Perak's overall property market transaction experienced an 8.5 per cent drop in volume in the first nine months of 2021, but its value of transactions rose by 6.7 per cent compared to the same period in 2020.

The decrease in volume was from 25,564 units in 2020 to 23,383 units in 2021 whereas, over the same period of the first three quarters, its value of transactions went from RM5.4 billion to RM5.8 billion. Thus far, Perak's property market has experienced a gradual resuscitation in almost all sub-sectors with the residential and commercial prices showing stability and easing while industrial saw improvement in prices.

To spur the market, the Perak government has formulated some of the most attractive and tangible assistance to her residents and buyers, this includes the RM1.2 billion allocation for comfortable and quality housing, especially to the low-income group which encompasses RM500 million to build 14,000 units of low-cost housing under Program Perumahan Rakyat, RM315 million for the construction of 3,000 units of Rumah Mesra Rakyat by Syarikat Perumahan Nasional Bhd, RM125 million for the maintenance of low cost and medium-low stratified housing and the RM310 million for the Malaysia Civil Servants Housing Program (PPAM).

The state government has also provided full stamp duty exemption on instruments of transfer and loan agreement for first-time home buyers until December 31, 2025, an extension of five years for stamp duty exemption on loan agreement and instruments of transfer given to rescuing contractors and the original house purchasers and also the government's collaboration to extend the Rent-to-Own Scheme which involves 5,000 units of PR1MA houses with a total value of more than RM1 billion.

Growth in Perak in 2H 2021 is expected to be better in line with the resumption of economic activities across the country, improvement in the labour market, continuing policy support and expansion in external demand, together with the efficacy of Covid-19 vaccinations and society's adherence to the SOPs in the new norm.

As 2022 will be faced with the end of loan moratorium and replaced with targeted loan moratorium to continue providing borrowers with further assistance, the country will also be pressured with rising inflation, as are market globally. But not all is lost in the Perak state given her bold ambition to be part of the Fourth Industrial Revolution economy through the Silver Valley Technology Park, dubbed Southeast Asia's first Digital Disruptive Technology Park. This advanced thinking industrial park will be focusing on high-value manufacturing and digital economy activities with an expectation to attract RM14 billion of private investments and create about 13,000 jobs.

The optimal management of Malay Reserved Land and government land by renting out for agricultural and business projects are also Perak's way of thinking out of the box. Other notable projects include the mixed development on 192.23 hectares at Batang Padang by Ageson Holdings Sdn Bhd and Perak Menteri Incorporated with a GDV of RM879.9 million, an affordable housing project on 92.97 hectares in Tapah with a GDV of RM295 million, the potential expansion of the RM105 million natural gas pipeline network with a new 62km link from Kampung Kuala Bikam, Bidor to Proton City in Tanjung Malim and the possibility of constructing a new airport including the extension of Sultan Azlan Shah Airport's (LTSAS) runway.

Factors to Watch in 2022

•RM1.5 billion allocation for low-income group housing projects.

•Optimal management of Malay Reserved Land and government land by renting out for agricultural and business projects.

•The Silver Valley Technology Park in Hulu Kinta within 15km of Ipoh City Centre is earmarked as Southeast Asia's first Digital Disruptive Technology Park focusing on high-value manufacturing and digital economy activities with a target to attract private investments worth RM14 billion and create about 13,000 jobs.

•Mixed development project of 192.23-ha at Batang Padang by Ageson Holdings Sdn Bhd and Perak Menteri Incorporated, includes government agencies & administration unit, industrial, commercial and residential with a GDV of RM879.9 million expected to be completed within 15 years.

•Joint development affordable housing project in Tapah on 92.97-ha with a GDV of RM295 million between Lagenda Properties Bhd's subsidiary and MajuPerak Holdings Bhd's subsidiary comprising 1,374 single storey terrace houses, 264 two storeys shop houses, petrol station, hypermarket, and office building.

•Potential to expand the RM105 million natural gas pipeline network with a new 62km link from Kampung Kuala Bikam, Bidor to Proton City in Tanjung Malim.

•Plans of a new airport and extend Sultan Azlan Shah Airport's (LTSAS) runway to meet demand from domestic investors and medical tourists.

Bright Spots in 2022

•The current 1.75 per cent low overnight policy rate (OPR).

