GEORGE TOWN: Is the government of the day doing the right thing to boost the ringgit?

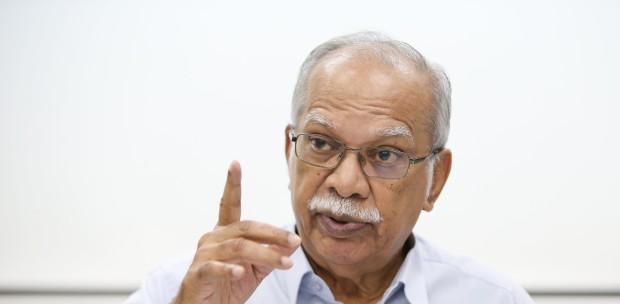

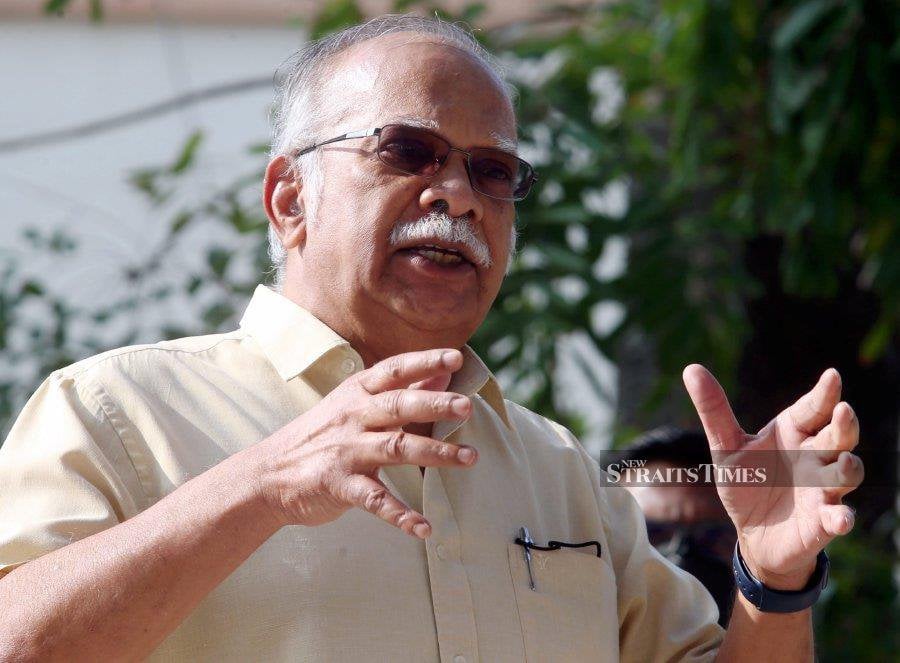

This is the poser raised by former DAP leader Dr P. Ramasamy over the devaluation of the ringgit.

He said Prime Minister Datuk Seri Anwar Ibrahim often repeatedly talked about investors having confidence in the country.

"However, he forgets to mention whether the government of the day is doing the right thing to boost the currency," he said today.

For instance, Ramasamy asked if the system of administration was incorruptible.

He questioned whether condoning high-profile corruption trials for political purposes would promote confidence in the political and economic systems.

He said slowly but surely, there were attempts to muzzle the media in reporting the truth when once brave and brilliant online publications had toned down their criticisms of the government.

He said the introduction of the code of ethics was seen as a nefarious way to manufacture consent among journalists in the country.

"Race and religions remain the two divisive anchors on which politics are organised shamelessly in the country.

"Once loudmouth champions of anti-corruption are quiet and subdued as mice. Power, positions and perks have come to be the preoccupation of these self-serving leaders.

"What confidence are we talking about as the country meanders its way aimlessly to address the economic, political and social fallout of the present economic crises manifesting as currency devaluation," he added.

Ramasamy said Bank Negara Malaysia (BNM) or Malaysia's central bank seemed to be too beholden to the government in power to say the right things about what ails the economy leading to the devaluation of the ringgit.

The ringgit experienced a 26-year historical low mark against the US dollar since the Asian financial crisis in the late 1990s.

In the last few days, the ringgit is hovering around 4.789 against the US dollar.

Ramasamy said from the government's perspective, this historic low was being explained by the rise in the interest rates of the US dollar and the lackadaisical performance of the Chinese economy.

He noted that even countries like Vietnam and others which depended on trade with China, more than Malaysia, had not experienced currency devaluation like Malaysia.

"Well, if external factors are not the main cause of the slide in the ringgit, what then are other factors?

"Despite the big or desperate talk by the prime minister of investors having confidence in the economy by way of aggregate investments last year, the level of confidence is not preventing the slide of the ringgit to a record low.

"It should not be forgotten that Anwar was the finance minister during the Asian financial crisis in the 1990s, when the ringgit plummeted to a record low. Whether coincidence or not, Anwar is not only the prime minister today but also the finance minister of the country.

"Given the slide of the ringgit to a record low, Anwar might not be doing the right thing as the finance minister. Maybe this is the right time that he should seriously consider passing over the post to someone who is a professional, well-versed in economic and financial matters.

"Even if Anwar has some rudimentary knowledge in economics, it is too heavy a burden to hold two important portfolios. There is no justification to hold on to the post of finance minister when Malaysia is one of the worst performing economies in the Asian region," he added.

Ramasamy further questioned where was the much needed competitive edge that Malaysia needed urgently to shoulder the present on-going crisis as reflected by the ailing ringgit.

He said the governor of BNM had encouraged the inflow of foreign currency by appealing to local and foreign businessmen in the country.

"The governor believes that the inflow of foreign currency might arrest the further decline of the ringgit.