A look back at Malaysia's property market in 2021 and what's potentially to come in 2022.

If the transition from 2020 to 2021 was about hope and sanity after the lengthy lockdowns, business closures, job losses and political instability, the path to 2022 are fraught with rising prices, rainwater levels, and the continuous permutations of the Coronavirus variant.

The preceding 365 days in 2021 has certainly been eventful, beginning with the Emergency Order declared in January, the National Covid-19 Immunisation Programme starting in February, the bitter pill of the Movement Control Order (MCO) replaced by the 4-phase National Recovery Plan (NRP) in June, the appointment of the 9th Prime Minister Datuk Seri Ismail Sabri Yaakob on August 21, dissolution of the Melaka and Sarawak state assemblies in October and November respectively before concluding the year with the "once in 100 years flood" in December which saw homes, cars and public properties submerged in parts of Selangor, Negeri Sembilan, Kelantan, Pahang, Melaka, and Terengganu, displacing more than 50,000 people with 48 fatalities and 5 missing as of December 27, 2021.

The detection of the index case of Omicron in the country on November 19, and only officially announced to the public on December 3, did not help either as it quickly ballooned to 62 by Christmas with the bulk of them imported cases. The new variant was also the reason for the government to freeze the Vaccinated Travel Lane (VTL) which had only begun on November 29, between Singapore and Malaysia. And although Health Minister Khairy Jamaluddin has affirmed in the same month that the endemic phase could be a long time away for Malaysia, any hopes for it to occur sooner has been shelved.

Overview of the Malaysian property market in 2021

Despite the lacklustre news, there were silver linings in the Malaysian property market in 2021. Market data presented by the Valuation & Property Services Department of the Ministry of Finance (JPPH) and Bank Negara Malaysia (BNM) in its quarterly and periodical updates demonstrated this against the battered backdrop the year before.

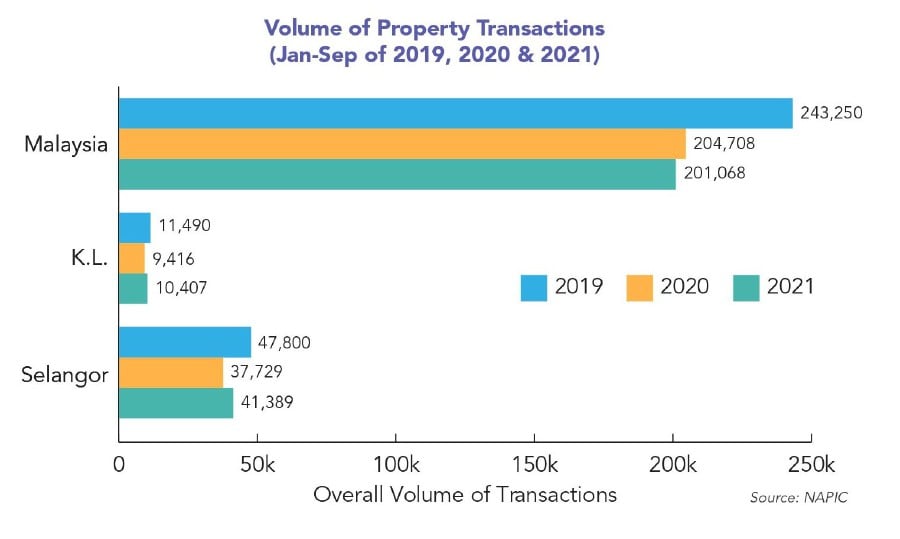

In 2020, the Malaysian property market was badly affected by the Covid-19 pandemic and this was reflected by the substantial drop in both the volume and value of property transactions for the year. The volume of transactions declined by nearly 10 per cent from 329,647 transactions in 2019 to 295,968 transactions in 2020 whilst the value of the transactions came down by 15.8 per cent from RM141.40 billion to RM119.08 billion during the same period.

Then in the first nine months of 2021, data released by JPPH indicated that the property market appeared to have shown signs of a slight recovery although its sustainability still hinges on many factors such as the government's ability to bring down Covid-19's infection rates, preventing the spread of any new variant of the virus, the country's political stability and the effectiveness of the measures implemented by the government to manage the pandemic with an eye to boost the economy, among others.

