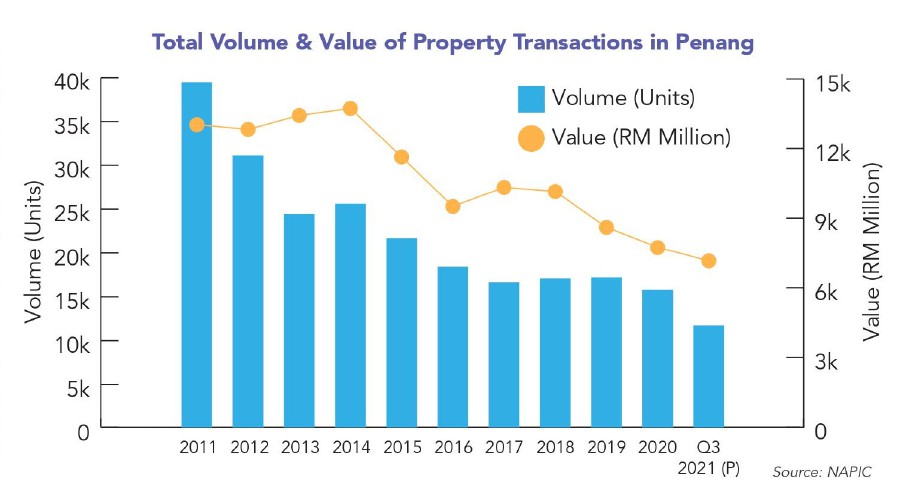

For the first nine months of 2021, Penang recorded 10,521 property transactions worth about RM5.4 billion which translates into an increase of 13.9 per cent in terms of volume and 33.7 per cent in terms of value of transactions compared to the same period in 2020. Performance on the mainland of Seberang Perai is also on an improving trend with its volume of transactions rising by 14 per cent while the value of transactions made a bigger leap with 50 per cent growth.

For the record, Penang is among only a handful of states in the country that charted a growth in its volume of transactions and occupies the higher quartile in the country for value of transactions for the period under observation in 2021.