•RM1.2 billion government allocation for comfortable and quality housing especially for the low-income groups which includes RM500 million to build 14,000 low-cost houses under Program Perumahan Rakyat, RM315 million for 3,000 units of Rumah Mesra Rakyat by Syarikat Perumahan Nasional Bhd, RM125 million for maintenance of low cost & medium-low stratified housing including assistance to repair dilapidated houses and those damaged by natural disasters and RM310 million for the Malaysia Civil Servants Housing Program (PPAM).

•Full stamp duty exemption on instruments of transfer and loan agreement for first-time homebuyers extended to December 31, 2025, effective for sale and purchase agreements executed from January 1, 2021, to December 31, 2025.

•Stamp duty exemption on loan agreement and instruments of transfer given to rescuing contractors and the original house purchasers are extended for five years, effective for loan agreements and instruments of transfer executed from January 1, 2021, to December 31, 2025, for abandoned housing projects certified by the Ministry of Housing and Local Government (KPKT).

•Government to collaborate with selected financial institutions to provide Rent-to-Own Scheme and will be implemented until 2022 involving 5,000 units PR1MA houses valued at more than RM1 billion.

Outlook for 2022

•The residential sub-sector will see a gradual growth in volume with stable prices.

•The commercial sub-sector is expected to gradually recover in 2022.

•The industrial sub-sector should be encouraging in light of the state government's interest to attract foreign direct investments that are in line with the Fourth Industrial Revolution.

Residential overview and outlook

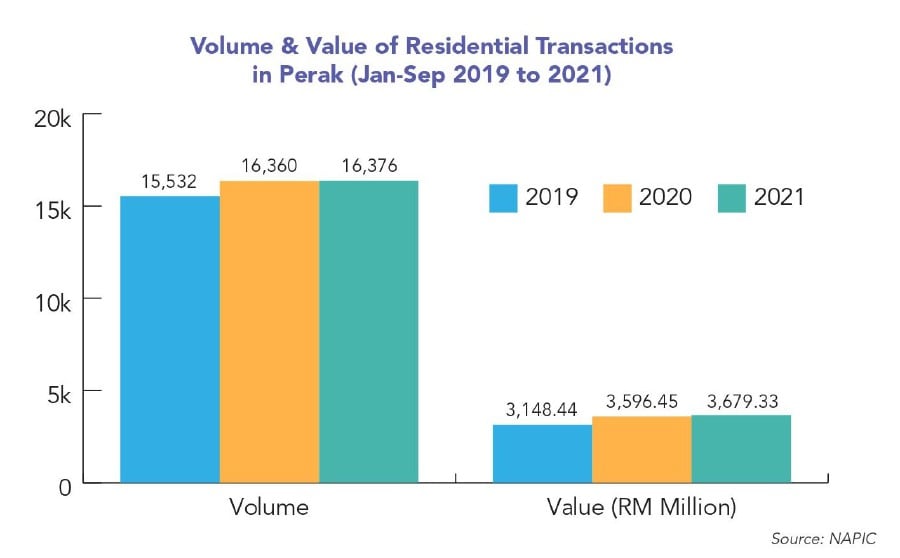

There were slight growths in the volume and value of transactions for the residential sub-sector in Perak for the first nine months of 2021 compared to the same period in 2020 at 0.1 per cent and 2.3 per cent respectively. This comes on the back of higher growth in the same period the year before compared to 2019 at 5.3 per cent and 14.2 per cent respectively.