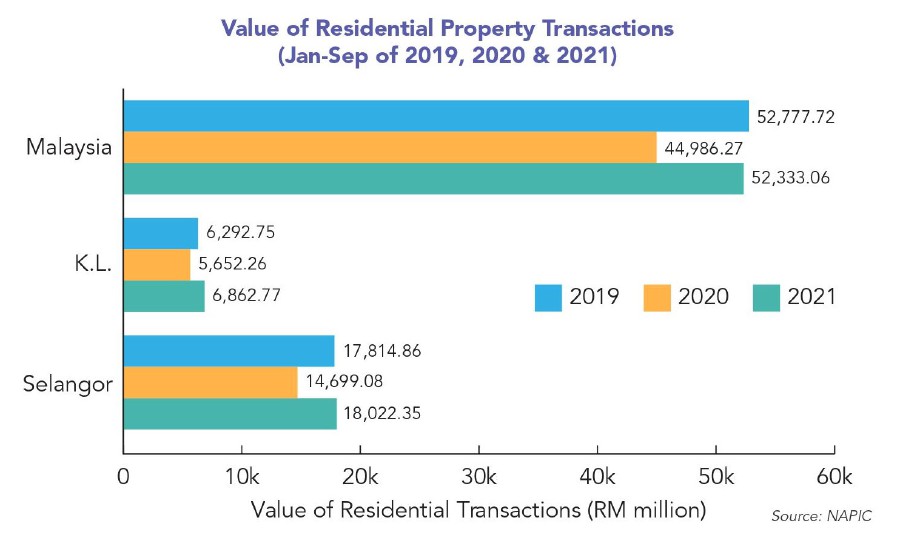

Year-on-year (y-o-y), Malaysia's volume of property transactions registered a 1.78 per cent marginal drop in the first nine months of 2021 to clock in at 201,068 transactions but the value of the transactions rebounded by nearly 14 per cent to almost RM98 billion or up about RM11.2 billion from 2020 but down RM11.2 billion from pre-pandemic levels in 2019. As in the past, the residential sub-sector was again the major contributor to both the volume and value of the transactions.

Residential – Getting back on track

Factors to watch in 2022

•The current low-interest rates which have brought down the cost of home financing will motivate house buying interest. However, economists are predicting that Bank Negara Malaysia may raise interest rates in 2022 to rein in inflation and if this happens, it may impact demand for properties.

•The Home Ownership Campaign (HOC) 2020/21 with its incentives and attractive offers has concluded its run at the end of 2021 and there has been no indication to date of an extension by the government.

•The achievement of a vaccination rate of above 79 per cent of the population and the progression to the provision of booster jabs will improve overall confidence and boost economic activities and thus ultimately benefit the property market. However, the emergence of Omicron has caused governments throughout the world including Malaysia to withhold the full reopening of international borders to control the spread of this new variant.

•The adoption of proptech apps and digital marketing programmes will help developers gain a better understanding of their purchasers' needs, develop a closer rapport with them and reach out to overseas buyers.

•The new MM2H rules which have raised qualifying income thresholds and fixed deposit placement amounts may deter new applicants and reduce foreign interest in Malaysian properties.

•The political situation in the country will continue to go through periods of uncertainty until the 15th General Election (GE15), which will likely be held in 2022, has been concluded and this will cause investors to be more cautious in the meantime.

•The primary market is faring better than the secondary market because of the incentives given by developers and the government under the HOC but this may change once the campaign ends.

•Some banks are refocusing on the secondary market because house buyers of such homes are perceived to be financially stronger and less likely to default.

•Developers have to accept lower profit margins as building material costs have risen and market conditions are not conducive to selling prices being increased to offset the higher costs.

Residential - Bright spots for 2022

•The focus of the residential market in 2022 will be on:

olanded residential properties;

oaffordable high-rise apartments under RM500,000;

osmaller units; and

oniche high-end projects in good locations.

•The secondary market may see an increase in interest because some banks are refocusing on this segment and at the same time, there is a vacuum in a new supply of higher-priced homes in good locations.

•The removal of RPGT for property disposals after the fifth year of ownership is expected to provide a boost to the residential property market as the investors may reinvest their sales proceeds in other properties.

•The continued recovery of the economy and reduction of the unemployment rate will raise confidence and provide a boost to the residential market in 2022.

•The establishment of Vaccinated Travel Lane (VTL) and the reopening of international borders may bring back foreign property investors.

•House designs will evolve to address issues arising from the pandemic such as a better-planned study area to make Work From Home (WFH) more comfortable, providing more electrical points, improved internet connectivity including for common areas, adoption of touch-less technology eg. automatic doors, voice-activated elevators, cellphone-controlled entry, hands-free light switches, curtains & temperature controls, implementation of controlled entry/exit points which can be manned with temperature screening or even some form of UV disinfecting device, dedicated lockers/room for the temporary storage of parcels for later pick-up by residents and charging stations/points for electric vehicles which are expected to grow in popularity in the coming years.

