Ah, the clickbait! No wonder we let our guard down when we see cheap, attractive products or services on smartphones. How dangerous they can be to unsuspecting users of social media.

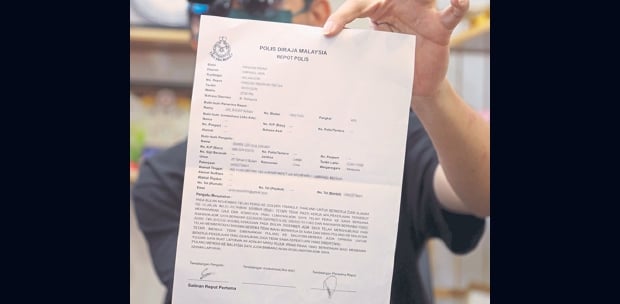

A man lost RM18,700 after clicking on a Facebook link to a cheap maid service in April this year.

After paying RM10 for a registration that took him to an unknown application, he lost that staggering amount of money in less than 10 minutes in multiple withdrawals while waiting on the phone with the bank to check the first unauthorised withdrawal.

He is not the only one. I have read of scores of people being cheated of their hard-earned money by fly-by-night business enterprises online.

Another unidentified woman was cheated of RM3,800 after ordering a delectable-looking fried crab from a company. She had clicked on an advertisement on WhatsApp.

The worst case in recent weeks was of a woman who shared her plight on social media. She lost RM163,000 in four banks to scammers in just one day.

These heart-wrenching stories agonise us, not just the victims. Regardless of the banks' advisory on the phishing tactics of scam syndicates, we still fall for clickbaits.

Victims give their personal data, such as email addresses, identity card numbers and credit card information.

It appears most victims have difficulty getting their money back as banks usually blame them for clicking on unknown applications or websites.

On the other hand, customers blame the banks for not warning them of multiple, unauthorised withdrawals.

One nephrologist lost RM13,000 in multiple withdrawals from her bank account. She lambasted the bank for not alerting her to the transactions that occurred at 2.30am. I wonder why the bank did not have a system to flag such ungodly-hour transactions.

Are the customers solely to be blamed? Will they ever get their money back? Will the banks reimburse them because they do not have a control system in the first place?

I believe banks can prevent reputational damage when they assume the responsibility of reimbursing customers who have been scammed.

Since we are so inclined to clickbaits, we must be on guard when it comes to online purchases. We need to have a healthy scepticism of individuals or companies.

It will be good if we take heed of the advisory given by the banking industry players, including Bank Negara Malaysia (BNM).

Fraud risk, said BNM recently, is constantly changing as scammers continue to devise more sophisticated methods.

Scammers can trick us in various ways. Hence, a good understanding of their modus operandi is important.

From my reading, the mistake that we usually make, sometimes unintentionally, is to download, install and open a dubious application of a product or service.

The application will ask us to allow it to access our photos and videos. In actuality, we are allowing the hackers to read our SMS, too.

We are told to register our personal details in placing an order for goods. The registration fee is negligible.

In most cases, scammers will lead us to only online banking, instead of payment by credit card. When the application leads us to an online banking interface screen, the trickery begins. The landing page is fake, cleverly created by these crooked people.

As we log in to our banking account using our username and password, the application will notify us that the bank is experiencing some problems like "service down" or "poor Internet connection".

While we attempt to log in a second time, the scammers have already siphoned off a large chunk of our money.

Our sense of trust is broken when we no longer feel safe with the banks' security.

But the fact is, we ourselves are to blame for what has happened.

The writer, a former NST journalist, is a film scriptwriter whose penchant is finding new food haunts

The views expressed in this article are the author's own and do not necessarily reflect those of the New Straits Times