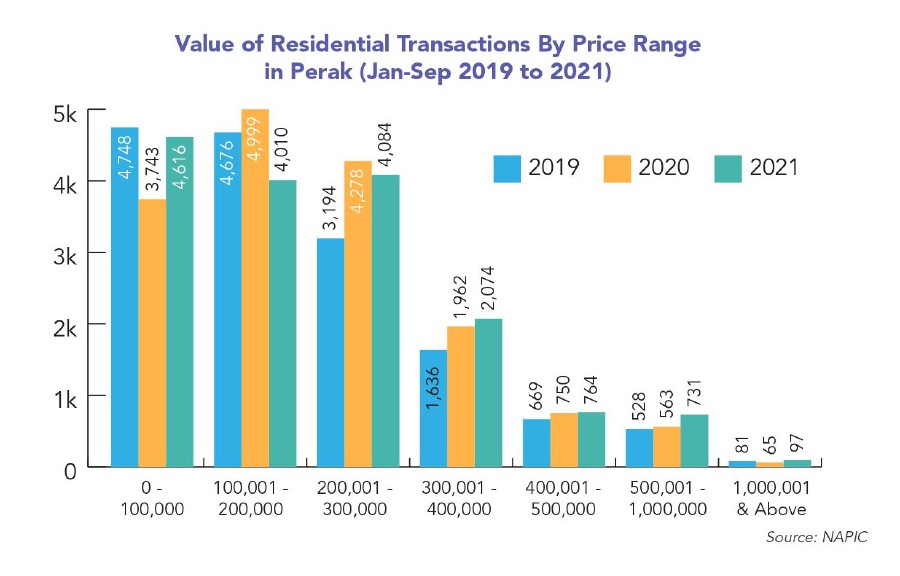

Most of the transactions that took place in 2021 were below RM100,000 and between RM100,001 to RM300,000 price bracket. Single storey houses were the most popular followed by vacant residential plots and double-storey terrace houses. In terms of locations, most of the transactions that took place were Kinta, Manjung, and Larut Matang.

The statistics showed that there was a massive drop of 83 per cent in new launches in the first half of 2021 compared to the same period in 1H 2020. Most of the launches in 1H 2021 were two to three storeys terrace dwellings. Overhang residential on the other hand showed a reduction in volume and value. The overall trend is expected to have continued until the end of 2021.

In terms of location, in Central Perak, investors can look at Bandar Seri Botani, Bandar Sunway Ipoh, Bandar Meru Raya while in West Perak, potential areas are Batu Gajah, Bandar Seri Iskandar, Manjung. Over in South Perak, there are Tanjung Malim, Tapah, Teluk Intan–Bagan Datuk and in North Perak, choice locations are in Taiping and Kamunting.

The year 2022 is expected to see a gradual growth in volume with stable prices as developers are likely to concentrate on clearing existing stock and also gradually release some held-back launches. But with new planned supply anticipated to grow in double digits with moderate sale performance, Perak's overhang residential numbers are expected to rise in 2022.