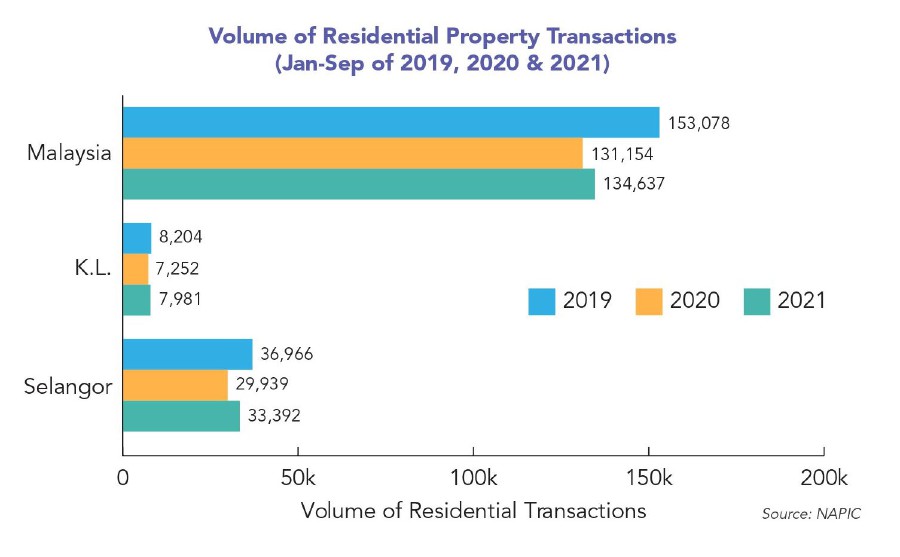

The performance of the residential sub-sector showed an improvement in the first nine months of 2021 as the volume of national residential transactions inched up marginally by close to three per cent compared to the corresponding period in 2020. The value of the transactions on the other hand went up by a larger margin at 16 per cent.

In line with the recovery, Bank Negara's data also showed that the first 10 months of 2021 witnessed a 32 per cent increase in the value of residential loans approved compared to the same period in 2020. Incidentally, this is the highest loan value approved over the last 10 years with March to June and October breaching RM10 billion per month.

Although approval for residential loans has been promising, NAPIC's latest available statistics nevertheless showed that the number of new residential units launched nationwide continued to decline in the first 9 months of 2021, sliding down by 36.7 per cent y-o-y from 29,556 units to 21,616 units. High-rise residences which made up 42 per cent of the new launches in 2020 also declined to 35 per cent.

Sales performance over this period however recorded an improvement to 34 per cent compared to the 22.7 per cent achieved in 2020. Terraced houses dominated the new launches with 15,893 units (54 per cent) followed by condominium/apartment with a 35 per cent share (10,371 units).

Meanwhile, the Property Industry Survey 1H2021 carried out by REHDA (Real Estate and Housing Developers' Association Malaysia) revealed that the local property market saw declines of eight per cent and six per cent in new launches and sales performance respectively in the first half of 2021. Only 39 per cent or 4,524 units were sold from the 11,601 units launched during the period compared to the 45 per cent sold from the 12,640 units launched in 2H 2020.

REHDA's survey also revealed that most developers held back on new launches in 2H 2021 but were planning instead to launch more projects in 2022 in anticipation of an improved market. These are tell-tale signs of the fading appeal of the Home Ownership Campaign (HOC) which may have completely run its course when it was needed most after being revived under the Short-Term Economic Recovery Plan (PENJANA) and extended to the end of 2021 from its original expiry of 31 May 2021.

The pace of increase in the residential overhang moderated to settle at 30,290 units worth RM19.75 billion as at Q3 2021. At the same time, there were another 23,346 units of overhang service apartments worth RM20.6 billion in the market.

In terms of price movements, the Malaysian House Price Index (MHPI) has always registered positive growth throughout the years although the rate of growth began to slow down in 2017. The deceleration was more pronounced in Q2 2021 as the MHPI registered an unprecedented negative growth and stood at 197.9 points, down 1.2 per cent y-o-y. Despite its subsequent recovery to 198.6 points in Q3 2021, the MHPI remains a 0.7 per cent drop from Q3 2020.

Dissecting the MHPI by property types, terrace houses stood out as the sole positive frontrunner, recording a 0.9 per cent y-o-y growth in Q2 2021 whereas all other residential types registered -2.7 per cent for high-rise, -3.1 per cent for semi-detached, and -6.1 per cent detached houses. Despite terrace houses' positive trajectory, it is still lower when compared to the previous quarters. The MHPI continued to spot negative growths in Q3 2021 with terrace homes at -1.0 per cent, high-rise -2.9 per cent, semi-detached -3.6 per cent, and detached homes -2.5 per cent.

In anticipation of a market-friendly budget to boost the property economy, Budget 2022 tabled on 29 October 2021 fell below expectations with only a handful of goodies announced and even fewer for the residential sub-sector. The key measures relating to the property market from Budget 2022 are as follows:

•Removal of RPGT (Real Property Gains Tax) from the 6th year onwards.

•Allocation of RM1.5 billion for the building of low-cost housing.

•RM2 billion allocation for the Housing Credit Guarantee Scheme to help those in the informal sector to own houses. The informal sector includes the small traders, micro-entrepreneurs, and participants in the gig economy with irregular income streams.

•Allocation to expand 5G services and RM3.5 billion for infrastructural projects.

•Allocation of RM1.6 billion to help the tourism industry.

