The fight against Covid-19 continues in 2021, however, launch activity in the first quarter of the year (Q1 2021) bears resemblance to pre-pandemic levels, perhaps a good sign that it's business-as-usual in the industry, having endured the worst disruption in recent history.

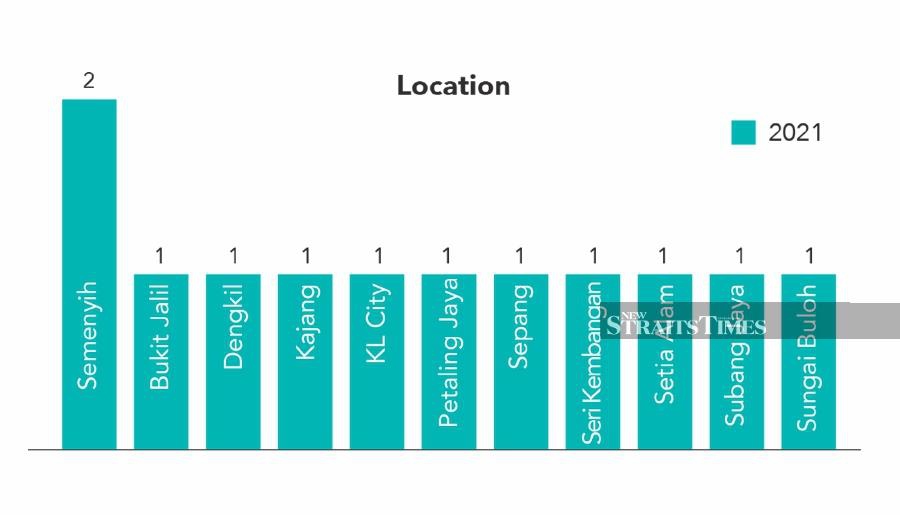

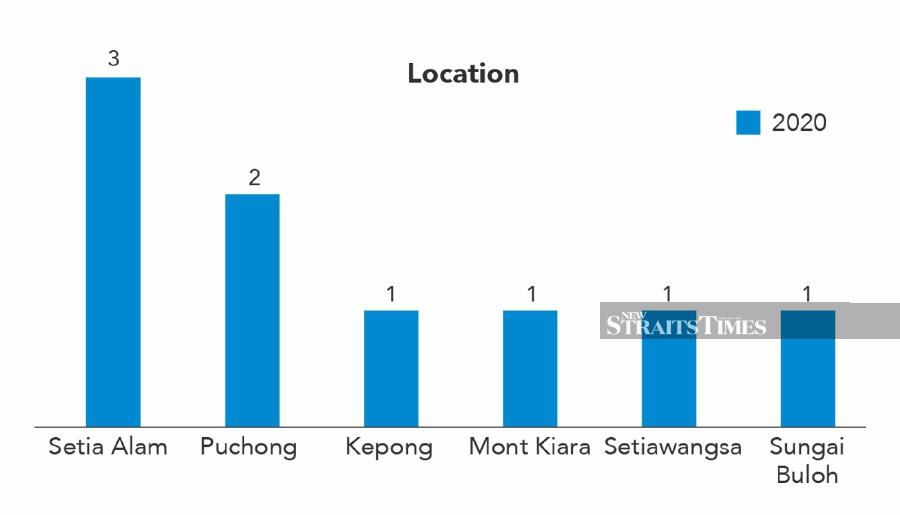

●Based on our compiled data, we see a slight increase in the number of launches for Q1 2021, with 12 launches across KL and Selangor, compared to nine for Q1 2020.

●The total number of units launched in Q1 2021 was however less than Q1 2020, with 3,030 units on offer or about 64 per cent compared to 4,720 units the previous year.