Commercial, hospitality, and retail overview and outlook

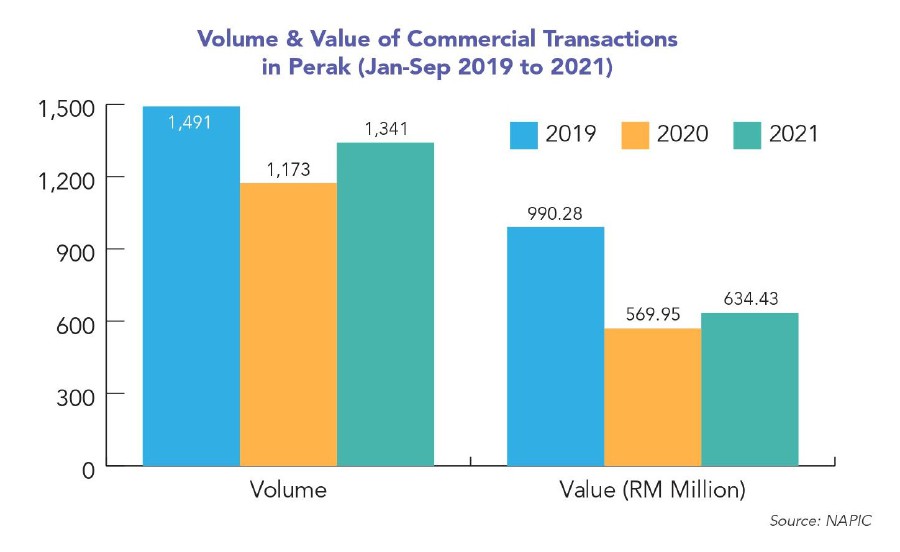

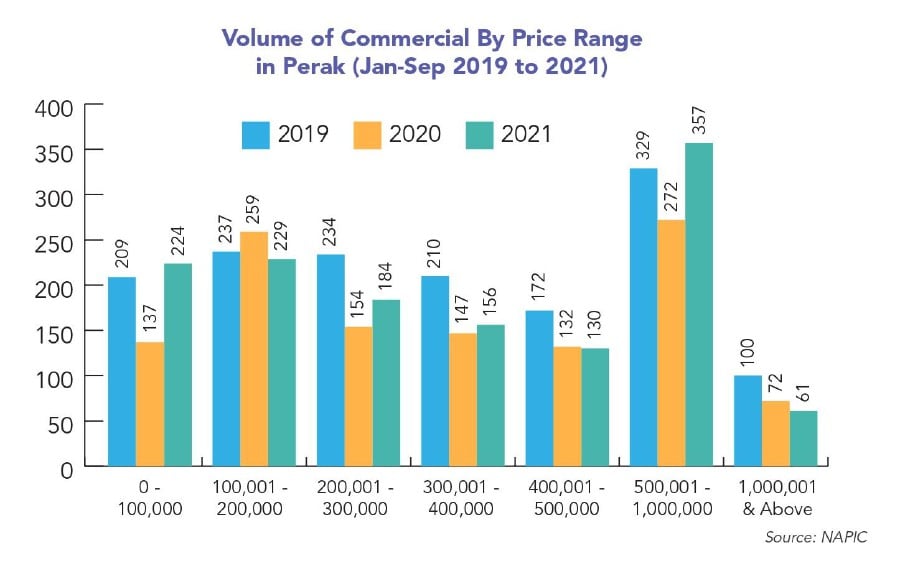

Over in the commercial sub-sector, both the volume and value of transactions experienced some improvement in performance in the first nine months of 2021 by growing 14.3 per cent and 11.3 per cent respectively. This however still lags behind the performance recorded in the pre-pandemic days of 2019.

Unlike the big cities such as Kuala Lumpur, Perak's commercial sub-sector only experienced a mild and short-term impact during the lockdowns that compelled the workforce to work from home. There were nevertheless increased activities at the official business premises with people returning to their offices after the lockdowns were lifted.

In Perak, purpose-built offices are mainly owner-occupied or occupied by government agencies. All other commercial users in the market tend to operate from the shop lots and shop offices.

With the re-opening of domestic tourism stipulated with strict SOPs and the incentive of an RM1,000 income tax relief for domestic holiday accommodations, Perak's retail and hospitality sub-sectors are expected to undergo a gradual recovery.

The performance of the leisure segment is highly dependent on the arrival of foreign tourists in 2021 and since the international borders have not been fully opened, the state government has set a target to receive three to five million domestic travellers by 2021. According to NAPIC, a total of RM25.9 million has been allocated for the restoration of tourism facilities and maximising the potential of the tourism industry and in line with this, tourist facilities such as Lata Tebing Tinggi in Selama, Taiping Zoo, Taman Alam Kinta in Kampar and Kellie's Castle in Batu Gajah have been the beneficiaries of the upgrading works.

With incremental crowd seen at the shopping malls daily, the performance of the retail sub-sector is expected to return to pre-Covid-19 level over time. The issue of Covid-19 will however still be hovering on the horizon and as such, all stakeholders must observe the SOPs to ensure the possibility of a Covid-19 recurrence remains low. Up until 1H 2021, the rental rate seems to have sustained while the overall occupancy rate for the shopping complex in Perak experienced only a minor drop of 0.1 per cent.

Although hospitality has a better chance of a quicker revival in Perak owing to domestic tourism and the pent-up desire to travel again by Malaysians after the lengthy lockdowns, the retail sub-sector is where property investors should be paying attention to if they are considering investing between the two considering its ability to fetch rental income while international tourist arrivals are still limited.

For investors looking to make an entry into the market, some potential locations for commercial offices include Ipoh SOHO, Greentown, Canning, Simpang, Taiping, Kamunting, Parit Buntar, Manjung, and Teluk Intan. Those looking at hospitality potential may consider Ipoh City Centre, Lumut, Manjung, Pangkor Island, Taiping, Teluk Intan, Bagan Datok, Gopeng and Belum Rainforest. For retail, there are Botani Village, Aeon Kinta City, Lotus Hypermarket, Ipoh Parage, Aeon Manjung, Aeon Kamunting, and Taiping Mall.

Like the residential sub-sector, the commercial property market is also expected to gradually recover in 2022.