Towards the end of 2021 and although December is traditionally a slower month for property sales in the past due to Malaysians going away for their annual year-end holidays, it was a bit different this time as many developers saw a surge in sales due to buyers rushing to take advantage of the incentives under the HOC 2020/21 before they ended on 31 December since there has been no announcement by the government that it will be extended into 2022. Further, with international travel restrictions in place and Covid-19 infections on the rise in many countries, most Malaysians preferred to skip their overseas holidays and opt for domestic travel and shorter breaks instead, thus allowing them more time to complete their sales documentation.

The residential market in Q1 2022 will be sluggish due to the lull during the Chinese New Year period as well as the lack of any fresh impetus after the end of HOC 2020/21. Sales activities will only pick up in March and improve gradually into the second half of the year.

Retail – Rebuilding

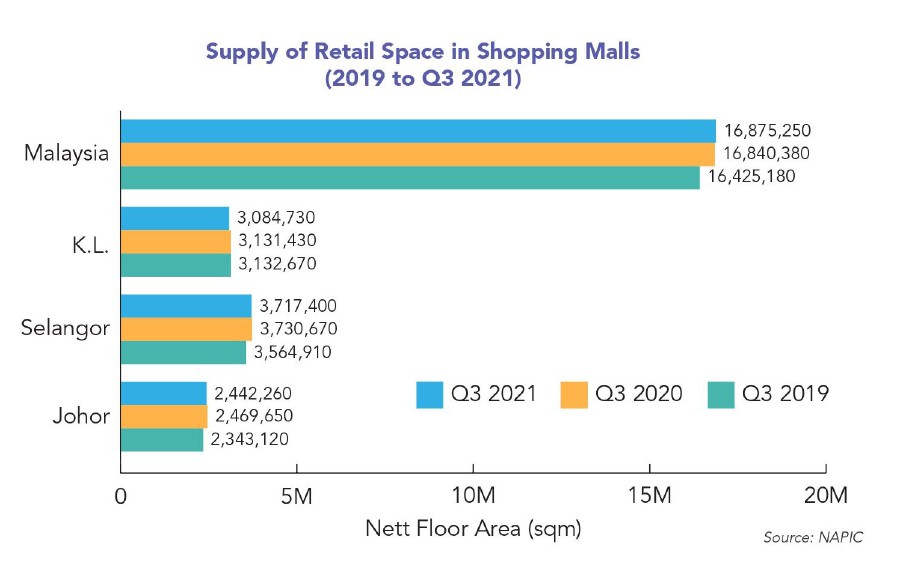

Over in the retail sub-sector, the supply of retail space in the country increased marginally in Q3 2021 to 16.875 million sqm from 16.840 million sqm in 2020 and 16.425 million sqm in 2019. The occupancy rate of the malls, on the other hand, declined to 76 per cent in Q3 2021 from 77 per cent in 2020 and 79.5 per cent in 2019.

Two rounds of lockdowns under MCO disrupted the business of shopping centres in the country for most of 2021 with the first starting from 13 January to 4 March. Dubbed MCO 2.0, a big majority of the retail trade was ordered to close during this time, and footfall at popular shopping malls in Klang Valley plunged by as much as 90 per cent compared to December 2020.

Klang Valley malls however ushered in large crowds on the weekend after the lockdown was lifted on 5 March with touristy spots also filled with sizable crowds. This gave the impression of recovery but the short respite in March was met with an abrupt end given the high daily caseloads exceeding 2,000 for two weeks in April. This led to another round of decline in malls' footfall in Klang Valley and even the Hari Raya Aidilfitri festive season was not enough to draw as many shoppers back to the malls compared to the preceding month.

The interstate travel bans which continued to be enforced since January 2021 and throughout the Hari Raya period also took a toll on malls located in popular shopping districts as shoppers from outside of the capital city who tend to make their visits to experience the higher quality malls have been restricted from travelling out of their hometowns. The deprivation caused a larger dent to the already impaled retail bottom line because many shopping malls in the Kuala Lumpur city centre relied on such tourists for about 15 per cent to 20 per cent of their retail sales.

The inevitable MCO 3.0 then followed from 3 to 31 May after the continuous surge of daily Covid-19 caseloads. During this period, retailers in the shopping centres suffered from poor sales when Malaysian shoppers consciously avoided enclosed places although "Low Risk" individuals identified by MySejahtera were allowed entry into the malls from 7 May 2021.

After almost a year of struggle from the pandemic in 2020 and subsequently lumbered with two more lockdowns, any hopes for a recovery in 2021 was completely dashed when daily confirmed Covid-19 cases also jumped to historical highs just in the first half of 2021.

Factors to watch in 2022

•The high daily positive cases remain worrisome with the new Omicron variant spreading rapidly across the world and Malaysia's first case officially announced in December 2021. In line with that, the Malaysian government has decided to delay the country's transition into the endemic phase due to the uncertainty that hovers over the virus' transmission. A potential fourth-wave pandemic looms for Malaysian retailers and the dire consequences from forced closure of physical stores is not something non-essential retailers can afford to face anymore.

