The past two to three years have witnessed several major global events which have greatly disrupted supply chain continuity and adversely impacted production levels worldwide. This has led to delays in the delivery of goods and materials resulting in shortages as well as an increase in prices of raw materials and finished goods.

Mercury Rising

Firstly. the Covid 19 pandemic which affected the whole world led to lockdowns imposed by governments worldwide in an attempt to fight and control the spread of the highly contagious and deadly disease which has resulted in more than half a billion infections worldwide and more than 6.3 million deaths at the point of writing this article. The disease has gone through various mutations and the number of infections has since then been brought under control in most countries.

The spike in cases in Shanghai a month ago has however led China, which has adopted a zero Covid-19 policy, to implement new lockdowns which once again affected the production and delivery of essential components like semiconductors and other key parts which go into the production of all kinds of everyday necessities and items ranging from computers to mobile phones and cars.

The lockdown in Shanghai has since been eased after the number of infections has been brought under control but a new lockdown has just been announced in Central Anhui where there was a recent spike in the number of infections. The lockdowns certainly affected the production of not only manufactured goods but also parts for other manufactured goods as well as food items, all of which in turn led to a rise in production costs, not just in the higher cost of raw materials but also holding financing and management costs.

The Russian invasion of Ukraine was something that the world did not bargain for although there were signs that were pointing towards that happening even a year ago. The cost of war, both direct and indirect, is high as food production from Ukraine, the world's bread basket was adversely disrupted and the sanctions imposed by the US and its Western allies on Russian exports caused a curtailment in supply chains and a steep hike in prices. In particular, oil and gas prices shot up the multi-fold and this in turn led to a significant increase in production costs.

Crude oil prices fell to a low of under US$20 per barrel in April 2020 during the height of the Covid-19 pandemic when economic activities came to a near halt but have since not only recovered but went on an upward trajectory, especially after sanctions were imposed on import of Russian oil and gas by the US and its Western allies. Crude oil has now breached the US$100 mark and still rising.

As oil and gas are the principal sources of fuel used by most industries, this has naturally led to a jump in production costs and consequently increased prices of intermediate goods such as steel bars, aluminum, and cement. This has then resulted in the rise in the cost of building materials required across the full spectrum of the industry such as electrical wiring, water pipes, sanitary ware, fittings, etc.

MY Indicators

In Malaysia, added to the woes faced by the construction industry was the current labour shortage faced not only by the industry but across all economic sectors including the hotel, F&B, manufacturing, plantations, and even the domestic workers' sector. The relevant ministries have, until now, not been able to resolve the labour shortage and alleviate the pains faced by businesses in the country. This has, together with the significant jump in building material prices, led to some contractors declining to participate in bids, turning away jobs, or adopting a more conservative approach in pricing their tender bids.

There were also instances where contractors who were tied to fixed price contracts chose to abandon the work sites as they would suffer even more financial losses if they were to continue till the works' completion due to the higher material prices which they did not anticipate and factor in.

In its Property Industry Survey 2H2021 and Market Outlook 2022 released in March this year, the feedback gathered by REHDA amongst its members was that "the average percentage increase in the cost of building materials over two years was 55 per cent for aluminum, 52 per cent for timber, 38 per cent for steel, 19 per cent for cement, 18 per cent for sand and 16 per cent for concrete. The REHDA survey also estimated that there will be an average 19 per cent increase in construction cost in 2022 and that based on this increase, there would easily be an 8 per cent to 12 per cent increase in the selling prices of the properties being built."

The survey also revealed that some developers may hold back on new launches this year due to the uncertainty posed by the rise in construction costs which may affect their pricing strategies and sales take-up rates.

