STAND-OUT performer Malaysia is likely to see its strongest annual growth rate in seven years in 2014, said Standard Chartered Bank (StanChart).

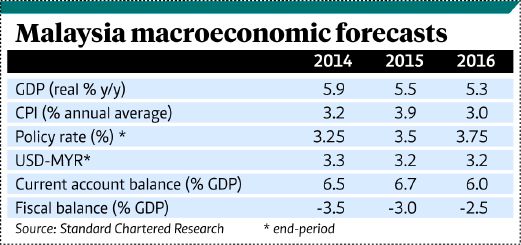

Despite some degree of cooling off in the second half of the year, StanChart still expects the economy to post a robust 5.9 per cent growth, after a strong 6.3 per cent in the first half of the year.

In the first six months, the domestic and external engines had both fired up the economy.

Domestic activities rose while investments remained firm with growth led by private sector investments.

StanChart said investment growth in Malaysia had outpaced its gross domestic product (GDP) growth in recent years due to the Economic Transformation Programme.

Malaysia’s export performance has remained strong despite the lacklustre commodity prices, as commodities account for only about 25 per cent of total exports.

It expects the current account to remain in surplus for the rest of this year as exports perform strongly.

The goods trade surplus should continue to more than offset the services and income deficits.

“We expect the current account surplus to remain steady at 6.5 per cent of GDP in 2014 (6.9 per cent in the first half of the year, as consumer goods imports may wane slightly), while exports may consolidate following their strong performance in the first half,” said economists Jeff Ng and Edward Lee in a report yesterday.

On monetary policy expectations, they expect Bank Negara Malaysia to stand pat for the rest of the year due to the moderating growth in the second half of the year.

The central bank has kept the overnight policy rate at 3.25 per cent despite a rapid first half growth performance and high inflation expectations.

“The central bank is keeping

the door open for another hike, in our view. ”

While further subsidy cuts may keep inflation supported, Bank Negara appears comfortable with supply side-driven inflation.

They said the property market is cooling off with the volume of transactions and property price increases easing.

Consumers face the headwind of high household leverage and the central bank will be cautious about over-tightening.

“Risks to our status-quo view include a resurgence in property demand, which could add to household leverage and lead to stronger-than-expected economic growth.”

Loan growth slowed to 8.6 per cent year-on-year in July, from 11 per cent in January, especially in agriculture, mining, trade, financial and business services.

StanChart described the household loan growth as more stable at 12.1 per cent.

However, any rise in household loan growth may trigger concerns about the household leverage situation.

On the outlook for the ringgit, the economists commented that the imminent end of the United States quantitative easing and a likely US Federal Reserve rate hike in the second quarter of next year may keep US dollar-versus-ringgit supported.

“Bank Negara’s decision to keep policy rates unchanged and China’s weak growth may also result in an upward bias for the dollar-versus-ringgit.”