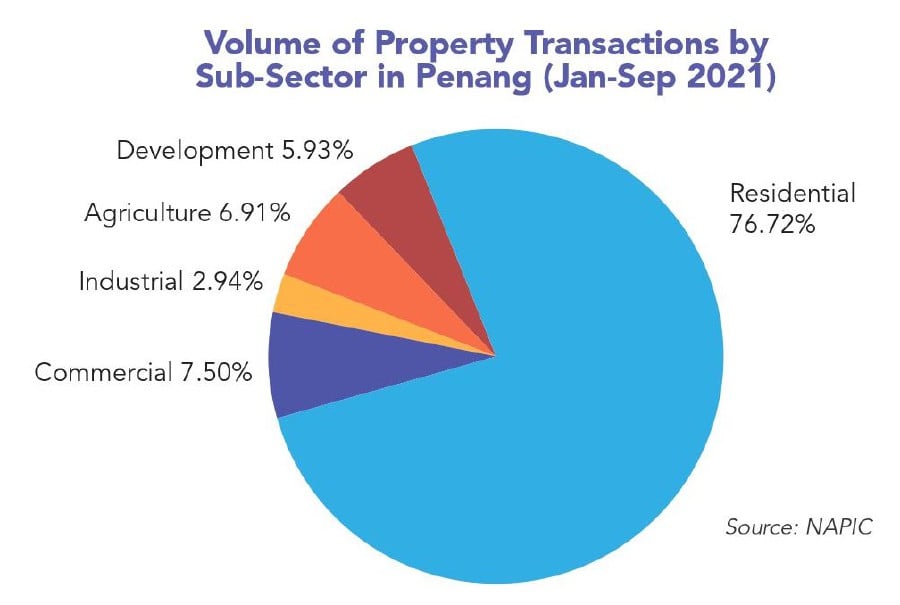

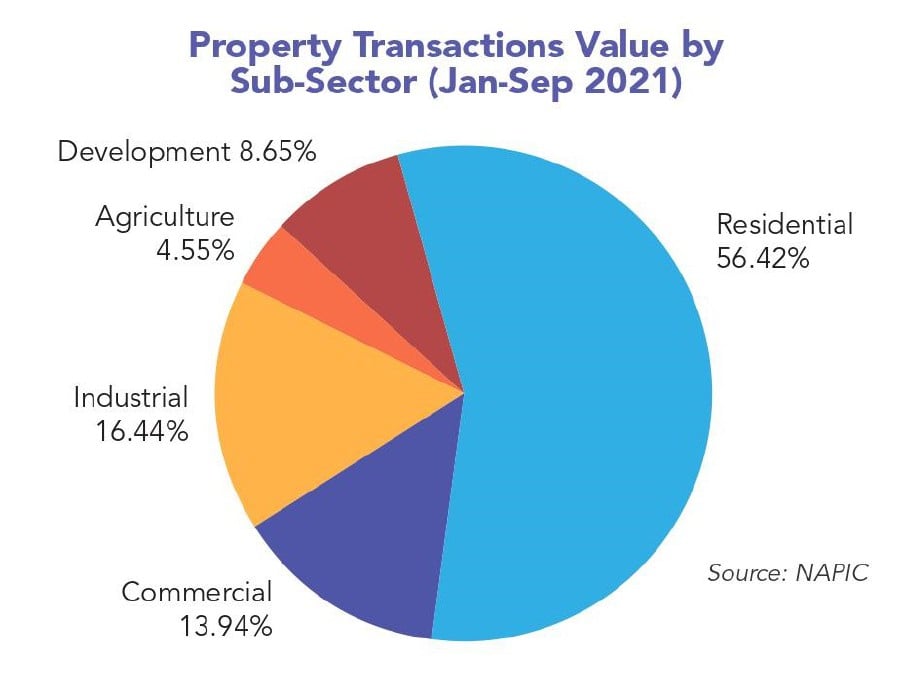

The residential sector continued to dominate the overall property market transactions with a lion share of 76.72 per cent followed by the commercial and agriculture sub-sectors at 7.5 per cent and 6.91 per cent respectively. In terms of value of transactions, the residential subsector contributed 56.42 per cent of the total value of transactions followed by the industrial and commercial sub-sectors at 16.44 per cent and 13.94 per cent respectively.

With market sentiments having returned with some confidence especially in the business sector after the successful National Covid-19 Immunisation Programme, the performance for Penang's property market in 2021 is anticipated to be stable and identical to what was recorded in 2020 whereas in Seberang Perai, performance is anticipated to be at the same pace seen in Q3 2021.

The Penang brand as an industrial and tourism hotbed has given it some reasons to look forward to a stronger 2022 from the devasting blows of the Covid-19 pandemic. Firstly, with Intel Corp's commitment to build a US$7 billion (RM30 billion) new production facility at Bayan Lepas FTZ 3 alongside the many other illustrious industrial success stories and secondly, for being hailed as one of "15 Best Islands in the World to Retire In" by global retirement and relocation portal, International Living. These are positive developments that can fan the Penang name further into the global markets and attract not just the leisure tourists and retirees but also foreign direct investments (FDI) and thereby creating more jobs and business opportunities in the state.

The good news also continued with Penang Development Corporation's (PDC) plan to set up two more Global Business Services (GBS) buildings with total net lettable area of 300,000 sq ft each as potential office venues for multi-national corporations to setup offices in. With this shall come jobs and economic multiplier effects for the state.

Factor to watch in 2022

•Removal of RPGT (Real Property Gains Tax) for property disposal made from the sixth year.

•RM2 billion allocation under the Housing Credit Guarantee Scheme to assist gig workers and small traders without steady income to apply for home financing.

Bright spots for 2021

•Intel Corp's US$7 billion (RM30 billion) planned investment into a new production facility at Bayan Lepas FTZ 3 is expected to create over 4,000 jobs and more than 5,000 construction jobs in the country.

•Penang Development Corporation (PDC) is planning to set up two Global Business Services (GBS) buildings with built-up area of about 300,000 sq ft each in the state after the successful first GBS, an MSC status building renamed as GBS@Mayang, to meet the growing needs of the GBS market.

•Penang named one of "15 Best Islands in the World to Retire In" after Malta and Mallorca in Spain by International Living, a website that covers global retirement or relocation opportunities.

•SEMICON Southeast Asia 2022, will be held in Setia SPICE Arena & Convention Centre from 21 to 23 June 2022. The trade show will shine a spotlight on the supply chain disruptions that have battered the semiconductor industry and an increased emphasis on environmental and sustainability challenges that industry players need to grapple with.

