FOR a more seamless and secure banking experience, Maybank will be implementing Secure2u on all bill payment transactions performed on Maybank2u web from December 15, 2021 onwards.

What's unique about Secure2u is that it links a user's smartphone to their Maybank2u account, which means they can only approve transactions using that registered smartphone.

Within the MAE app, users will either receive a six-digit Secure TAC or Secure Verification via push notification, where they can easily approve transactions.

MAYBANK SECURE2U

The Secure2u feature will be the preferred method on all bill payment transactions performed on Maybank2u web (effective December 15, 2021 onwards) as part of Maybank's efforts to make online banking safer for users.

Secure2u is a safer and faster authentication method that helps reduce the risk of SMS fraud and users will not have to rely on their telco network and SMS to complete a banking transaction.

Approving transactions is also made more convenient with Secure2u because all one has to do is tap on the push notification to authorise them.

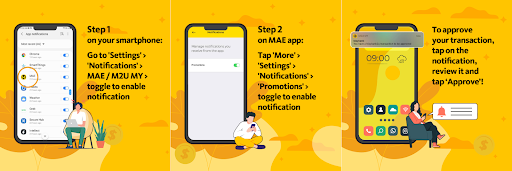

HOW TO ENABLE PUSH NOTIFICATIONS

Firstly, users need to ensure that notification settings are enabled on their phone and their MAE or M2U app.

After requesting Secure2u to approve transactions, users will receive a push notification to prompt them to approve it. Then, simply open the push notification and tap "Approve" to complete the transaction.

HOW TO PREVENT AUTO LOGOUTS

One common issue users may experience is being logged out from the Maybank2u website when they approve a transaction via Secure2u.

This is because users can only be logged in on one device or have one active session at a time for security reasons.

However, once users have enabled push notifications on the M2U or MAE app, users can tap to approve transactions without logging into the app or worrying about double logins.

OTHER SECURITY MEASURES

Lost devices: In the event that users lose their registered smartphone devices, they can immediately deregister their device on the Maybank2u website.

Users can follow these steps to deregister their device: "Settings > Security > Secure2u > Toggle"

As an alternative, users can also contact Maybank's Customer Care hotline at 1-300-88-6688 (local) to deregister Secure2u as soon as possible.

Fraud: Users are advised to contact Maybank's Fraud Hotline right away at 03-58914744 if a user has a reason to believe someone else has illegally accessed their phone or Maybank2u account.

To prevent fraud, users are advised to not share their Secure2u TAC with anyone and are recommended to lock their devices with a passcode to prevent any security breaches.

To activate Secure2u, please follow these video guides for more information:

Enable Secure2u on M2U app:

Enable Secure2u on MAE app:

Visit Maybank's website to learn about the Secure2u feature or for any assistance.