The state of Sarawak has experienced a growth in the overall property transactions volume and value in the first nine months of 2021 compared to the same period in 2020.

In terms of volume, it went up by 14.6% to arrive at 15,783 units from 13,775 units while in value, it rose by a higher margin at 34.6% to RM5.4 billion from RM4 billion. The positive growth makes Sarawak one of the few that have seen its market turnaround in the period under observation compared to the other states in the country.

It is also heartening to know that the 12th Sarawak state elections held on 18 December 2021 and the forecast of the Sarawak property market in HB Perspective 2021 share one thing in common, the results were almost predictably accurate. While the state elections did not spring much surprises as to which party will remain in power and whether or not Tan Sri Abang Johari Openg will continue as the Chief Minister, our forecast also could not have departed further from our analysis with the long-standing favourite landed residential properties continue to be taken up more than the high-rises and the fellow sub-sectors of commercial and industrial both showing recovery and resilience in 2021.

Results such as these were displayed as early as the first half of 2021 by NAPIC's official data compared to the corresponding period in 2020. But aside from the strong demand for landed residential, capital of the state, Kuching experienced a slight drop in the transacted volume for residential, industrial, agricultural and development sectors in 1H 2021 compared to 2H 2020 with only a slight increase in the commercial sub-sector which can be attributed to the opening up of the economy after the lockdowns. From NAPIC data also, there was a decrease in new planned supply, starts and completion in the residential and commercial sub-sectors and as such, the year 2022 will mostly see developers concentrating on clearing the existing stocks accompanied with launches in landed properties to meet market demand.

In terms of overhang properties, there was a steep increase of 77.01% in the commercial sub-sector in 1H 2021 in Sarawak from 1H 2020. Shophouses make up a big majority of the overhang. This is however anticipated to reduce in 2022 as the supply has receded due to Covid-19.

Sarawak's property market ended on a stable growth fashion in the second half of 2021 and this will set the state off in positive momentum going into the new year. As such, 2022 is poised for a year of stability and positive performance with potential growth in landed residential and agriculture vacant lands.

Factors to Watch in 2022

• Several major infrastructure projects undertaken in Sarawak will provide a boost to the future development of the state's economy when completed, they include:

oconstruction of the Coastal Highway and bridges.

oconstruction of the Pan Borneo Highway which includes:

upgrading of federal roads from 2 to 4 lanes, construction of 115 bridges, 25 elevated interchanges, 3 rest and service areas and 6 lay-bys. (Phase 1 - one package completed (WPC01 - from Telok Melano to Sematan – 33km);

connecting the highway to Simanggaris in Kalimantan (Indonesia) by the 3,901km Trans–Kalimantan Highway South (10 more packages under construction and expected to be completed in June 2022 and 2023)

Phase 1 connecting Telok Melano-Sematan–Miri comprising 12 work packages covering 786.41km with a project cost of RM16.12 billion.

Phase 2 connecting Miri and Lawas covering 98km.

oJalan Johari Sunam – Jalan Kemena in Bintulu measuring 4.5km currently under construction.

oKuala Kemena Jepak Bridge in Bintulu measuring 1,283m costing RM467 million currently under construction and expected to complete in April 2023.

oupgrading Route 8101 Jalan Datuk Mohd Musa where in Kuching there will be 4 additional lanes, 3 new bridges, pedestrian walk and street lighting along Jalan Kota Samarahan in Kuching with a total 11.6km costing RM229 million expected to complete in 2023.

onew Mukah Airport at 7km from Mukah Town sited on 115.3-ha with a terminal area of 3,120sqm and 1.5km runway costing RM300 million replacing the old short take-off and landing strip. New airport is completed and commenced operation on 17 June 2021.

oSarawak's Petrochemical Hub (SPH) at Tanjung Kidurong, Bintulu, sited on 432-ha with a GDV of RM16 to RM20 billion per annum, currently under construction.

oThe proposed second Kuching-Samarahan Trunk Road, Kuching & Samarahan Division with a bridge over Sg. Sarawak at Sejingkat.

Bright Spots in 2022

•Landed residential in suburban areas.

•Sarawak does not have a high residential property overhang as there is no over building and overbearing launches of new projects.

•The decision of companies to adopt a work from home (WFH) arrangement did not seem to have a major impact on the demand for office space in the state.

•The industrial sector was affected by the supply chain and logistics issues during the pandemic as experienced in other states but the impact on the industries in Sarawak have not been that substantial.

•Expansion of the Samajaya Free Industrial Zone.