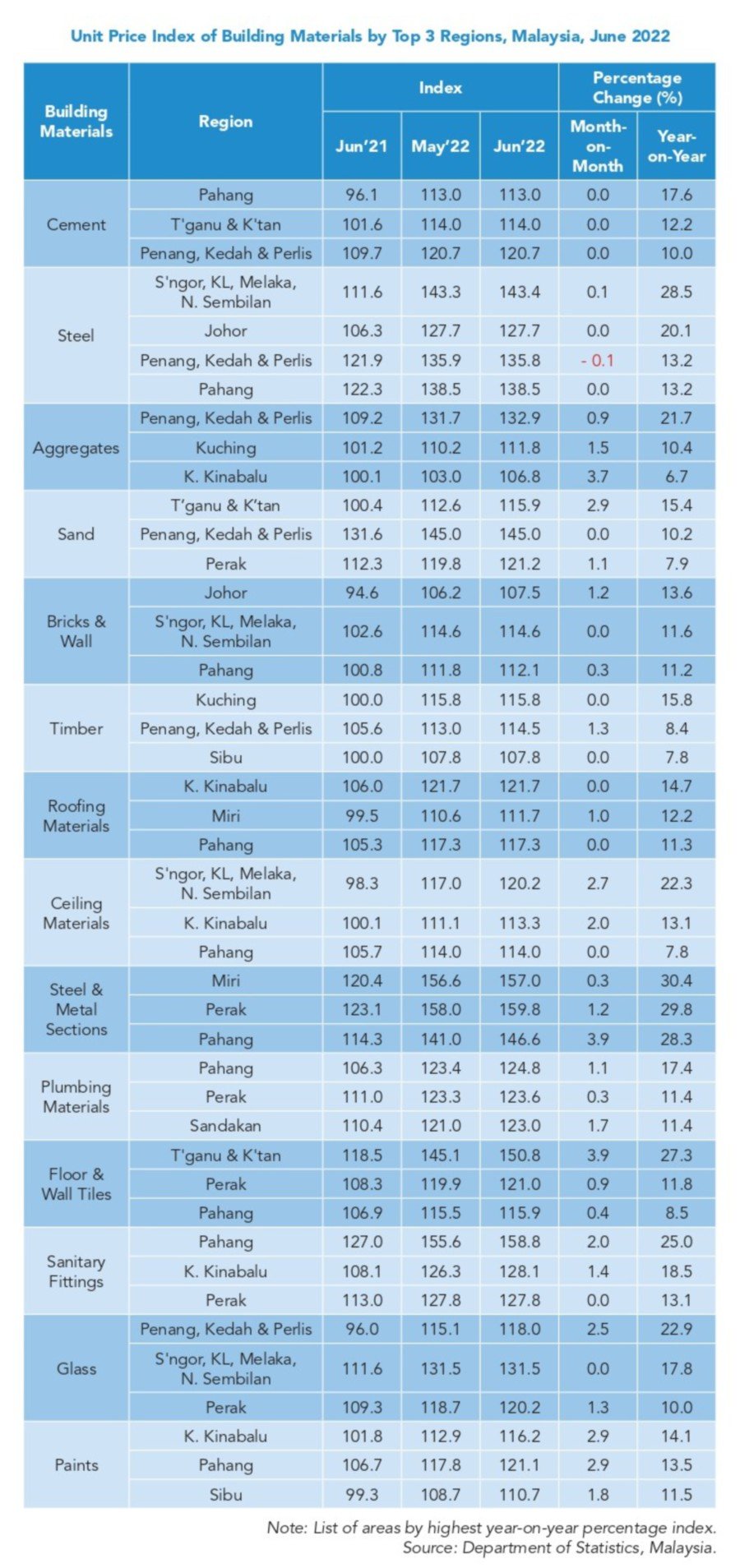

The Department of Statistics Malaysia (DOSM) also confirmed the increase in construction costs. In their latest posting on their website, the DOSM revealed the following:

● All building materials recorded increases in May 2022 as compared to a year ago. Steel bars increased 20 per cent with an average price of steel bars @ RM3,910 per metric tonne as compared to the previous year (May 2021: RM3,258 per metric tonne). Meanwhile, cement recorded an increase of 12.2 per cent in May 2022 with RM20.89/50kg as compared to RM18.61/50kg in May 2021. In addition, prices of most building materials such as aggregates, sand, bricks & walls, roofing materials, and ceiling materials also registered increases.

●The unit price index of building materials increased between 4.1 per cent to 19.9 per cent. The price index per unit of steel and steel & sections increased by 19.9 per cent and 18.1 per cent respectively in May 2022 as compared to May 2021. In addition, the price index per unit of cement also increased by 12.4 per cent during the period.

