The subsale residential property market in Malaysia has seen steady growth in the last few years, says MyProperty Data managing director Joe Hock Thor.

Joe said the ongoing Covid-19 pandemic has presented a prime opportunity for investors to capitalise on the discounted prices of properties available in the market.

He said this upward trend is further accelerated by the effects of the pandemic.

"There is a rise in overall interest in the secondary market as some property owners are selling their assets at lower prices to maintain liquidity, creating opportunities for investors to acquire them below market value," Joe said.

Joe said the discounted prices coupled with the various incentives available and the current low-interest-rate environment has presented an avenue to pick up quality assets for the future.

"With properties often considered as a hedge against inflation, these assets may offer a long-term boon with the eventual market recovery and stabilisation," he said in a statement.

Joe said the Real Property Gains Tax (RPGT) exemption has also driven some investors to cash in their existing assets and make a profit.

He said this is reflected in the spike in the average number of subsale listings tracked on PropertyGuru.com.my, which grew by 21.3 per cent between 2019 to 2021.

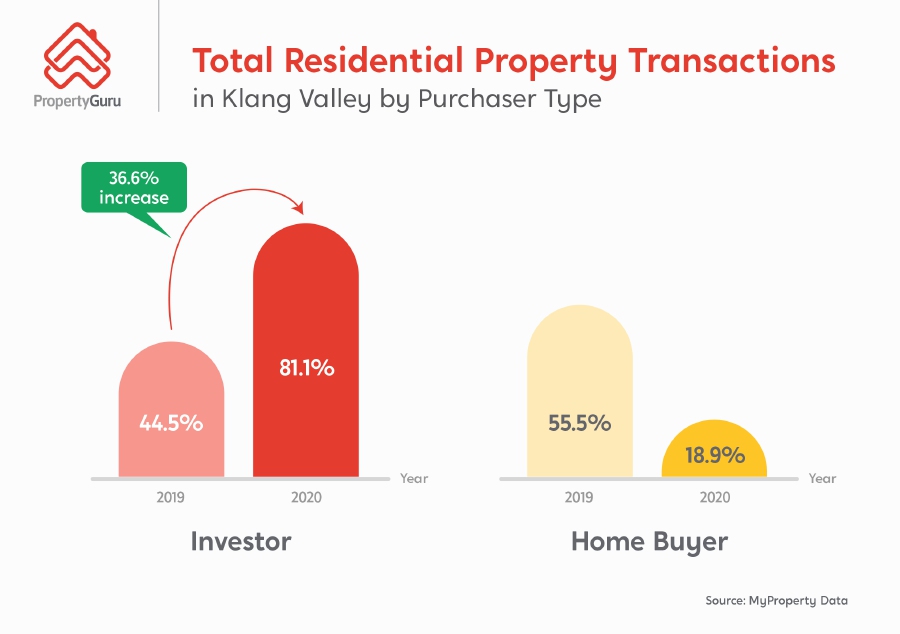

"The economic downturn in 2020 has led to a 47.2 per cent drop in the total number of residential property transactions in Klang Valley. However, the impact is largely seen among first-time homebuyers, which used to comprise 55.5 per cent of total property purchases in the area in 2019 but has since then dropped to 18.9 per cent in 2020," Joe said.

Joe said appetite for residential properties remains strong among investors, with a 36.6 per cent year-on-year (YoY) increase in investor activity from 2019 to 2020.

He said this change in trend could potentially be attributed to first-time homebuyers being more cautious of the current situation, with complications and challenges presented by Covid-19 spurring them to take a wait-and-see approach.

Joe said this is further backed by findings in the PropertyGuru's Consumer Sentiment Study H1 2021, which found that 58 per cent of Malaysians aged between 22 and 29 (the of most first-time homebuyers) are deferring their property purchase by one to five years due to the impact of Covid-19 on the economy, employment and income.

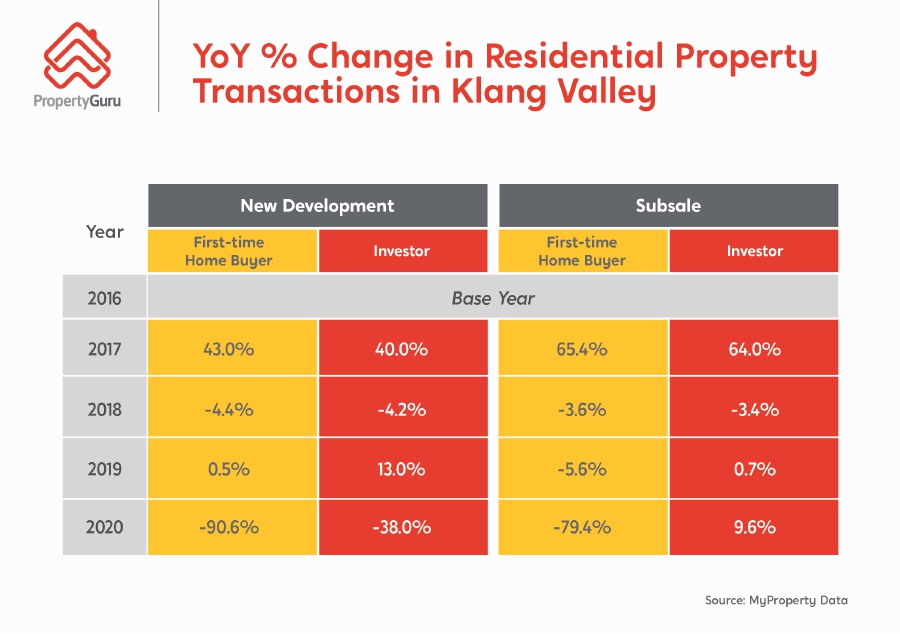

The economic downturn last year has affected both new development and subsale residential property sales in Klang Valley, seeing a YoY drop of 64.9 per cent and 41.1 per cent, respectively.

Joe said the steeper decline in new development property transactions could be due to delays in new project launches, as construction progress was affected during the first Movement Control Order.

In 2020, the property market in Klang Valley recorded the lowest new development purchase in the last five years, with a 90.6 per cent and 38 per cent YoY decrease in the number of transactions made by first-time home buyers and investors, respectively.

On the other hand, the total number of transactions in 2020 for subsale properties was the lowest for first-time homebuyers (79.4 per cent YoY decrease), but the highest for investors (9.6 per cent YoY increase), in the same five-year period.

This change in purchase behaviours is more prominent among landed properties. Between 2016 and 2019, the landed property transactions from subsale and new development properties are split at about 70 per cent and 30 per cent respectively. This has shifted to 84 per cent and 16 per cent respectively in 2020.

Meanwhile, for high-rise property transactions, the split between sub-sale and new development properties have remained consistent at around 80 per cent and 20 per cent respectively across the last five years.

"Covid-19 has undoubtedly impacted both the real estate market and property purchase trends in Malaysia last year. For aspiring first-time homebuyers who have the capital but are indecisive in taking the leap into homeownership, they will require more enticement from developers and the government alike.

"To help spur the industry and to increase homeownership, there need to be greater incentives offered to first-time homebuyers – be it attractive rebates from developers or assistance from the government. We are pleased to hear of the government's recent decision to extend the residential home stamp duty exemption scheme under the Home Ownership Campaign until this year-end, as we believe this will not only help to reduce the burden of home buyers, but it can also help to support the sector's recovery," he said.