•Border closures and the cumbersome entry requirements will continue to impact foreign tourists' arrival and deter overseas leisure travellers from visiting. Klang Valley retailers who have been conventionally reliant on tourist's spending will also be affected.

•Prices of necessities and many consumer goods have risen since November 2021 and are expected to continue into the first half of 2022. This has led many F&B outlets to increase prices, at the same time, the higher cost of living will also affect the purchasing power of Malaysian households.

•Malaysians' take-home pay has been reduced by the Covid-19 pandemic and the well-being of this income stream is highly dependent on the country's pace of economic recovery in 2022. As such, the country's economy needs to remain vibrant as it will encourage higher employment and provide a security net in their finances. This, in turn, shall motivate better spending on consumer goods and services and this will be good news for the retail market.

•Sales tax levy will be imposed on low-value goods from abroad which are sold by online merchants and sent to consumers in Malaysia via air courier services.

•Service tax will be levied on e-commerce platforms except for food and beverages delivery and logistics.

Retail – Bright spots for 2022

•A direct cash aid programme rebranded as Bantuan Keluarga Malaysia (BKM) will continue in 2022. Families with a household income of less than RM2,500 a month and with 3 or more children will receive RM2,000 whilst single parents with an income of less than RM5,000 will receive an additional RM500 and a further RM300 will be distributed to households with senior citizens. The adjusted minimum contribution from 11 per cent to nine per cent to KWSP (Kumpulan Wang Simpanan Pekerja; EPF) will be extended for another 6 months until June 2022 and will result in higher monthly take-home pay for the KWSP-contributing Malaysians.

Quarterly retail sales performances

In Q1 2021, the Malaysian retail industry recorded a negative growth rate of 9.9 per cent in retail sales compared to the corresponding quarter in 2020. MCO 2.0 was imposed at this time from 13 January 2021 to 4 March 2021 and during the initial period of this lockdown, the majority of the retail trades were ordered to close. Some non-essential retail shops were however allowed to open subsequently although business was no longer as brisk with few customers visiting the shops during peak hours.

The situation on the ground was worse than MCO 1.0 which began on March 18, 2020. From February 5, 2021, more retail businesses were allowed to open in stages before shopping traffic finally recovered when MCO 2.0 ended on March 5, 2021.

In Q2 2021, the industry recorded a positive growth rate of 3.4 per cent in retail sales compared to the same period in 2020. The positive growth is attributed solely to the low base effect experienced a year ago when the Malaysian retail industry suffered a year-on-year decline of 30.9 per cent in the quarter because of business closures.

Shopping traffic recovered momentarily when MCO 2.0 ended in March 2021 but was soon met by MCO 3.0 after a continuous surge of daily Covid-19 cases. The majority of the retailers were faced with very poor sales during this period as shoppers also deliberately avoided enclosed places.

Phase 1 of the FMCO (Full MCO) then ran for 2 weeks starting from 1 June 2021 and all non-essential retailers were ordered to shut their stores while Malaysian folks nationwide were also asked to stay home. A revised "exit plan" from Covid-19 known as the 4-phase National Recovery Plan (NRP) was subsequently introduced on 15 June 2021 which compelled non-essential retailers to remain closed and Malaysian consumers to stay at home, not unlike the conditions set by FMCO.

In Q3 2021, the industry almost went on a free fall to record a disappointing growth rate of -27.8 per cent in retail sales. Most retailers were forced to shut down in the first half of the quarter itself.

All factors considered, Retail Group Malaysia (RGM) expects the retail industry to regain some momentum on its recovery by the end of the year and so for Q4 2021, the estimated growth rate has been revised upwards from 12.7 per cent (forecasted in September 2021) to 18.3 per cent. Retailers were hopeful that sales will climb higher in December 2021 as it coincides with two upcoming major celebrations - Christmas on December 25, and Chinese New Year on February 1, 2022.

As the National Covid-19 Immunisation Programme has been rather successful by reaching 90 per cent vaccination rates among adults towards 4Q 2021, things began looking up when spas, wellness, and massage centres were allowed to open to fully vaccinated individuals from 1 October 2021 followed by the lifting of interstate travel ban on 11 October 2021. With domestic tourism also beginning to ply the routes for Cuti-Cuti Malaysia, it brought more sales to retailers in the Klang Valley especially those dependent on tourism spending.

For the full year of 2021, RGM estimates the Malaysian retail industry's growth rate to conclude on a positive 0.5 per cent and for the record, this is the fifth revision of the growth rate since the end of 2020, signalling the dynamic changes that have taken place in the Malaysian retail industry in the period under observation. Moving forward, RGM predicts a six per cent growth rate in retail sales in 2022.

