Most Chinese local governments saw revenue from land sales fall in 2021, damaging their budgets just as Beijing calls for faster spending to counteract a housing-market slowdown and pull the economy out of a downturn.

Thirteen of China's 31 provinces saw income from selling land-use rights drop more than 20 per cent in 2021 from a year earlier, Tianfeng Securities Co. analysts including Sun Binbin wrote in a note Wednesday. That includes Xinjiang, Helongjiang and the other two provinces in the northeast, and Shanxi in the north.

Another 10 had falls of 20 per cent or less and only six provinces, including Beijing, Shanghai, and Zhejiang, saw revenue from land sales grow. There was no information on two provinces. Yunnan in the southwest only achieved 19 per cent of its sales target for the year, and some other provinces were also well below target, the report said.

The decline shows how the property market problems are affecting local governments, with the plunge in home sales since the second half of last year and the cash crisis at some real-estate firms making developers reluctant or unable to replenish their land holdings. This in turn could undercut China's plan to speed up fiscal spending and front-load infrastructure investment this year to stabilise the economy.

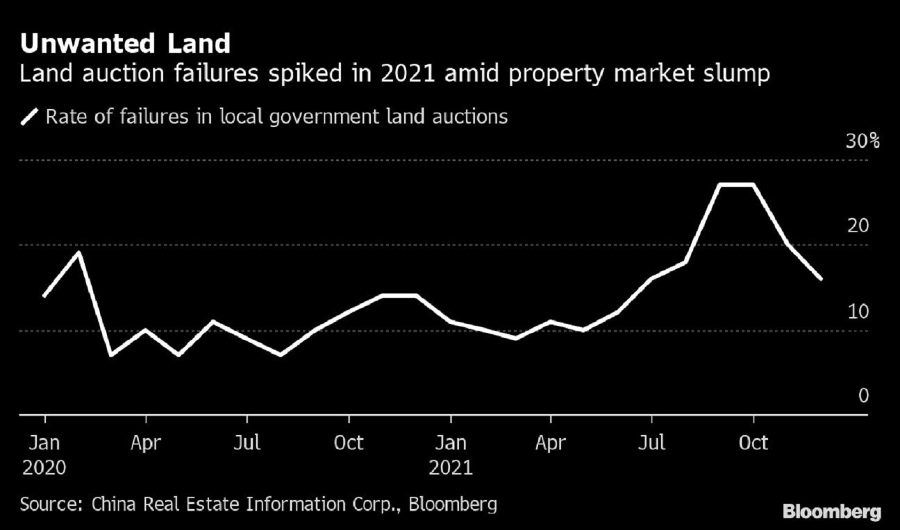

More than a quarter of land parcels offered by local governments went unsold in September as no developer submitted bids, the highest rate since at least 2018, according to data compiled by China Real Estate Information Corp., which tracks auctions across 128 Chinese cities. The rate declined to 16 per cent last month, CRIC figures showed, after regulators loosened financing curbs on the property sector.

Instead of selling land to cash-strapped developers, local governments may be forced to rely more on purchases by local government financing vehicles, according to the Tianfeng report - effectively selling to themselves. These LGFVs are companies set up by governments that raise money and pay for various projects, but their finances aren't included on official balance sheets. Quite a few regions did this last year, the analysts wrote.

To help local governments beef up their spending power, Beijing has allowed them to sell some infrastructure bonds early, just as it did in other years when top policy makers were keen to get the provinces to borrow and spend as quickly as possible. China plans to keep its 2022 quota for local government special bond sales unchanged from last year at 3.65 trillion yuan (US$573 billion), Bloomberg reported Tuesday.

Governments at all levels made a combined 6.8 trillion yuan from selling land-use rights in the first 11 months of 2021, up 3.8 per cent from a year earlier, according to the Ministry of Finance. Income from sales is usually the highest in December. That data will be released later this month. - Bloomberg