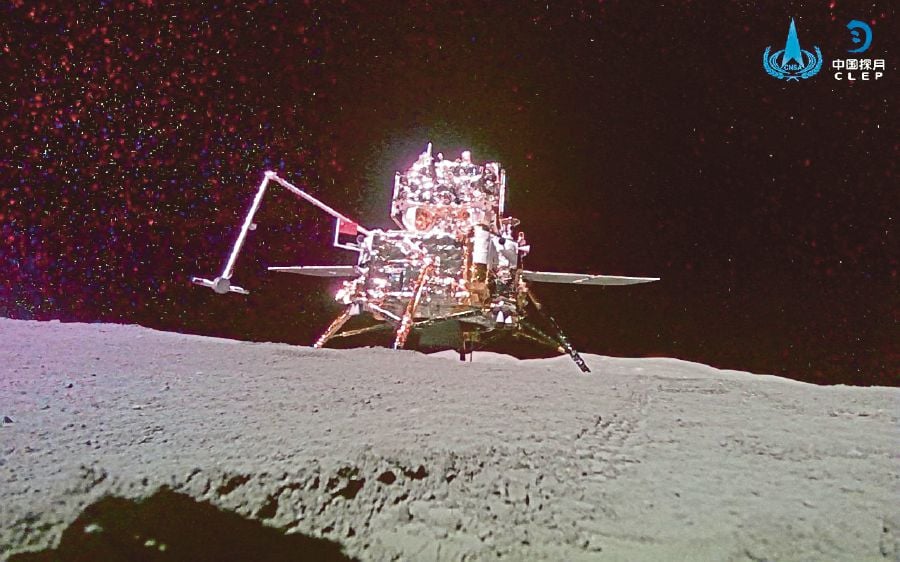

A WORLD-FIRST launch from the far side of the Moon last week showcased China's progress in space, and Beijing now wants its commercial sector to catch up to rivals such as Elon Musk's SpaceX.

Chinese companies lag far behind American frontrunners led by SpaceX, which plans to launch Starship, a massive prototype rocket that may one day send humans to Mars, on Thursday.

The gap is narrowing, however, as Beijing realises the value a solid commercial sector can add to its capabilities, experts said.

It could even become similar to the development of electric vehicles where EV pioneer Tesla, also founded by Musk, was an early mover in China but now faces fierce competition from a host of homegrown rivals, said analyst Chen Lan.

"In five years, SpaceX may feel pressure. The situation in today's EV market will probably happen again when a lion (Tesla or SpaceX) faces a pack of wolves (Chinese companies)."

Tesla was recently overtaken by China's BYD as the world's top seller.

Beijing opened up parts of the space sector to private capital only in 2014 but hundreds of companies have since sprung up.

A CERES-1 commercial rocket, for example, sent three satellites into orbit on Thursday, one of dozens of launches planned this year.

"China's commercial space sector is impressively large and deep," said Blaine Curcio, founder of Orbital Gateway Consulting.

While SpaceX is "vastly ahead" of its Chinese equivalent, "if we compare the fifth, or the 10th most-developed launch companies in the US and China, China is probably ahead", he said.

China's government has sent humans into orbit, built a space station and landed rovers on the Moon and Mars, where it aims to send crewed missions by 2030 and 2033 respectively.

In contrast, Chen said, the commercial sector is focused on low-cost launch vehicles and small satellites.

However, this launching capacity will be critical to China's aim of establishing satellite mega-constellations, state broadcaster CCTV reported in April.

China is developing two such networks: Guowang, set to consist of 13,000 spacecraft, and G60 Starlink, envisioned at 12,000.

Chinese satellites currently in orbit, though, number in the hundreds rather than thousands.

CCTV said speed was vital because China's satellite plans face multiple competitors and a limit on the number of spacecraft in orbit and available frequencies for use.

Its report made repeated references to SpaceX, whose Falcon 9 rockets act as workhorses for the National Aeronautics and Space Administration, and whose Starlink satellite constellation covers dozens of countries.

China harnessing commercial launching capacity in a similar way would "help traditional state-owned players focus on civil and military programmes... while also boosting China's launch and space capabilities and meeting national strategic goals", wrote SpaceNews.com's Andrew Jones.

The opportunity must be grasped in the next five to 10 years "to help our country seize the right to speak in the space of the future", CCTV quoted a representative of domestic firm LandSpace as saying.

Control of the cosmos is another arena for US-China rivalry, with both accusing the other of hiding its space programme's military goals.

The next decade of competition with China is the "most critical 10 years" in history, a former US Space Command chief said recently.

There are "deep links" between China's state and commercial sectors, said Curcio, with many companies founded by former employees of state-run companies or academics from government institutes.

The relationship was not always straightforward, "since the state is loath to surrender their monopoly on anything" and "companies have a lower ceiling for what they are allowed to do", he said.

Still, the central government is increasingly throwing its weight behind the sector.

It was termed a "strategic emerging industry" to be "nurtured" at an annual meeting of China's top decision-makers last December.

China made 26 commercial launches in 2023, said state media, including LandSpace's Zhuque-2 rocket, the world's first methane-fuelled rocket.

"The next milestone will be a Falcon 9-class launcher and first stage re-use," said Chen, which several companies were expected to achieve this year.

The commercial sector should make up 30 of China's planned 100 launches this year.

By comparison, SpaceX comprised 98 of 109 US launches in 2023, said astrophysicist Jona-than McDowell.

The writer is from Agence France-Presse