Outlook for 2022

•The residential property market has shown signs of a recovery in 2021 and this trend is expected to continue into 2022.

•The purpose-built office market is expected to be stable in 2022 as there is limited new supply coming onto the market.

•The industrial property market will continue to do well in 2022 and will benefit from the completion of the major infrastructure projects currently being constructed in the state.

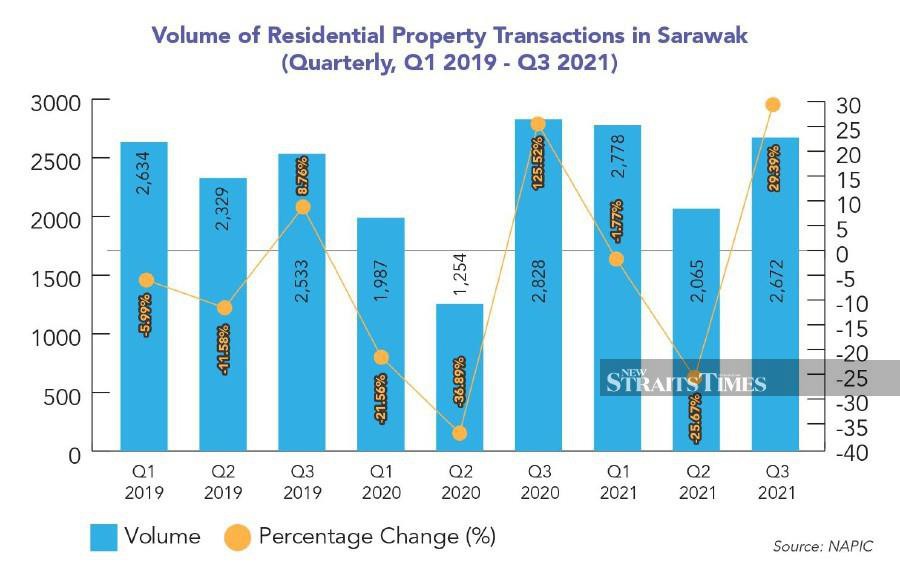

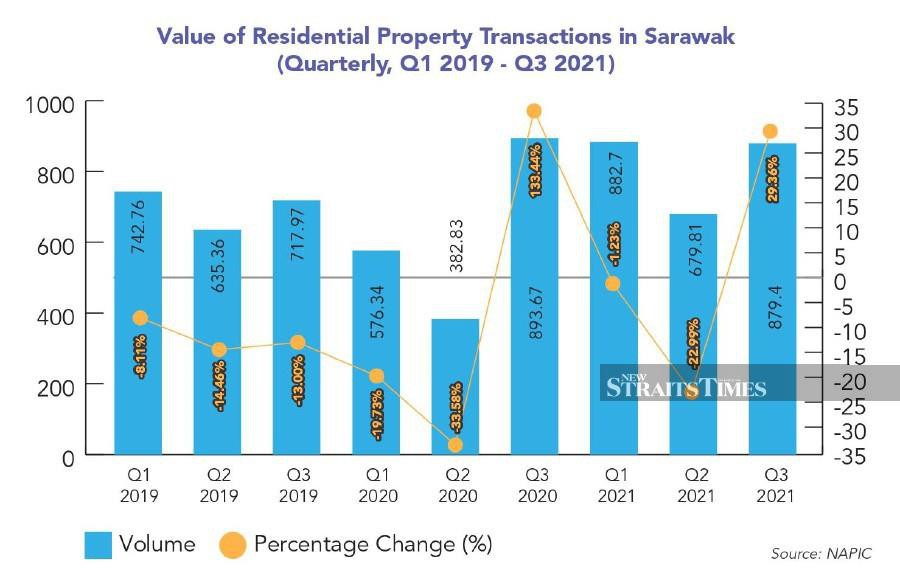

Residential Review & Outlook

The total volume and value of residential property transactions recorded in the first nine months of 2021 showed signs of recovery after it was adversely impacted in 2020 by the Covid-19 pandemic which resulted in a decline of 19% in the volume and 10% in the value of transactions. In the first nine months of 2021, the market recovered with an increase of 23.83% in the volume of residential property transactions whilst the value of transactions went up by 31.79% y-o-y, a sign that was already shown by the statistics as early as the first half of 2021.

Based on NAPIC's data, there were 1,161 residential units launched between Q1 and Q3 in 2021 with a sales take-up rate of 23.7% over the nine months. There were also 1,862 units of overhang residential properties worth RM702.96 million. Bulk of the units launched comprised condominiums and apartments but based on our analysis, landed residential properties enjoyed higher sales take-up rates compared to the high-rises.

