KUALA LUMPUR: The Employees Provident Fund (EPF) says a full separation of assets under its syariah savings from other kinds of investments will ensure competitive and sustainable returns for its members.

The EPF is working to completely separate its Simpanan Syariah assets from investing alongside syariah-compliant assets in Simpanan Konvensional to enhance its business model.

"We target to roll this out in 2024 as mentioned in the recent 2023 Budget announcement," EPF chief executive officer Datuk Seri Amir Hamzah Azizan said at a briefing on the EPF's performance last year and dividend announcement here today.

By separating, both syariah and conventional accounts would have their own independent strategies and differentiated strategic asset allocations, Amir added.

"This will ensure more optimised, competitive and sustainable long-term returns for both Simpanan Syariah and Simpanan Konvensional.

"It has been six years since we introduced Simpanan Syariah. We are currently working on enhancing the current business model by fully separating Simpanan Syariah assets from investing alongside syariah-compliant assets in Simpanan Konvensional," Amir Hamzah said.

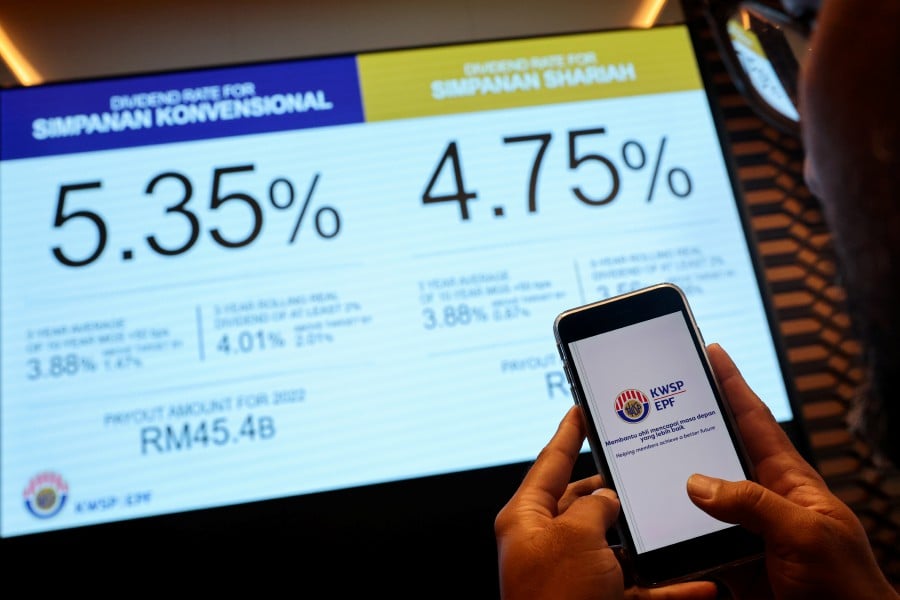

The EPF wrote down RM3.43 billion of its listed equity portfolio last year, higher than the RM1.15 billion write-down recorded in 2021, in line with the volatility in the equity markets.

A total of 74 per cent of the total amount came from syariah-compliant counters that underperformed, which in turn, had impacted the EPF's Simpanan Syariah performance for the year.

Bank Muamalat Malaysia Bhd head of economics and market analysis Mohd Afzanizam Abdul Rashid said the full separation would allow EPF to focus on identifying key weaknesses in investee companies.

"I think it's a step in the right direction. With shareholders activism, it could nudge the performance among investee companies more strategically. Hence, we can expect better returns in the years to come," Afzanizam told the New Straits Times.

Universiti Putra Malaysia senior lecturer of School of Business and Economics Dr Mohamad Khair Afham Muhamad Sena said the move would give more competitive returns to the account holders of Simpanan Syariah.

Khair said since the adoption of the dual scheme in 2017, the highest gap recorded was 50 basis points, while the lowest gap recorded was 25 basis points, with returns from the conventional scheme being higher every year.

"Hopefully, it can close the gap and will attract more holders towards the syariah scheme," he said.

Research fellow with Centre for Market Education and UCSI University Malaysia assistant professor Dr Liew Chee Yoong said the move would not bring a huge impact.

"In my view, it does not move the needle much. The returns on syariah savings still depend very much on the EPF's investment strategies and the global economy, as well as geo-political outlook," he said.

Putra Business School economic analyst Associate Professor Dr Ahmed Razman Abdul Latiff said it would be challenging for Simpanan Syariah to achieve higher returns on investment.

"This is due to lower allocation of funds under the scheme compared with conventional ones. Additionally, most financial institutions are among the major contributors of income under conventional schemes," Razman said.