Office – Under pressure

The aftermath of the pandemic on Malaysia's office sub-sector has left it faced with the dwindling demand for space and a colossal amount of new office space coming on stream when several large-scale office projects come to completion from 2022 onwards. Despite the positive signs of economic movements like the workforce returning to business premises more frequently, this has not translated into significant uptake of office space across the country. This is largely attributed to the scattered recovery pace of business enterprises including some having fallen off from the competitive landscape altogether.

In addition to the flight from office to home as part of the measures to curb the spread of Covid-19 in 2020, a new norm has settled in 2021 as the office market adapts to smaller dimensions or if not, is left entirely vacant. It is amidst such a backdrop that the office sub-sector has continued to record a decline in occupancy rates due to the stifled demand. Some of the key contributing factors include companies deferring expansion plans, the hybrid workstyles between work from home (WFH) and working on-site in the office, cutting down on space requirements after a headcount reduction and closing down of business enterprises completely.

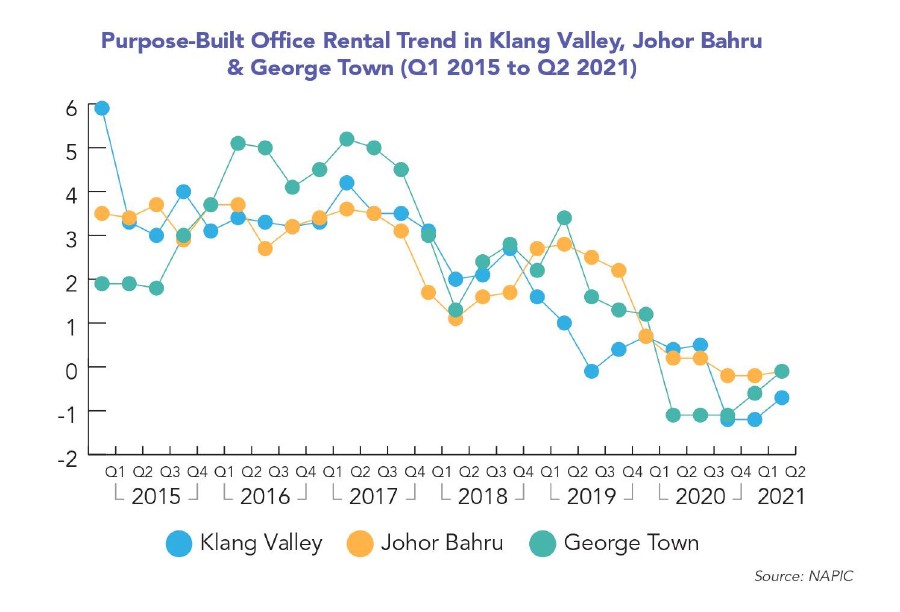

As at Q3 2021, occupancy rates of privately-owned purpose-built offices (PBO) in the country declined to 70.8 per cent, continuing the steady decline from 82.4 per cent in 2018, 80.6 per cent in 2019, and 80.2 per cent in 2020. Meanwhile, the rental index for PBOs for the main urban centres of the Klang Valley, Penang, and Johor recorded marginal declines of 0.1 per cent, 0.1 per cent and 0.7 per cent respectively in Q2 2021. It is imperative hence for the government and the business community to think out of the box and identify ways to restore the shine to the office market.

Factors to watch in 2022

•Recovery in the office sub-sector requires sustainable recovery in the economy which will then be able to generate an increase in demand for office space or at least enable companies to maintain their present offices.

•The new hybrid style of working from home and on-site in the office adopted by many major companies will reduce requirements for office space by these companies.

•Concerns of an oversupply of office space in the Klang Valley will continue to weigh down on the office market in 2022 and exert downward pressure on occupancy and rental rates.

•The expected completion of several large-scale office projects over the next one to two years such as Merdeka 118 and Tun Razak Exchange will worsen the oversupply situation.

•With lessons learned during the Covid-19 pandemic, new office buildings will adopt layouts, designs, and technologies designed to cope with any new pandemics which may break out in the future.

Office – Bright spots for 2022

•The implementation of various economic stimulus programmes by the government to boost the recovery of the economy will help increase demand for office space and stabilise occupancy and rental rates.

•The decline in demand for office space which was aggravated during the pandemic may lead to some developers shelving or deferring their new office projects. This will help alleviate the oversupply of office space, especially in Kuala Lumpur.

•The first nine months of 2021 saw an increase in FDIs. This will spur economic growth and benefit the office market.

Industrial – Continue rising

Despite the challenging conditions during the Covid-19 pandemic which disrupted supply chains and affected production, certain segments of the industrial sector have benefitted from an increase in demand, both locally as well as overseas. Manufacturers involved in the production of healthcare products, electrical & electronics (E&E) equipment, petroleum, chemical, rubber & plastic products, food, beverage, and tobacco products have seen an increase in exports.