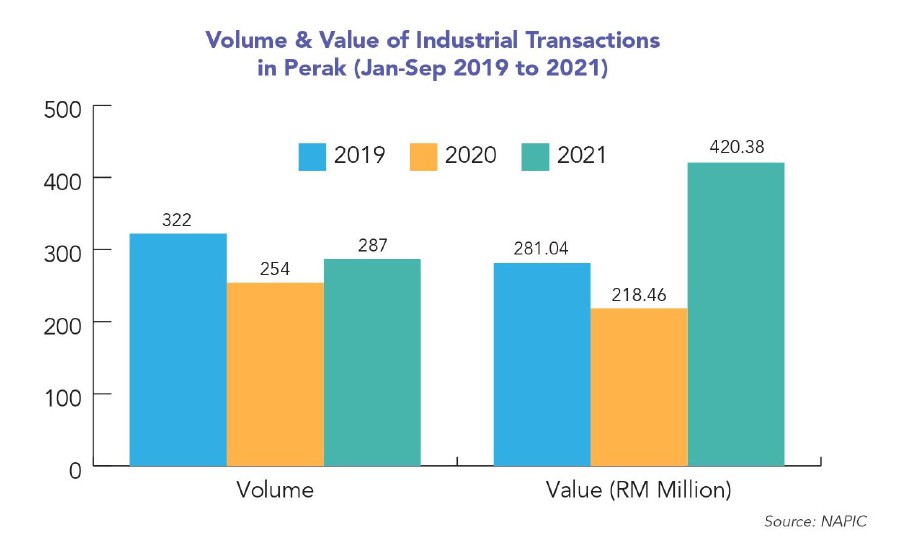

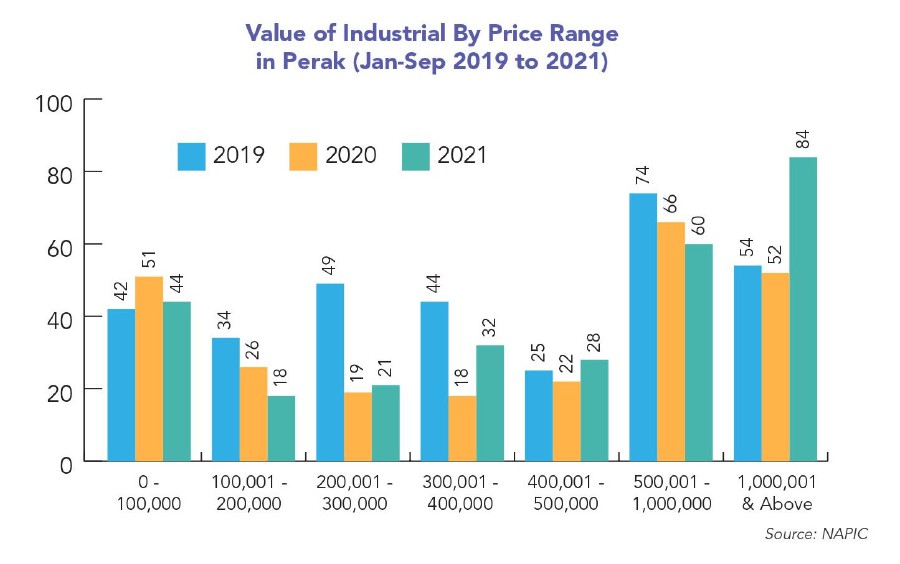

Industrial overview and outlook

Perak had seen an improvement in the volume (up 13 per cent) and much greater growth in value (up 92 per cent) of industrial transactions from Q1 to Q3 2020 against the same period in 2021. Popular transactional value was in the range of RM500,001 to RM1 million and above RM1 million.

Kinta area stood out as it has the most industrial transactions. Popular among the buyers were vacant industrial plots, detached units followed by semi-detached factories/warehouses. A notable industrial transaction that took place in 2021 was land sold by Ageson Bhd to ZheJiang GuoRong Digital Economy Group for RM278 million.

In terms of space utilisation, although there have been innovative usage for courier services, central kitchens etc, such trendy adoptions have not translated to significant uptake of industrial properties in Perak. Most are still used for conventional purposes like manufacturing, storage, and distribution.

Investors keen on participating in the Perak's industrial market for 2022 may sample locations in Tasek Industrial Park, Menglembu Industrial area, Pengkalan Industrial Estate, Kamunting Raya Industrial area, Lumut Port Industrial Park, Gepong Industrial area, and Tg. Malim Industrial Estate.

Moving forward, the performance of Perak's industrial sub-sector in 2022 is looking to be encouraging in light of the government's focus to draw foreign direct investments into the state for advancing its industrial capacity consistent with the Fourth Industrial Revolution experienced worldwide. - Story courtesy of Henry Butcher Malaysia