As there is a decrease in the new planned supply, starts and completion in Sarawak's residential properties, developers are expected to focus on clearing their existing stocks and launch more landed properties. Moving forward, the trend of recovery spotted in 2021 in the sub-sector is expected to continue into 2022.

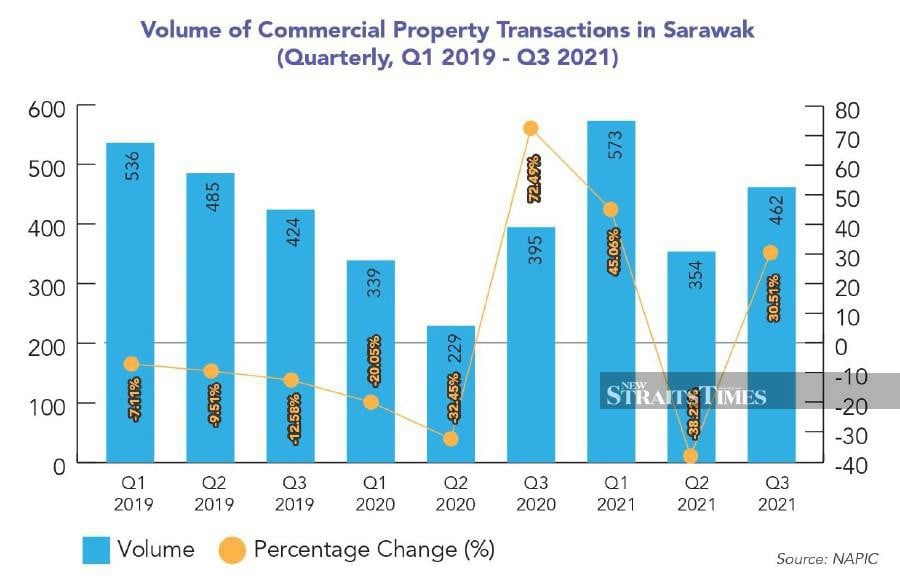

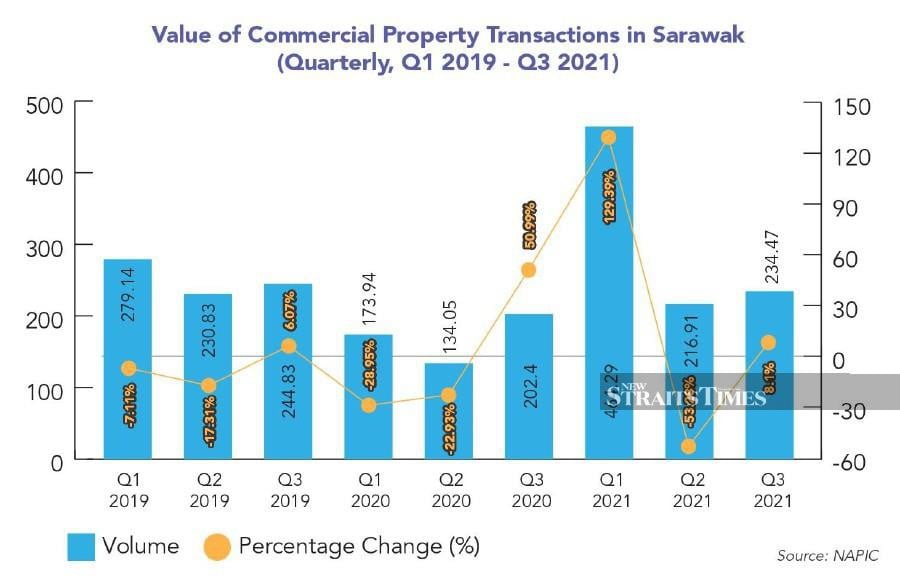

Commercial Review & Outlook

The commercial property market in Sarawak saw a sharp decline in both volume and value of transactions in 2020 due to the lockdown imposed during MCO 1.0 which had a big impact on businesses. The volume and value of transactions came down by around the same margins at 33% and 32% respectively. The first nine months of 2021 however saw the market staging a recovery as the volume of transactions in this period jumped by 44% and the value of transactions leapt by 78%.

There were 1,389 units transacted in the first nine months of 2021 with a total transaction value of RM915.67 million with most of the transactions for 3 and 3.5 storeys shops followed by stratified shops.