Logistics companies involved in warehousing and transportation have also registered a substantial increase in business due to the rise of online shopping, not forgetting a growing interest in data centres. This has cushioned the fall in demand for industrial properties caused by business contractions suffered during the MCO periods. But amid the rising interests in these industrialised areas during the pandemic, Malaysia's FDI still fell 55 per cent to RM14.6 billion in 2020 with NAPIC's data also reflecting the sharp drop of volume and value of industrial property transactions in Malaysia for the year.

The Ministry of International Trade & Industry (MITI) however reported a quick rebound in the first nine months of 2021 to RM30.2 billion which more than doubled 2020's FDI. The positive inflow is mirrored by NAPIC's data which showed an increase of 29.4 per cent in volume and 19.8 per cent in value of transactions for industrial properties in Malaysia in 1H 2021. Manufacturing remained the main contributor followed by the financial, wholesale, and retail trade sectors.

Malaysia, which has signed the agreement under the Regional Comprehensive Economic Partnership (RCEP), will be the 12th country to implement the agreement in March 2022. RCEP is the world's largest free trade agreement covering 15 countries with a combined population of 2.2 billion or nearly a third of the world's population. The ratification of RCEP is expected to bring a lot of trade benefits to Malaysia and provide a boost to the country's manufacturing industries.

The state of Selangor continued its domination with 35.7 per cent of the total transactions. Terraced factories formed 32.2 per cent of the total industrial transactions, followed by vacant plots at 27.6 per cent and semi-detached factories at 22.4 per cent. The industrial property market continued to improve in Q3 2021 which saw a 16.2 per cent increase in the volume of transactions and a substantial jump of nearly 26 per cent in the value of the transactions y-o-y.

Factors to watch in 2022

•The industrial sub-sector will continue to be driven by the e-commerce sector which has generated demand for distribution hubs, warehousing and logistics facilities that are strategically located near high population areas and served by a good network of highways to enable fast point-to-point delivery to consumers. The MCO has created a huge increase in demand for online purchasing, especially for groceries and food.

•There has been an increase in interest in putting up data centers.

•Matured and sought-after areas will remain popular locations for manufacturers and warehouse operators.

•The emergence of an, even more, infectious and dangerous variant of the Covid-19 pandemic will slow down the economic recovery and disrupt manufacturing activities like the recent discovery of Omicron which has put all countries on alert with Malaysia also tightened its borders to prevent the entry and spread of this new variant.

•The 12th Malaysia Plan launched in October 2021 will focus on the following key areas of industry:

oMoving the electrical & electronics (E&E) sector up the value chain;

oMaximising the full potential of the creative industry;

oEstablishing a sustainable aerospace industry; and

oRealising the potential of the biomass industry.

•The progression of the country to implement the strategies drawn up for the Fourth Industrial Revolution (IR4.0) will bring positive spin-offs to the industrial property sub-sector.

•Malaysia will be implementing the RCEP (Regional Comprehensive Economic Partnership) agreement that it has signed, in March 2022.

Industrial – Bright spots for 2022

•All economic sectors have now been allowed to open after the country entered Phase 4 of the National Recovery Plan (NRP).

•The economic slowdown caused by the Covid-19 pandemic appears to have bottomed out as restrictions locally and in overseas markets have been eased further.

•Inter-state travel is now allowed and international borders are gradually reopening with VTL (Vaccinated Travel Lane) being established to enable entry into the country with fewer hassles.

•Malaysia's trade statistics showed that exports have continued to rise month-on-month in 2021 and the trade balance has remained positive. This will provide a boost to the demand for industrial properties.

•The increase in the inflow of FDIs, especially in the manufacturing sector, in the first nine months of 2021 will hopefully translate into an increase in demand for industrial space/properties.

Hospitality – Rebirth

Malaysia's plan to hold "Visit Malaysia 2020 (VM2020)" was scuttled by the Covid-19 pandemic and as a result, actual tourist arrivals and spending achieved were way below the targets set for the year. Total tourist arrivals for 2020 came up to only 4.3 million which was about 14 per cent of the 30 million targets set under VM2020 and more than 83 per cent lower than the 26.1 million tourist arrivals achieved in 2019. Tourist expenditure on the other hand came up to only RM12.688 billion or about 12 per cent of the RM100 billion targeted under VM2020.

