KUALA LUMPUR: The repatriation of funds by government-linked companies (GLCs) and government-linked investment companies (GLICs), corporations and investors will help to support "grossly undervalued" ringgit, given that the funds held overseas have grown exponentially since early 2020, said economists.

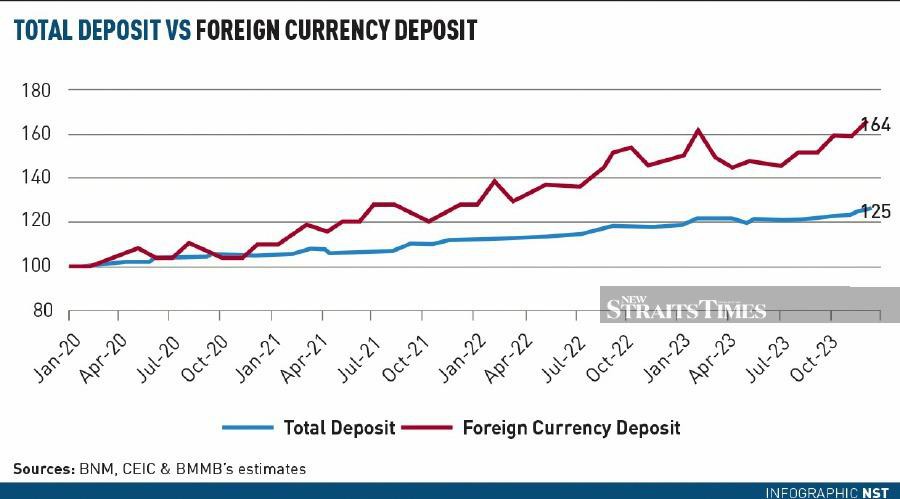

The substantial amount of foreign currency deposits has outpaced the total deposits since January 2020.

Converting earnings abroad into the local currency could help the ringgit to regain some of its value, they added.

Bank Muamalat Malaysia Bhd chief economist Dr Mohd Afzanizam Abdul Rashid said Bank Negara Malaysia made a policy change in 2016 requiring exporters to convert 75 per cent of their exports into ringgit.

"This measure was able to stabilise the ringgit when the US dollar-ringgit pair traded below 4.00 back then," he said.

The measure was lifted in March 2021.

"I guess it makes sense for Bank Negara to make some intervention in the foreign exchange market as the market may have been excessively distorted by the uncertainties over the United States Federal Reserve (Fed) interest rate cut.

"From my assessment, the fair value of the ringgit against the US dollar should be around 3.90," he added.

Economist Dr Nungsari Ahmad Radhi said since 2013/2014, the ringgit has been on a downward trend, which was a reflection of Malaysia's loss of competitiveness.

He said it was time to work on improving competitiveness, quality and productivity of human capital, and government fiscal health.

Last week, the local currency touched 4.800 against the greenback, the weakest level since the Asian financial crisis in 1998.

Bank Negara issued a statement on Tuesday saying the ringgit was undervalued and should be trading higher on account of the country's positive economic fundamentals and prospects.

Governor Datuk Abdul Rasheed Ghaffour said the central bank had stepped up engagements with GLICs, GLCs, corporations and investors to encourage continuous inflows into the foreign exchange market.

Sunway University economics professor Dr Yeah Kim Leng said the ringgit was grossly undervalued and had overshot its fundamental value as there was too much demand for the US dollar.

"But at the same time, there are opportunities for companies and investment funds to bring back foreign funds and profits, taking advantage of the low value of the ringgit."

He added that since short term currency fluctuations are driven by supply and demand for the ringgit versus the US dollar and other foreign currencies, the government could also consider incentives for early repatriation, after weighing the relative cost and benefit.

Yeah said it was timely to engage with GLICs, GLCs, pension funds, asset management companies and exporters on reshoring excess foreign funds, to capitalise on profitable investment opportunities within Malaysia.

Yeah said the ringgit would continue to be affected by foreign fund outflow until the Fed lowered its interest rate.

Economists polled by the Business Times agreed that a fair value for the ringgit was between 3.9 and 4.3 to the US dollar.

Malaysian University of Science and Technology Prof Dr Geoffrey Williams said the current exchange rate was favourable for repatriating profits.

"Now is a good time for repatriation of profits before the ringgit strengthens again. If they repatriate it now, this will also create demand for the ringgit and support its value," he said.

"My fair value for the ringgit is between 4.20 to 4.30," he added.