There was a total supply of 527.08 sq metres of privately owned purpose-built office (PBOs) space in Sarawak as at 1H 2021 with a recorded occupancy of 86.4%, slightly up from the 85.4% recorded in 2020. The work from home culture implemented during the pandemic did not appear to have much impact on the purpose-built office (PBO) market due to its limited supply. Moving forward, the PBOs market is expected to be stable in 2022 as there is limited new supply of such properties coming into the market.

The commercial sub-sector of the state on the whole is expected to slowly resuscitate in 2022 given that in Kuching alone has seen a mushrooming of supermarkets in 2021. With most of the commercial activities having returned to their official business premises for day-to-day operation, business is looking to have come back to normal. But to ensure a safe distance at work, it may require a bigger working space or utilise the age-old shift system like the manufacturing plants. Demand as such for larger premises may gradually seep back into the market again after Covid-19 is more contained and under control.

Industrial Review & Outlook

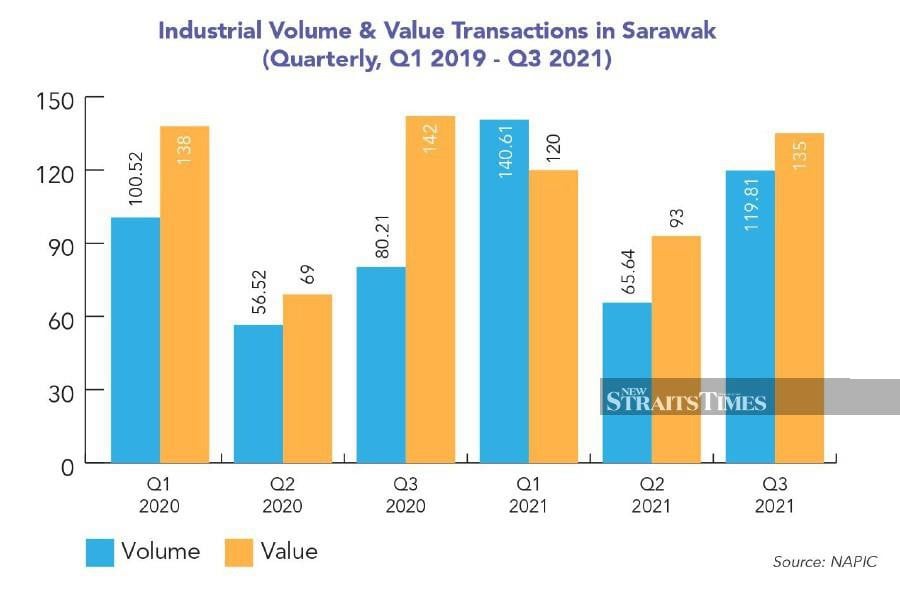

The industrial sub-sector in Sarawak was fairly stable in the first nine months of 2021 with an almost similar number of industrial properties at 349 units changing hands compared to the same period in 2020 at 348 units but with a higher value of transactions of RM326.06 million or a 37% rise against the RM237.25 million in the same period in 2020.

In terms of property type, there was a high number of semi-detached industrial properties transacted during this period followed by vacant industrial plots. 2021 also saw the expansion of factories like Taiyon Yuden, Longi, ILJIN and Western Digital in Samajaya Free Industrial Zone in Kuching. Utilisation of industrial factories and warehouses have so far been confined to manufacturing, storage and distribution with little or unnoticeable change for innovative adoption like central kitchens in Klang Valley.

Sarawak's industrial property market is expected to continue doing well in 2022 and will also stand to benefit from the completion of the major infrastructure projects currently being constructed in the state.

Retail & Hospitality Overview & Outlook

The massive natural greenscapes of Sarawak and its indigenous communities steep in cultural identities and values have been the cornerstone of tourism for the state. With Covid-19 having blocked all entry for travel by neighbouring states and also international tourists, the retail and hospitality sub-sectors have suffered just like her peers elsewhere in the country. But unlike most other states in Malaysia, Sarawak's retail may have a better and earlier chance of a revival before hospitality does and this is due to the present demand from the local market itself. This proves that a self-sustaining economy is a reliable model that could see a locality through in times of crisis.

At present, the performance of the retail sub-sector has not reached pre-Covid-19 levels with businesses especially in the down town areas relying on tourists looking to continue its challenging days. For it to come around, it has to wait until the cumbersome quarantine requirements and other SOPs are eased so incoming tourists can flock again to the beautiful and rich Sarawak. - Henry Butcher Malaysia