•Travel Safe Alliance Malaysia (TSAM) partnered with the Penang State Executive Council Office for Tourism and Creative Economy (PETACE) to attract tourists with the aim of economic recovery while prioritising safety and hygiene.

•The International Coordinating Council of UNESCO's Man and the Biosphere Programme officially recognised Penang Hill (Bukit Bendera) as a biosphere reserve and inducted into the World Network of Biosphere Reserves on 15 September 2021, becoming Malaysia's third biosphere reserve after Tasik Chini in Pahang (2009) and Banjaran Crocker in Sabah (2014).

•Bandar Cassia located in Batu Kawan on the main land of Seberang Perai will continue to be the main hotspot in 2022.

•The Batu Kawan Industrial Park Phase 2, which is an extension of the Batu Kawan Industrial Park to meet the rising demand, will be another major project in Seberang Perai.

Residential overview and outlook

Penang's residential sub-sector recorded transactions of 9,192 units in the first nine months of 2021 worth a total of RM4.08 billion. Demand continued to be focussed on residential units priced at RM500,000 and below which accounted for 74.5 per cent and 42.1 per cent of the total volume and value of residential property transactions in the state respectively.

In Seberang Perai, volume of transactions for the residential market moderated by 20 per cent whilst its value of transactions eased by 14 per cent in the period under observation in 2021 compared to 2020. Its residential sub-sector may have bottomed out in 2021 after having reached 5,114 units in volume of transactions worth RM1.8 billion up to Q3 2021. The market is expected to remain active in 2022.

In accordance with the House Price Index compiled and published by NAPIC, the all house price index has dropped slightly by about 1.54 per cent to 192.1 as of Q3 2021 from 195.1 in Q3 2020.

By types of property, semi-detached houses saw the highest decline of about 6.6 per cent at 215.0 points (Q3 2020: 230.2), followed by high-rise residential which dropped by approximately 2.3 per cent. For detached houses, the price index has gone up by 4.79 per cemt at 233.9 compared to 223.2 in Q3 2020.

Penang has the second highest number of residential overhang in the country with 4,638 units as at Q3 2021 although when it comes to the service apartments segment which are usually commercial titled, the state is not among the top contributors to the national overhang numbers. The issue of overhang is also not as serious in Seberang Perai as developers have stopped launching large scale projects in the mainland while the existing excess supply is slowly being absorbed over time.

