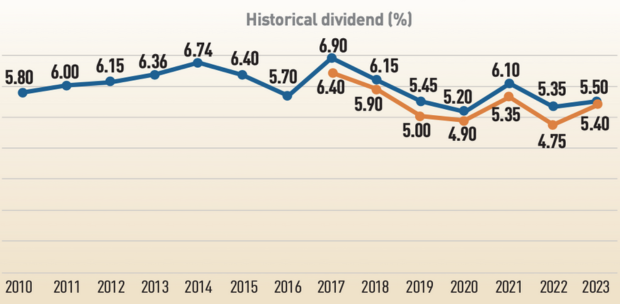

KUALA LUMPUR: The Employees Provident Fund (EPF) is expected to announce a dividend of 5.5- 6.5 per cent for 2023, higher than the 5.35 per cent for conventional savings and 4.75 per cent for shariah savings in 2022.

UniKL Business School economic analyst Associate Prof Dr Aimi Zulhazmi Abdul Rashid said the positive expectation in the distribution of better dividend rates in 2023 was based on EPF's current quarterly performance.

"EPF has a more sustainable economic scale with assets under management (AUM) of RM1.1 trillion. Thus, it gives EPF advantages in terms of investment options and the negotiation process with external fund managers.

"However, due to the large size of the investment fund, the EPF has to work harder to get a high return in terms of ringgit, even if the percentage is small. For example, for every one percent dividend, the EPF with assets of RM1.1 trillion has to pay RM11 billion and this is challenging enough in the current economic situation.

"EPF is expected to provide a better dividend with the projection for 2023 being between 5.5 and 6.5 per cent," he told Berita Harian.

In addition to EPF's improved performance, he said Malaysia's economy also continued to grow last year.

"Furthermore, the movement of EPF senior management to hold a larger portfolio in the Ministry of Finance and the Prime Minister's Department at the end of last year also provided an indication of the excellence of EPF management that attracted the attention of the country's leadership," he said.

He added that one of the EPF's biggest challenges was balancing domestic and foreign investment, especially in supporting local companies from the aspect of capital investment in expanding profits and prospering the country.

"Bursa Malaysia's main index did not show a significant increase. The index once exceeded 1,500 points in January 2022, but for the whole of 2023, it only hovered at the level of 1,400 to 1,450 points.

"This is due to world capital market factors that are directed towards the United States (US) following the Federal Reserve (Fed) which continues to raise interest rates in 2023,

"Thus, it affects foreign fund managers, especially those who change their investment portfolio from Bursa Malaysia to the US," he said.

However, Aimi Zulhazmi said there are large local listed companies on Bursa that recorded steady profits such as banking institutions, oil and gas and construction despite the global economic slowdown, because they continue to pay good dividends.

"Obviously this will definitely help the EPF realise its investment in local companies strategically and be able to provide better dividend returns to contributors.

"The wisdom of the EPF is highly demanded by contributors, especially the decrease in AUM after various withdrawals were allowed when the Covid-19 pandemic hit the country," he said.

Meanwhile, Universiti Putra Malaysia's School of Business and Economics Senior Lecturer, Dr Mohamad Khair Afham Muhamad Senan said the announcement of the recent dividend increase by Amanah Saham Bumiputera (ASB) could be a benchmark for the possibility of an increment in EPF dividends.

He said looking at the improved performance recorded in the first three quarters of this year supported by the absence of large special withdrawals, enabling the EPF to distribute a better dividend rate than in recent years.

"Added to the strengthening labour market conditions (decrease in the unemployment rate and lead to an increase in the number of contributors overall).

"This factor makes the overall size of the investment bigger and contributes to a bigger return.

"However, it cannot be considered as something certain. Amanah Saham Nasional Bhd (ASNB) depended more on the performance of the country's economy, where the EPF puts 35 percent of its holdings through overseas investments," he said.

Mohamad Khair said apart from ASNB, EPF is also seen as one of the most stable and safe portfolios, making it remain competitive, and is expected to remain high compared to the long-term investment benchmark, which is fixed deposits.