The absence of the Home Ownership Campaign (HOC), increasing inflationary pressures, and the unexpected Russia-Ukraine war may have caused fewer launches coming into the market in 1H 2022.

• The first half of 2022 had far fewer project launches than in 1H 2021 with only 14 projects or about 38% against 37 projects. This is likely to be attributed to the expiry of the HOC on 31 December 2021

• In terms of units, there were 7,595 units in 1H 2022 compared to 11,560 units in 1H 2021. This year's units make up about 66% of the total units in 1H 2021.

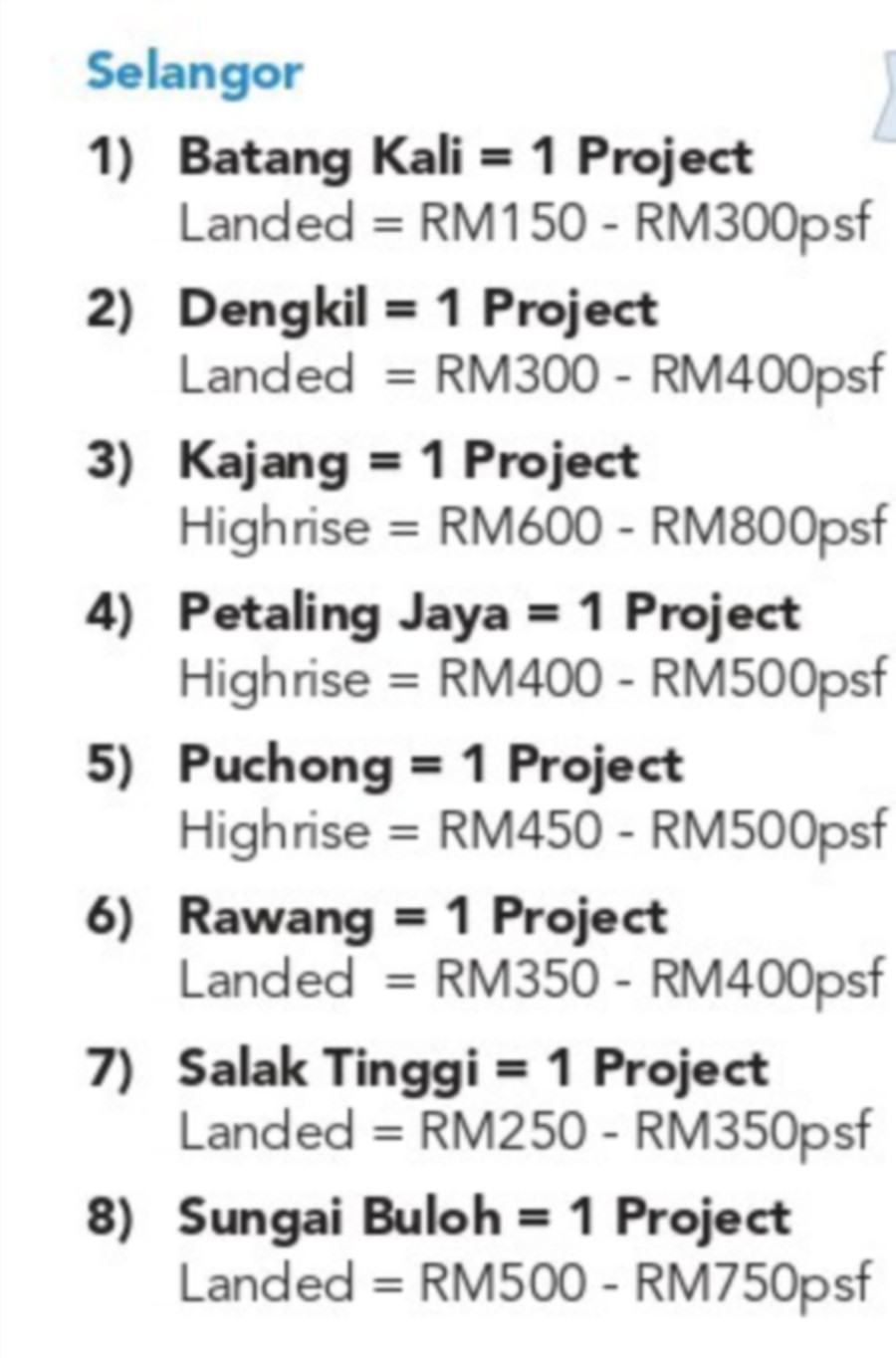

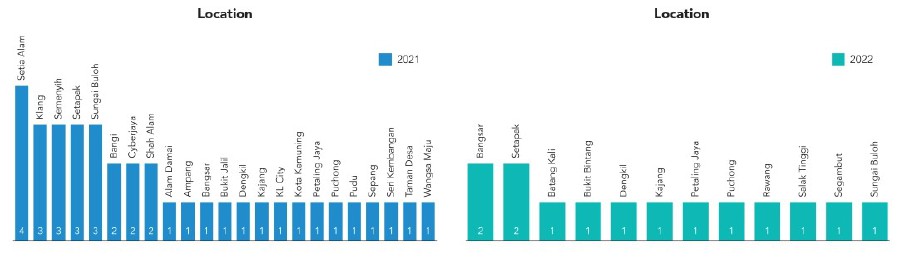

• Selangor had 8 projects launched compared to Kuala Lumpur's 6 projects in 1H 2022. This is marginally higher when compared to the statistics in the same period in 1H 2021 where Selangor launched 27 projects against Kuala Lumpur's 10 projects.

• By units, Selangor had a slightly higher 4,283 units or commanding 56% of the total units launched compared to Kuala Lumpur's 3,312 units or 44%. This is in total contrast to the corresponding period last year where Kuala Lumpur had the lion's share of 69% or 7,937 units of the total units launched compared to Selangor's 31% or 3,623 units.

• The most active month in the first half of 2022 is January with 4 projects (same as January 2021), perhaps from the spillover effects of the just expired HOC or for projects that couldn't or did not launch in 2021 due to certain reasons. The momentum however receded over time with no project launches in April 2022 as well.

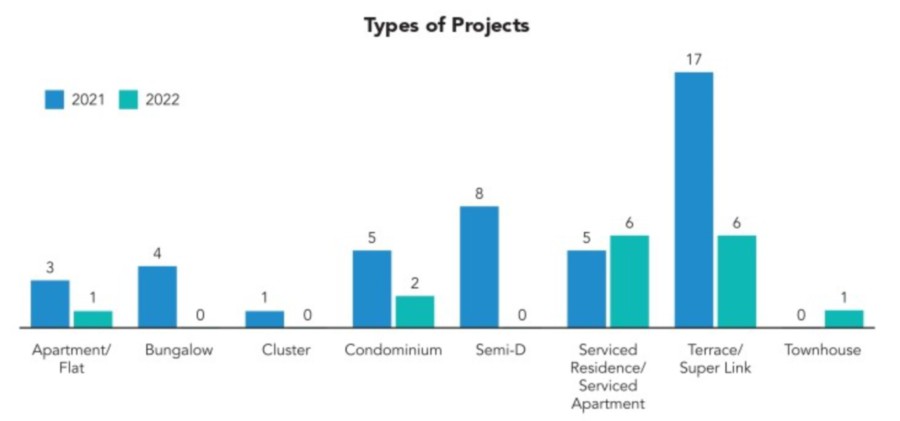

• Terrace houses and serviced residences/serviced apartments dominated 1H 2022 with 6 projects each, with zero projects for the larger homes like a bungalow, semi-detached, and cluster homes, probably due to the impending economic conditions of the country that may shrink a buyer's appetite. In 1H 2021, terrace houses were leading by a big margin with 17 projects launched.