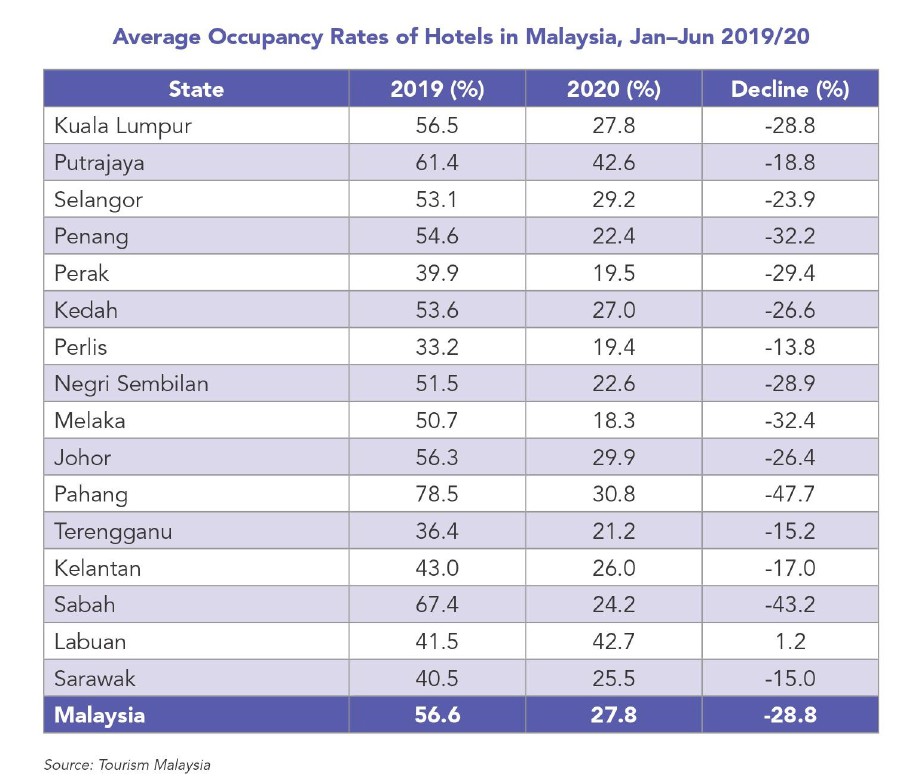

With travel restrictions in place for most of the year, domestic tourism also took a hit with only 131.7 million local tourists travelling compared to the 239.1 million in 2019. At the same time, domestic tourism expenditure came down by 60.8 per cent from RM103.2 billion in 2019 to RM40.4 billion in 2020. It is however interesting to note that statistics provided by Tourism Malaysia showed Labuan was the only territory that registered a positive 1.2 per cent variance in average hotel occupancy rates between 1H 2019 and 1H 2020 with Terengganu, Kelantan, and Sarawak next with the least drop in performance at -15.2 per cent, -17 per cent and -15 per cent respectively. But as travel restrictions were in force for most of the first nine months of 2021, tourist arrivals for the first eight months of the year were down by 90 per cent y-o-y.

Based on a report released by the Malaysian Association of Hotels (MAH) in June 2021, hotel occupancy rates have been averaging under 30 per cent per month throughout the year. This is due to the restrictions placed by the government on both interstate travel and international tourist arrivals for most of 2021. MAH expected occupancy rates for Q3 and Q4 2021 to be at 21 per cent and 28 per cent respectively.

According to the Association also, the unforgiving pandemic has wiped out around RM6.5 billion of revenue from the hotels in 2020 and another RM9 billion in the first seven to eight months of 2021. Due to the deplorable state of the hospitality business, MAH disclosed that about 120 hotels have closed down either temporarily or permanently nationwide.

With most economic sectors having been given a new lease of life after the successful vaccination drive in 2021 and certain real estate sub-sectors showing signs of recovery, the space left by the hotel closures may make it a fertile ground for a rebirth of the hospitality industry, barring any major Covid-19 waves that will also curtail travel in 2022. - Henry Butcher Malaysia

Factors to watch in 2022

•Improvement in the domestic tourism industry with the resumption of interstate travel effective 11 October 2021.

•The reopening of international borders beginning with the first international tourism bubble implemented for Langkawi effective November 15, 2021, and the establishment of the Vaccinated Travel Lane (VTL) arrangements starting with Singapore effective from November 29, 2021, and with other countries from January 1, 2022, which were then halted due to Omicron in late December 2021.

•The high vaccination rates achieved by the government will improve overall confidence and boost domestic as well as international travel.

•Some hotels approved as quarantine centres for returnees from overseas or Covid-19 cases with mild symptoms have managed to fill up otherwise empty rooms.

Hospitality – Bright spots for 2022

•With most of the population is fully vaccinated and proper SOPs in place, tourists will feel safer to travel locally.

•Allocations by the Government under Budget 2022 to help the local tourism industry will provide a welcoming boost to this important economic sector.

•Hotels have implemented SOPs to prevent the spread of the Covid-19 virus and this will provide some assurance and peace of mind to hotel guests.

•Air fares are currently higher than usual as airlines adjust to the higher costs incurred in implementing Covid-19 protocols and SOPs. With the expected increase in passengers in the coming year, the airlines may be able to bring down costs and make air travel more accessible again.

•Malaysia Airports Bhd (MAHB) has reported a recovery of passenger traffic for its network of airports in the country for November 2021 to 2.3 million, the first time it has surpassed the 2 million mark since the onset of the Covid-19 pandemic in April 2020. It also reported a surge in domestic aircraft movements which grew 43 per cent to 27,084 in November from the 18,966 recorded in October. This is an indication that domestic tourism is on the road to recovery and augurs well for the hospitality industry.