KUALA LUMPUR: MARKET regulators, Securities Commission (SC) and Bursa Malaysia are facing an uphill battle in curbing market manipulation, according to the latest Asia Pacific corporate governance (CG) report.

The Asian Corporate Governance Association (ACGA) CG Watch survey highlighted that although regulators are driving reform, market manipulation is still a significant problem in Malaysia.

Despite proactive monitoring of the markets and efforts to prosecute companies and insiders, Malaysia still grapples with political interference and significant delays in legal proceedings, making it hard for regulators to keep the markets fair.

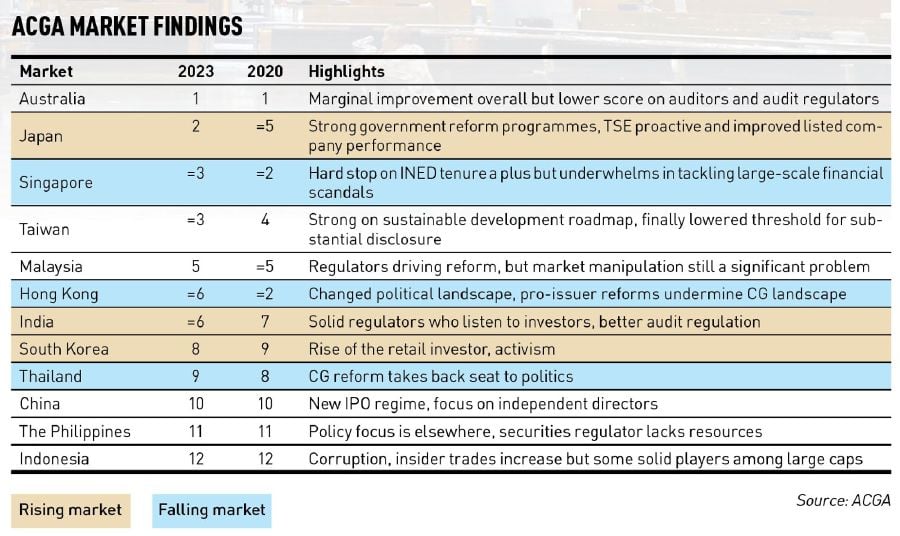

The ACGA's biennial report on 12 markets in the Asia Pacific region delves into CG performance and practices.

The CG Watch survey seeks to answer 108 questions in seven categories.

They conducted desktop research and spoke to regulators, investors, listed companies, auditors, and other stakeholders in the region.

"Sadly, we are not seeing much improvement in anti-corruption work in most markets.

Extra-jurisdictional reach still yields few results in most of the region, with blockbuster graft trials few and far between — Malaysia being a notable, though at times disappointing, exception.

"And there is still a high degree of opacity in the enforcement data provided by governments," the CG Watch survey said.

ACGA analyst Chris Leahy said regulators' efforts are hampered by political interference and material delays in cases that are prosecuted through the Attorney General's Office, even where SC has the right of audience as deputy prosecutors.

"We have seen this in some high-profile market manipulation, insider dealing and corruption cases where actions against certain subjects are inexplicably dropped despite material evidence to support prosecution."This casts serious doubts on Malaysia's appetite to tackle political and business corruption."

Leahy said despite creditable efforts by SC and Bursa Malaysia to enforce securities violations such as insider trading and market manipulation, these issues continue to be a material problem for Malaysia's securities markets.

Many of these problems occur among small-cap companies listed on Bursa Malaysia that have smaller free floats and are easier for insiders and market syndicates to control and manipulate.

Executives from SC and Bursa Malaysia, during a discussion admitted that this issue continues to be problematic for Malaysia's markets, he said.This shows they have a difficult job to do, added Leahy.

With the prevalence of political influence within the legal systems and the ability of certain insiders to exploit their influence to ensure legal impunity, issues with insider trading and market manipulation are unlikely to improve without a sea of change within Malaysia's political system.

"This change is not something that will happen overnight, if at all," said Leahy.

Malaysia ranks eighth out of the 12 markets for government and public governance, followed by China and Indonesia.ACGA is funded by a network of 106 member firms from 18 markets, of which 70 per cent are institutional investors with more than US$40 trillion in assets under management globally.