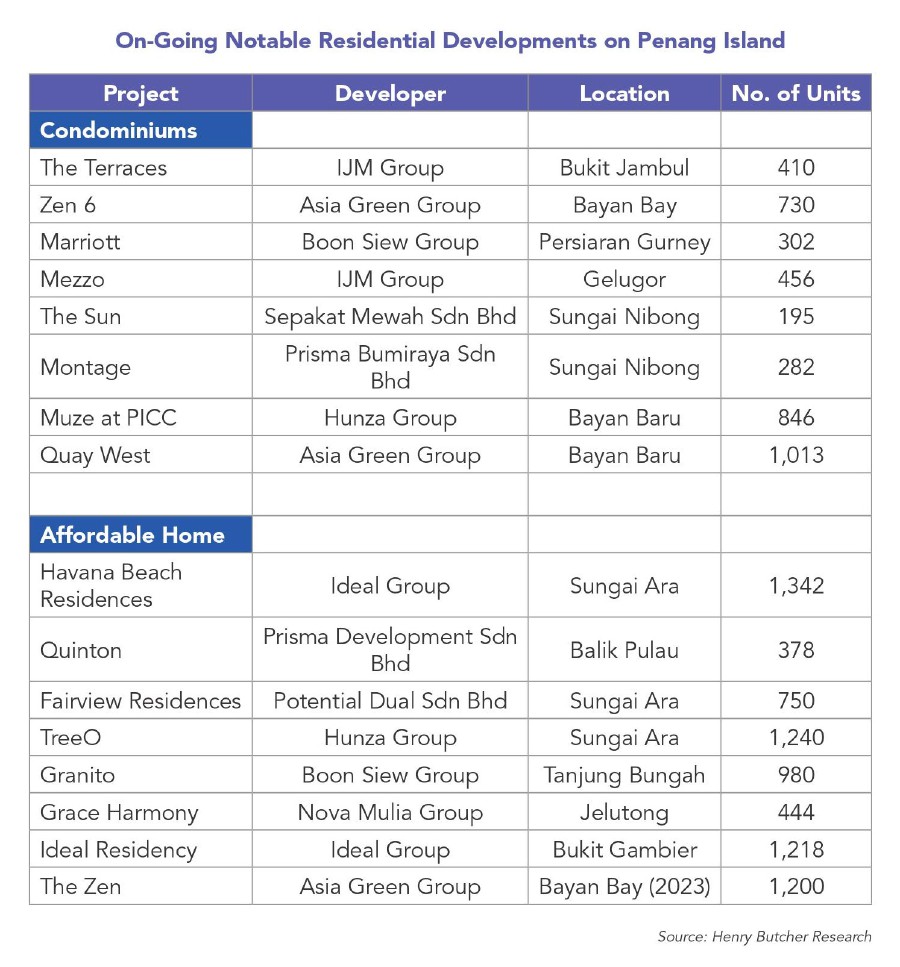

Some of the key projects that are currently ongoing in Penang Island are contributing more than 12,000 units of residences with the larger ones like Quay West in Bayan Baru by Asia Green Group offering 1,013 condominium units. In the affordable price range category, Havana Beach Residences in Sungai Ara and Ideal Residency in Bukit Gambier by the Ideal Group, TreeO in Sungai Ara by the Hunza Group and The Zen in Bayan Bay by Asia Green Group are projects with more than 1,000 residential units each.

Commercial overview and outlook (purpose-built office)

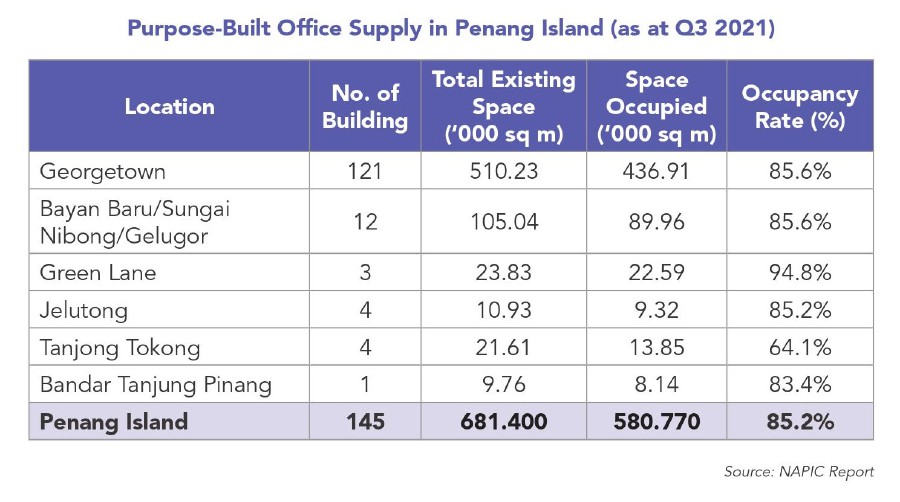

As at Q3 2021, there were 145 privately owned stratified purpose-built office (PBO) buildings located on Penang Island with a total space of about 681,400 sq metres. Of this total, 121 buildings with about 64 per cent of the total space (approximately 437,000 sq metres) are located in the Georgetown area with 510,230 sq metres. The occupancy rate of PBO on Penang Island remained relatively healthy and stable at about 85 per cent, up from 79.4 per cent in Q3 2020.