All these seem to point to a strong likelihood of house prices being raised by property developers in the coming months. Nevertheless, there are other factors besides construction costs that determine the pricing of houses. The state of the economy and the housing market, and the receptiveness and ability of buyers in accepting price increases is one major factor that will determine how much of the cost increase can be passed on to the buyers. We now examine some of these factors.

Recess Time?

Global economic growth this year appears to be easing towards a slowdown as a result of the difficulties and challenges posed by the economic sanctions imposed on Russia by the US and its allies. According to a research report by Nomura Holdings Inc., there is a likelihood of many major economies slipping into recession and if this happens, Malaysia will quite likely experience a slowdown in its export growth and this will then inevitably impact overall economic growth for the year. In turn, this will affect investors' sentiments and result in not only the equities market but also the property market taking stock of the situation and tapering off to a certain extent. Once the demand for properties cools off, developers will be in a weaker position to pass on any additional costs to the buyers. As it is, the residential property market, although showing some signs of a recovery from the slowdown caused by the pandemic, has yet to demonstrate that the recovery is sustainable and not just a temporary correction.

Based on the latest available data from NAPIC, the Malaysian House Price Index recorded a 2 per cent q-o-q decline in Q1 2022 or a -0.1 per cent drop y-o-y compared with Q1 2021. NAPIC's report also revealed that a total of 94,544 units were transacted in Q1, representing a marginal 4.9 per cent drop from the previous quarter. The performance of the property market in the second half of 2022 will provide clearer signs of the direction of the market.

The recent hikes in interest rates by Bank Negara Malaysia (BNM) and anticipated further hikes this year have increased borrowing costs and this will hurt the property market although the extent of the impact will depend on how high the central bank is prepared to push up the OPR without sacrificing growth. Banks have also been adopting more stringent criteria in processing loans and this will provide a sort of handbrake on property sales to borrowers who are financially less capable of adding to their financial commitments.

Amongst some of the major domestic concerns affecting the country is the continued political uncertainty and constant jostling for power not only between the parties in the ruling government and the opposition but also amongst the various rival camps within each of the parties, both within as well as outside the government. There have been opposing stands on when GE15 (15th General Elections) should be held depending on which camp the politicians are in although it would appear quite likely to be within this year. This uncertainty has caused investors to adopt a more cautious stance and is certainly not helpful to the property market.

The moving on of the country to an endemic phase has resulted in the easing of SOPs and the return of tourists into the country. Nevertheless, we have yet to see a resurgence of buying interest in Malaysian real estate by foreign investors. The stricter and less favourable qualifying criteria under the revised MM2H (Malaysia My 2nd Home) programme have not helped either and it will take quite a while and much more effort by all stakeholders before foreign investors return in a big way to help reduce the stock of unsold upmarket homes.

In conclusion, property prices are headed for an increase this year as developers will have to pass on the higher costs of building these properties to the buyers. However, due to the many challenges and uncertainties that the country is currently and will continue to face for the rest of the year, it is unlikely that developers will be able to pass on all the additional costs to the buyers. They will have to find the right balance of recovering some of the additional costs which will affect their bottom line but without sacrificing sales momentum which is important for cash flow considerations.

Developers will probably try to absorb as much of the costs as they possibly can and for those projects which are in good locations and which can still attract strong interest, the price increase, if we dare to venture a guess, would likely be in the range of between 5 per cent to 10 per cent. For projects which are not selling that well despite having been on the market for some time since being launched, there would likely be minimal or no increase in selling prices. We also believe that there will not be any increases in prices of completed properties in the secondary market, particularly of those in the higher price brackets and in locations where demand is not so strong and the rental market is a bit weak.

With the increase in interest costs, it will become more burdensome to even owners of medium-priced properties to service their mortgages and those who are financially more hard-pressed would be more willing to consider lower offers for their properties. At the same time, buyers will also have to reconsider their budget for property purchases as their loan eligibility limits will be affected somewhat by the increase in monthly mortgage repayments due to the increase in interest costs. - Story courtesy of Henry Butcher Malaysia