KUALA LUMPUR: The Employees Provident Fund (EPF) is poised to achieve comparable returns for 2024, provided it maintains its optimal strategy without external interference, said an academician today.

Professor Geoffrey Williams, an economist and the provost for research and innovation at the Malaysia University of Science and Technology, expressed confidence that 2024 presented no greater challenges than the previous year, potentially leading to improved performance for the EPF.

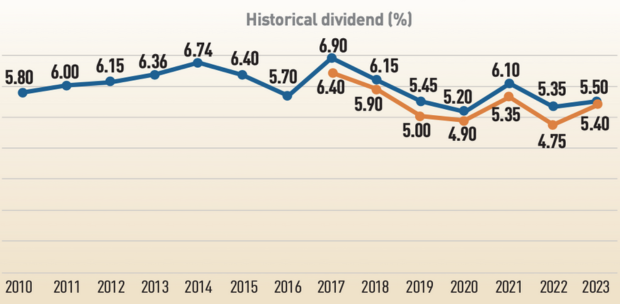

He said that the EPF dividend rate of 5.5 per cent for conventional funds for the financial year ended Dec 31, 2023 (FY2023) was good and in line with his expectations of 5.5-6.0 per cent.

The total EPF payout for FY2023 stood at RM57.8 billion; 13 per cent higher than RM51.14 billion in FY2022, he noted.

"This reflects an excellent investment strategy last year by the EPF team under the helm of the previous EPF chief executive officer Datuk Seri Amir Hamzah Azizan, who is now Finance Minister II," Williams told Bernama.

He said that the total investment income of RM66.99 billion and the RM57.8 billion payout proved that a good portfolio management strategy involving domestic and overseas assets could continue to perform even in difficult circumstances.

"It also shows that if a separate new Malaysian superfund of similar size was set up by combining underperforming government-linked investment companies, the returns could solve the civil service pensions problems and even provide a Universal Basic Pension for everyone," he added.

He pointed out that a new Malaysian superfund could even be run by the EPF portfolio managers, which could yield returns akin to those achieved in 2023.

"The sad side is that because of the EPF withdrawals policy, millions of people cannot benefit because their accounts have been depleted," said Williams.

In January, the EPF announced a RM708 million Government Additional Contribution incentive for 1.4 million EPF members aged between 40 and under 55 with EPF savings of RM10,000 and below in their Account 1 as of Feb 24, 2023.

"So, 1.4 million members will get a dividend bonus of RM500 each, but still they will have virtually nothing in their accounts.

"This is why a Malaysian superfund should be set up to help everyone, even those with no pension savings at the moment," Williams said.

Meanwhile, Bank Muamalat chief economist Dr Mohd Afzanizam Abdul Rashid said the EPF's dividends for FY2023 were respectable, considering that the global financial markets were rather volatile due to the interest rate hike in the United States as well as geopolitical uncertainties, including concerns over China's economy owing to the fall of its property markets.

"Against such a backdrop, the EPF was able to deliver higher dividends compared to the previous year, and the portfolio diversification strategy into global markets has helped them to make the portfolio more resilient," he added.

Mohd Afzanizam said the ongoing new registrations for employers and members suggest that the Malaysian economy has improved, while the labour market is deemed to be at full employment status.

"This has allowed the employees to contribute to EPF funds, and businesses have been recruiting new workers which necessitates them to register and contribute to EPF," he added.

According to the EPF, its new member registrations amounted to 460,447, bringing the total number of EPF members to 16.07 million as at December 2023.

Out of that amount, a total of 8.52 million were active members, representing 50 per cent of Malaysia's 17.03 million labour force as at end-2023. – BERNAMA