KUANTAN: Pahang police received 1,710 reports regarding commercial fraud with 564 investigation papers opened involving losses of RM9.743 million for the first three months of this year.

Pahang police chief Datuk Seri Ramli Mohamed Yoosuf said the cases increased from the same period last year, which were 495 investigation papers but the total loss recorded was higher at RM10.2 million.

"Online fraud is the main contributor, with 478 cases involving a loss of RM6.9 million of which e-purchase fraud is the highest at 156 cases, followed by 80 cases of fraudulent job offers in addition to other cases such as Macau and Love Scam, investment fraud and non-existent cash loans.

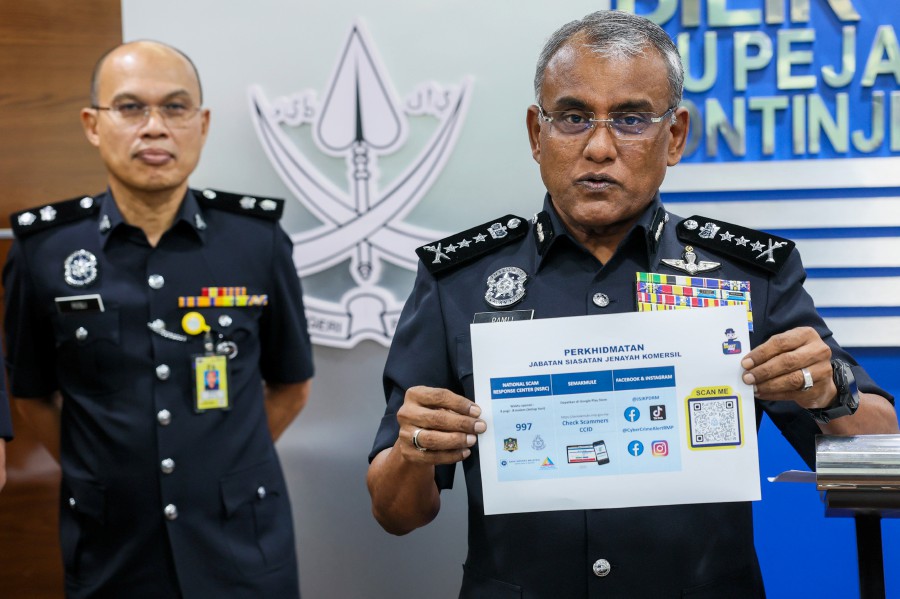

"Most of the victims are men between 17 and 40-years-old, with the majority of 229 cases involving private sector workers followed by public servants with 69 cases, self-employed (58 cases), unemployed (57 cases), students (45 cases) and retirees (20 cases)," he said at a press conference at the Pahang police headquarters here today.

Also present were Pahang Criminal Investigation Department chief, Datuk Mohd Yusri Othman and Pahang Commercial Crime Investigation Department chief Superintendent Wan Rosli Wan Othman.

Ramli also said that out of the 564 investigation papers, the Kuantan district recorded the most cases with 227 investigation papers, followed by Bentong and Temerloh with 75 cases each, Raub (35 cases), Bera (30 cases), Pekan (29 cases) and Rompin (26 cases).

According to Ramli, so far this year, JSJK Pahang has arrested 319 suspects with 303 involved in fraud cases including owners of accounts used in the crime.

"We advise members of the public not to lend or rent out bank accounts to third parties because the consequences of 'mule account' fraud can affect their own fate when charged in court or face civil lawsuits.

"The community is also reminded not to be tempted by sales offers that are too far down from the normal market price or offer too high a profit or overly-lucrative job offers on social media," he said.

Ramli also advised members of the public to always check https://semakmule.rmp.gov.my/ before making transactions and not to download any suspicious links. – BERNAMA