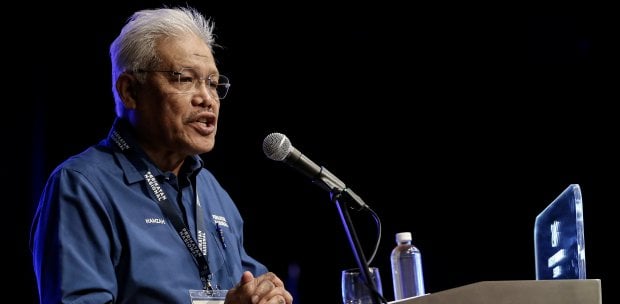

KUALA LUMPUR: The high-value goods tax that the government plans to introduce will not burden low-income groups, says Finance Minister II Datuk Seri Amir Hamzah Azizan.

The tax, also known as the luxury tax, will be imposed at a rate of five to 10 per cent based on specific threshold values for each commodity, Amir told the Dewan Rakyat today.

"This tax is progressive because it is imposed on those who can afford to purchase high-value goods and does not burden low-income groups.

"The government is committed to strengthening the country's financial position to support the development agenda and the welfare of the people.

"We are also open to considering other tax measures that can increase revenue without causing long-term effects," he told the Dewan Rakyat today.

He made these remarks in response to Rodziah Ismail's (PH-Ampang) question, who asked him to state the government's readiness to introduce more progressive tax alternatives to increase revenue and address deficits.

Amir Hamzah also gave an assurance the government would intensify efforts to address leakages in tax collection.

"In addition to exploring new tax measures, efforts would be redoubled to tackle revenue collection leakages and ensure that those who are supposed to pay taxes fulfil their responsibility."

He added that the government has implemented various measures to boost national income, notably through tax reforms.

This includes the capital gains tax on the disposal of unlisted shares, effective from March 1.

"In alignment with international tax standards and principles of social equity, taxes are also applied to the sale of capital assets as an additional revenue stream for the government, complementing corporate income tax.

"However, it's important to note that this tax does not apply to individuals disposing of unlisted shares."