• There were 10 high-rises and 6 landed projects launched in 1H 2022 compared to 13 high-rises and considerably more landed properties with 30 projects in 1H 2021.

• By percentage and by property type, there's a similarity between both periods with 78% of the units contributed by the high-rises and 22% by the landed properties although the total number of units is far less in 1H 2022 with 7,595 units compared to 11,560 units in 1H 2021.

• Properties measuring 801 sq ft to 1,000 sq ft were featured by 7 projects, the most number, in 1H 2021, which is similar to the corresponding period in 2021 with 10 projects selling units with similar built-ups. The larger 1,200 sq ft to 1,500 sq ft saw 6 projects carrying them in 1H 2022 followed by 601 sq ft to 800 sq ft, slightly different from 1H 2021 with 8 projects each carrying the 1,201 sq ft to 1,500 sq ft and 1,501 sq ft to 1,800 sq ft built-ups.

This changing trend to the smaller units may be a direct reaction to the market conditions where property developers may have prioritised selling properties that fit the people's budget than selling at higher prices but risks a lower demand.

• The change in pricing also saw the selling prices per unit of RM401,000 to RM600,000 category featured by the most number of projects, 10, in 1H 2022. In the corresponding period last year, 31 projects had units priced above RM1 million and this could likely be attributed to the HOC's incentives for the buyers that emboldened the developers despite the full effects of Covid-19 having yet to play out.

• There were also more projects with projects sold at the lowest pricing per sq ft ie. below RM500 per sq ft in 1H 2022, compared to other higher price brackets. Although it was also popular in 1H 2021, the RM501 to RM750 per sq ft and the RM751 to RM1,000 per sq ft price brackets did not trail very far. Again, this could be due to the changing market environment in 2022.

• Bangsar and Setapak in Kuala Lumpur led the market with 2 project launches each in 1H 2022.