KUALA LUMPUR: The hospitality sector in Malaysia has witnessed significant changes and developments over the years.

The sector faced numerous challenges due to the Covid-19 pandemic, impacting hotel occupancy rates, average daily rates and investor confidence.

However, as the industry gradually recovers, there are positive signs indicating renewed interest and optimism among hotel owners and investors, according to Knight Frank.

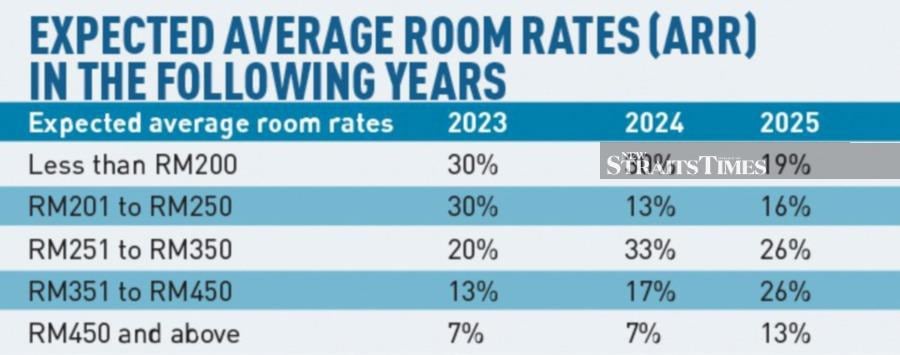

Based on the findings of the firm's Malaysian Hospitality Investment Intentions Survey 2023, 30 per cent of respondents expect average room rates (ARR) this year to be below RM200.

This indicates a focus on affordability and price sensitivity, suggesting a competitive market.

Additionally, 30 per cent of respondents anticipate room rates in the range of RM201 to RM250, reflecting a segment of respondents who expect slightly higher rates while still emphasising affordability.

Moving to 2024, there is a shift in expectations, as 33 per cent of respondents project ARR in the range of RM251 to RM350, indicating an increase in anticipated pricing.

"This suggests a growing confidence in the market's ability to support higher room rates, potentially driven by factors such as increased demand, improved economic conditions, or enhanced hotel offerings," Buckley said.

Meanwhile, 13 per cent of respondents still anticipate an ARR in the range of RM201 to RM250 in 2024, indicating a sustained focus on affordability.

Looking ahead to 2025, the expectation of higher room rates continues to strengthen, with 26 per cent of respondents anticipating rates in the RM251 to RM350 range, demonstrating a sustained belief in the market's ability to support this pricing segment.

Another 26 per cent of respondents project rates in the RM351 to RM450 range, indicating a further increase in expected average room rates.

Meanwhile, the majority of respondents (40 per cent) expect an occupancy rate ranging from 61 per cent to 80 per cent this year.

Additionally, 30 per cent of respondents anticipate occupancy rates in the range of 41 per cent to 60 per cent, suggesting a positive sentiment towards moderate occupancy levels.

"This reflects an optimistic outlook and indicates confidence in the industry's recovery and increased demand for hotel accommodations," said James Buckley, executive director, capital markets - investments at Knight Frank Malaysia.

Looking ahead to 2024, 60 per cent of respondents are projecting an occupancy rate between 61 per cent and 80 per cent, which signifies a sustained positive trend and an increasing confidence in the sector's recovery.

Furthermore, 17 per cent of respondents anticipate occupancy rates in the range of 21 per cent to 40 per cent, indicating expectations for a gradual rise in demand and occupancy levels.

Moving to 2025, the positive sentiment persists, with 52 per cent of respondents expecting an occupancy rate between 61 per cent and 80 per cent, reflecting a sustained belief in healthy occupancy levels and a positive market outlook.

Additionally, 24 per cent of respondents anticipate an occupancy rate above 80 per cent, indicating a strong belief in robust demand and the potential for high occupancy levels in the coming years.