times by international reserves.

ADB expects the GDP growth in Malaysia to moderate in the second half of this year, largely reflecting a high base brought about by a pick-up in growth in the second half of last year.

Although growth momentum is expected to ease further next year, strength in the major industrial economies, particularly the United States, should generate further export gains.

But it expects domestic demand to moderate on firmer fiscal and monetary stances.

“While consumption spending will be supported by the firm labour market, wage increases, and government cash transfers, it faces headwinds from higher inflation and rising interest rates.”

Consumers, it said, may be more sensitive than in the past to rising interest rates because household debt has climbed and most housing mortgages have variable rates linked to market rates.

It also expects government spending to be restrained by the need for fiscal tightening.

Improving demand from major industrial economies will fuel investment in Malaysia’s export-oriented manufacturing although a number of factors such as higher domestic funding costs, an expected tightening of credit globally and fiscal constraints will temper growth in investment next year.

Inflation is now forecast to average 3.3 per cent this year, accelerating to 3.6 per cent next year when the goods and services tax comes into effect and subsidies are further trimmed.

The report said that despite some strengths in the five large Asean economies and Malaysia’s surprising growth acceleration, aggregate growth is moderating this year, slowed by stabilisation policy and weaker commodity export prices in Indonesia, political disruption in Thailand, a government spending slowdown in the Philippines on soft domestic demand in Vietnam.

Aggregate growth in the Asean 5 is now expected to be 4.8 per cent this year before recovering at 5.6 per cent next year.

ADB said the financial markets in the region have reacted calmly to actual US tapering that began in January when policymakers were taken by surprise.

Today they seem to have factored in the upcoming tightening US monetary policy by keeping policy rates elevated, limiting the risk that a surprise factor will worsen any financial turbulence as it did in the second half of 2013.