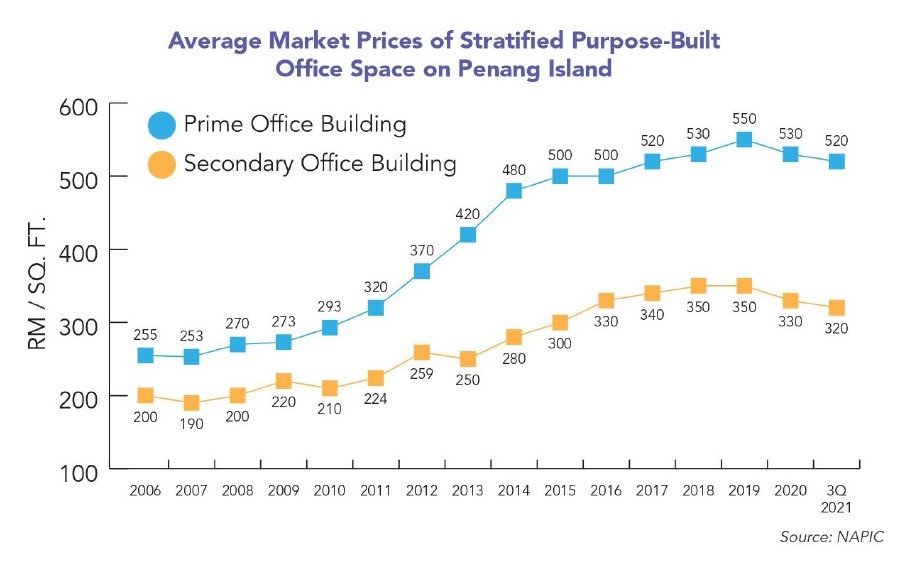

Average prices of stratified office space located within prime PBO buildings such as Gurney Tower, Menara Northam, Maritime Piazza and E-Gate were transacted between RM450 per sq ft and RM750 per sq ft depending on the location, size (floor area), layout, condition (renovation) and view of each unit.

For stratified office space located within the secondary office buildings, the prices transacted in the secondary market were generally below RM350 per sq ft and these buildings are normally aged (built in the 1980's), suffers from a lack of maintenance with outdated facilities, have limited car parking space and larger floor areas compared to the modern PBO buildings.

Average market prices of stratified PBOs have in fact been declining since 2019 with the prime office buildings at RM520 per sq ft in Q3 2021 matching prices in 2017 and for the secondary office building at RM320 per sq ft levelling prices between 2015 to 2016.

In terms of rental rates, stratified PBO space located within prime office buildings is able to command a monthly rental of between RM2.50 per sq ft and RM3.50 per sq ft (RM2.00 per sq ft to RM3.50 per sq ft in Q3 2020) whilst those located in the secondary office buildings is between RM1.80 per sq ft and RM2.50 per sq ft (up slightly from RM1.30 per sq ft and RM2.00 per sq ft).

There was no PBO building completed in 2021 and three PBO buildings were under construction as at Q3 2021, all located in the Georgetown area. Upon completion, these buildings will offer an approximate 56,500 sq metres of office space into the office sector on Penang Island.

Like the residential sub-sector in Seberang Perai, the commercial property market has also experienced a market correction between the first nine months of 2021 compared to the same period in 2020. In the period under observation, there were 515 transactions worth RM317 million in 2021 compared to 712 transactions worth RM430 million in 2020, representing a moderation of 28 per cent and 27 per cent in volume and value of transactions respectively. This sub-sector is expected to slowly recover in 2022 in tandem with the economic recovery nationwide.

Commercial (retail)

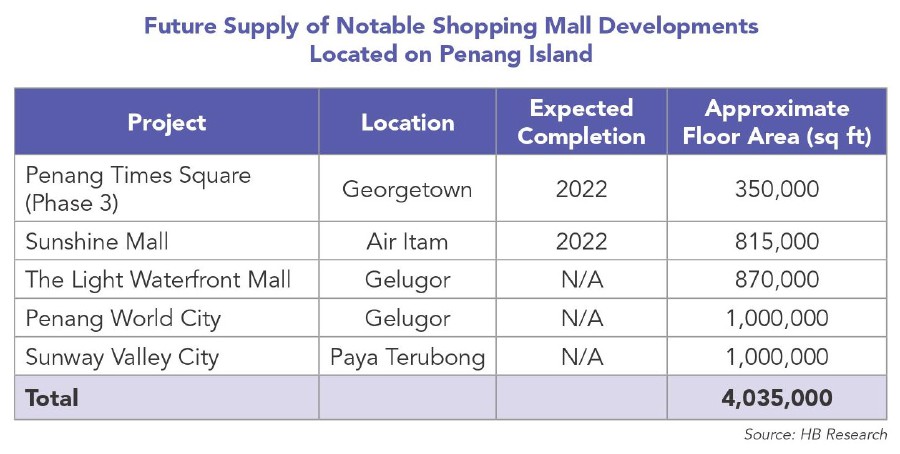

As of Q3 2021, there were 68 retail complexes (comprises of shopping centers, arcades and hypermarkets) located on Penang Island offering a total retail space of about 1.062 million sq ft (98,663 sq metres). A majority of the retail complexes are located in the Georgetown area, with 22 buildings and accounting for about 44.4 per cent of the total retail space, followed by Tanjong Tokong and Sungai Nibong with about 11 per cent (117,150 sq metres) and 10 per cent (105,490 sq metres) respectively.