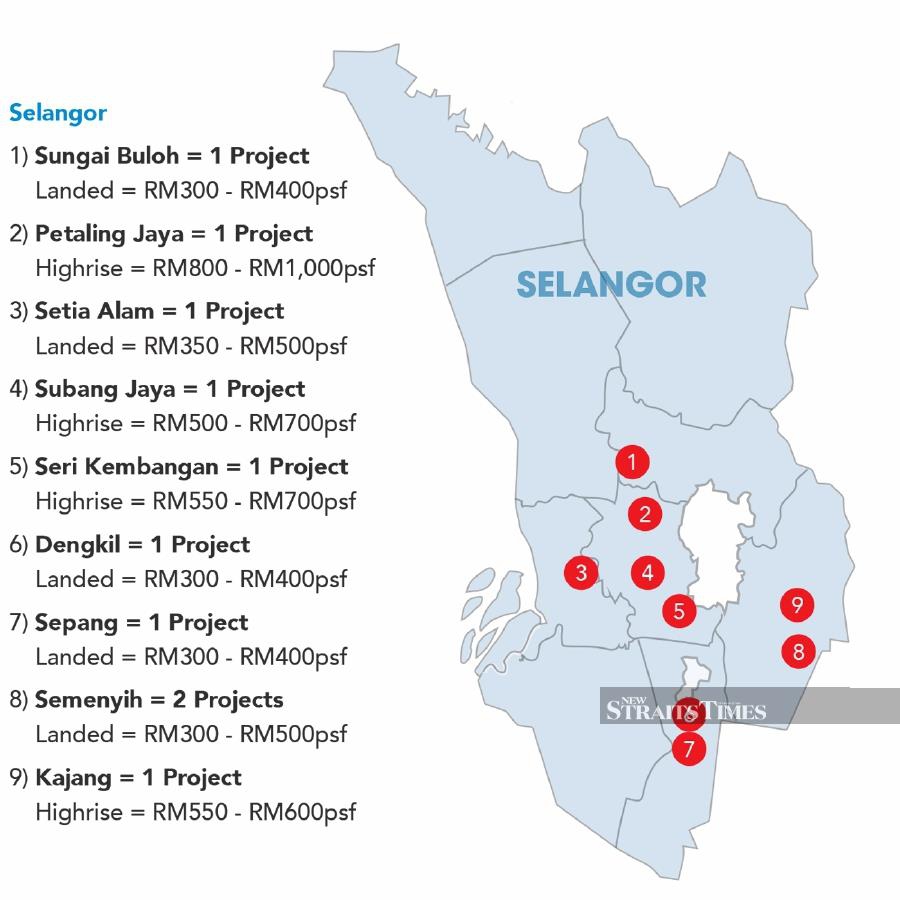

●Selangor saw more launches throughout both periods were in Q1 2020, it commanded a slight edge at 67 per cent share but totally dominated with 83 per cent in Q1 2021.

●In terms of the total number of units launched, Kuala Lumpur edged ahead in Q1 2020 with 70 per cent at 3,317 units but Selangor raced ahead with 75 per cent or 2,258 units in Q1 2021.

●Q1 2021 looked to be a livelier period for launches with three in January, four in February, and five in March, perhaps an indicator of developers already used to the "new normal" and the various opportunities that accompany it such as leveraging on digital technology etc.

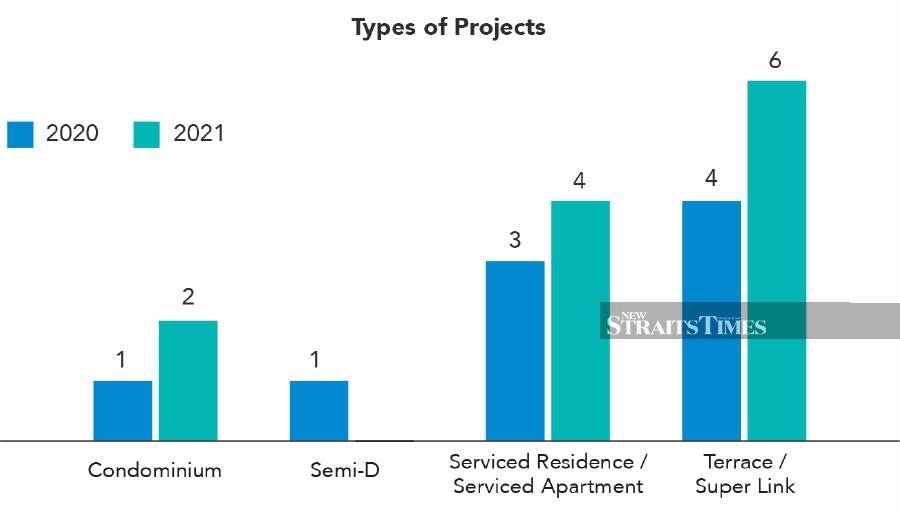

●Q1 2021 saw an even distribution in terms of property type with six landed and six high-rise projects. The corresponding period in the previous year had five landed and four high-rise launches.

●Although there were two more high rises launched in Q1 2021, the number of units offered is lesser at 2,391 units or 61.5 per cent against 3,885 units in Q1 2020.

●There are more landed units in Q1 2021 with 639 homes offered from six projects compared to 835 from five projects in Q1 2020.

●Terraces and super links seem to be getting the attention with all six landed projects launched in Q1 2021 within this category. In Q1 2020, terraces and super links had slightly less with four launches.

●Serviced residences or serviced apartments were also popular over the two corresponding quarters with four projects in Q1 2021, which is one more than Q1 2020s three projects.

●Unit configurations are relatively well-distributed across both time periods but it is interesting to see that there were five projects offering units exceeding 2,000 sq ft over the two quarters, catering to a possible shifting trend of buyers looking for larger homes.

● The bulk of the projects or 10 in Q1 2021 offered units priced between RM601,000 to RM800,000, followed by nine in the affordable range of RM401,000 to RM600,000. Not far behind are the pricier ones between RM801,000 to RM1 million with seven projects and five more projects with units beyond RM1 million.

●Before the Covid-19 pandemic, Q1 2020 was more catered to the affluent with seven out of nine projects priced above RM1 million, followed by 10 projects altogether between RM601,000 to RM1 million price brackets.

●Perhaps influenced also by the Covid-19 aftermath, Q1 2021 launches look to emphasise value for money with six projects (out of 12) offering units priced below RM500 per sq ft (psf) compared to the seven projects (out of nine) offered units in Q1 2020 priced between RM501 to RM750 psf.

●KL's two launches were located in the city proper (high rise, RM800 to RM900 psf) and in Bukit Jalil (high rise, RM600 to RM700 psf) with both featuring great accessibility yet at times overwhelmed by high traffic due to its popularity.

●Value landed buys continue to feature prominently in Selangor, in particular Sungai Buloh, Dengkil, Sepang (each with projects offering units priced between RM300 to RM400 psf), Setia Alam (RM350 to RM500 psf), and Semenyih (RM300 to RM500 psf). - Henry Butcher Malaysia