WHAT is success?

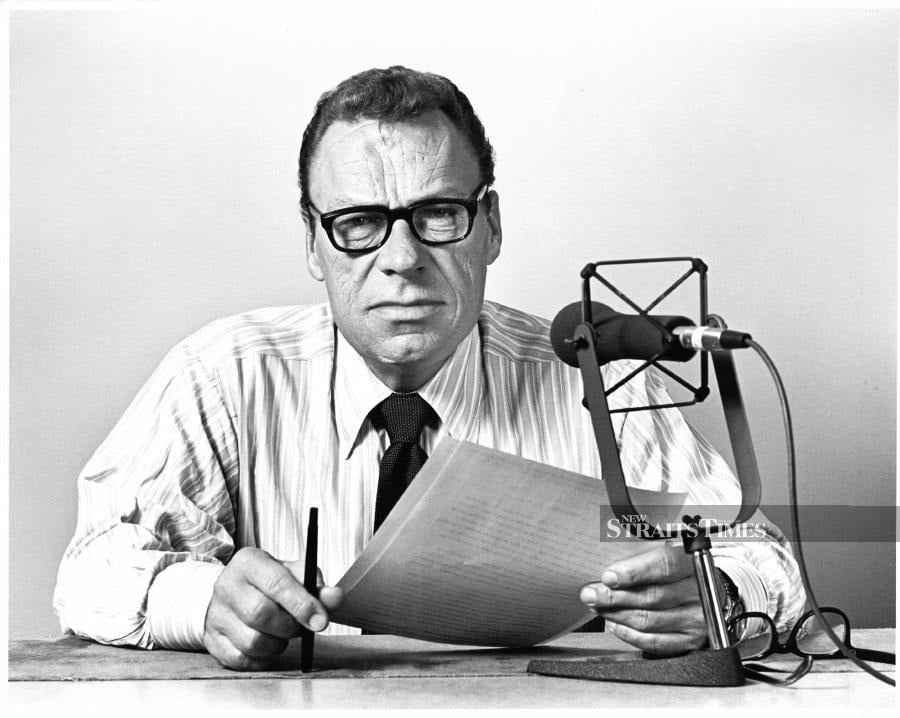

For a usable answer, let's jump back 67 years to 1957, when a fading British Empire granted Malaya independence, and when master communicator Earl Nightingale created something truly unique:

A spoken-word record entitled The Strangest Secret.

More than one million copies of this non-music hit vinyl record were sold, which helped launch the nascent audio publishing industry. In his record, which was later turned into a book, Nightingale said: "Success is the progressive realisation of a worthy goal."

Think about that as we consider the approximate two-decade initial educational journey — from, say, age five to 25 — most of us traversed through kindergarten to primary and secondary school and then on to college or university, as we attended class, did our homework, memorised facts, understood processes, remembered skills, analysed data, and synthesised principles.

Why did we do all that? To be able to live and laugh and love. In other words, to succeed in life. And that loops us right back to Nightingale's potent definition of success.

We all wear different hats in life. Each such "hat" is a distinct role we might play given our circumstances; some such roles are spouse, parent, child, grandparent, grandchild, employee, employer, teacher, student, breadwinner, dependent, and so on.

Reread my shortlist of possible roles. Pick those that pertain to you; also add other roles that are unique to you, which I don't know about.

ROADMAP TO SUCCESS

After you've identified the top, say, four or five roles that are of greatest relevance to you, write each one at the top of a separate blank page of a notebook that you might use as a personal journal. Then, below each main heading, think about and list goals associated with every important role. Aim for at least 10, ideally 20, goals per role.

Once you've completed your personal list of 40 to 100 goals, take time to prioritise them in order of importance to you. Then against the top five goals for each of your key life roles, decide on whether they should be short-term goals to be accomplished inside the next two years; medium-term goals to attain between the coming two and seven years; or long-term goals that will take more than seven years to achieve — perhaps over 10 to 30 years, although goals that extend beyond your lifespan over, say 50 to 75 years can also be accomplished using estate planning instruments like private trusts.

Few readers will complete this arduous task. But the minority who do so will find themselves with a personal (and personalised) customised roadmap to genuine success within the precious handwritten pages of their journals.

Nightingale's advice, then, provides us with the key to attaining each of our top goals. It is good guidance and should be repeated:

"Success is the progressive realisation of a worthy goal."

SOUND FINANCIAL PLANNING

If one of your primary life "hats", or roles, is being the breadwinner of your family, then it is likely that you are responsible not just for bringing in the "dough" to pay for today's family and personal expenses, but also to build up savings and investments to meet future expenses — both while you continue working in the future to earn your active income (by the sweat of your brow) and later still when you no longer earn a living but still need money.

How that money will flow into your life is encapsulated in a formula I teach my clients and audiences:

TI = AI + PI, which stands for Total Income equalling Active Income plus Passive Income.

In the realm of personal finance, sound financial planning dictates that during our active earning years (more likely, decades), we need to over-earn and under-spend to generate a regular monthly cash flow surplus to channel to savings and investments.

Your collection of savings and investment vehicles is your SIP or savings-investment portfolio. If, for example, at age 35 you have an SIP worth RM100,000 excluding, say, RM120,000 in EPF, and you hope to retire at 65 — since our national official retirement age of 60 is too low, given Malaysian demographic trends — with a retirement nest egg worth RM5 million, then taking to heart Nightingale's useful definition of success, you will arrange your financial affairs to progress from your combined current investable wealth (CIW) – comprising your SIP plus EPF – of RM220,000 at 35 to RM5 million by 65.

Along the way, you will set progressive milestones such as growing your CIW (= SIP + EPF) or current investable wealth to RM500,000 and then to RM1 million and RM2 million and so on in bite-sized increments until you reach — and probably exceed — your RM5 million CIW goal.

Reaching each significant milestone along the way is reason to celebrate your success-soaked life. Furthermore, as you reach each half a million or one million RM marker, you will revisit another financial goal associated with your breadwinner role: To incrementally grow your PI as the impending end of your AI earnings approaches.

So, as you see your monthly PI grow by RM100 or RM1,000, take time to celebrate your sequentially progressive success.

© 2024 Rajen Devadason

Rajen Devadason, CFP, is a securities commission-licensed Financial Planner, professional speaker and author. Read his free articles at www.FreeCoolArticles.com; he may be connected with on LinkedIn at www.linkedin.com/in/rajendevadason, or via [email protected]. You may also follow him on Twitter @Rajen Devadason and on YouTube (Rajen Devadason).