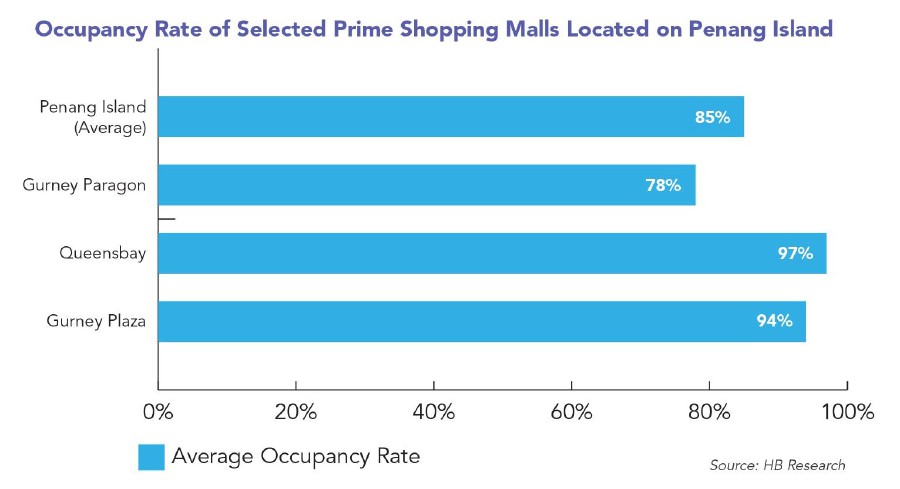

The overall occupancy rate of retail complexes located on Penang Island was recorded at about 80 per cent.

In Seberang Perai, the anticipated increased activities in official business premises post-lockdowns are expected to contribute positively to the retail sub-sector and help it recover slowly towards the end of 2021. Although it will not spot a V-shape recovery given the cautious sentiments among retailers and investors due to the still ongoing Covid-19 pandemic, it will nevertheless trudge back to pre-pandemic level over time and consequently generate good demand in the commercial market on the whole and contribute to the latter's slow recovery.

Industrial

The market prices of vacant industrial land in Bayan Lepas Industrial Park located on Penang Island are recorded at between RM80 per sq ft and RM140 per sq ft depending on the exact location, size (land area) and the remaining unexpired leasehold period. Rental rates of vacant industrial land located in this industrial park on the other hand ranged between RM0.30 per sq ft and RM0.60 per sq ft whilst the rental rates of industrial premises are in the range of between RM1.50 per sq ft and RM2.00 per sq ft.

There were a number of notable transactions of residential development land, commercial buildings and major industrial premises (above RM10 million) on Penang Island in 2021 and these are summarised in the table below.

Over in Seberang Perai, Bandar Cassia in Batu Kawan is expected to attract interest in 2022 as a hotspot for investment while the Batu Kawan Industrial Park Phase 2 is the industrial equivalent built to meet the rising demand in the mainland. Developers who had managed to clear off some stocks during the lockdown periods are expected to begin releasing some new launches into the market albeit at a smaller scale. These new releases shall also meet the pent-up demand of keen investors and generate some positive movements in 2022.

Unlike the residential and commercial sub-sectors, Seberang Perai's industrial market has shown some resilience in the first nine months of 2021 compared to the same period in 2020 with total volume of transactions registering only a marginal drop of five per cent to arrive at 297 properties exchanging hands but its total value of transactions shot up by 44 per cent to reach RM992 million. This demonstrates that demand for industrial properties in Seberang Perai has been fairly strong amidst the uncertain times posed by the Covid-19 pandemic.

Demand for industrial properties here has been coming mainly from segments like the electrical & electronics (E&E), logistics, medical supplies and others.

Moving forward, Seberang Perai's industrial sub-sector is expected to perform well in 2022 in view of the high demand in Batu Kawan Industrial Park, Penang Science Park and the comparatively cheaper land prices against those in Penang Island. - Story and infographics courtesy of Henry Butcher Malaysia