KUALA LUMPUR: The e-Madani cash handout for some 10 million eligible Malaysians will not lead to a rise in inflation as the RM1 billion injection is too "meagre' to do so, but it will create good economy.

Economists said the RM100 e-wallet credit will particularly help brick and mortar businesses that are currently facing challenging circumstances.

Nusantara Academy for Strategic Research senior fellow Dr Azmi Hassan said the terms and conditions set under the e-Madani programme could help physical retail outlets that are facing a "challenging" operating environment.

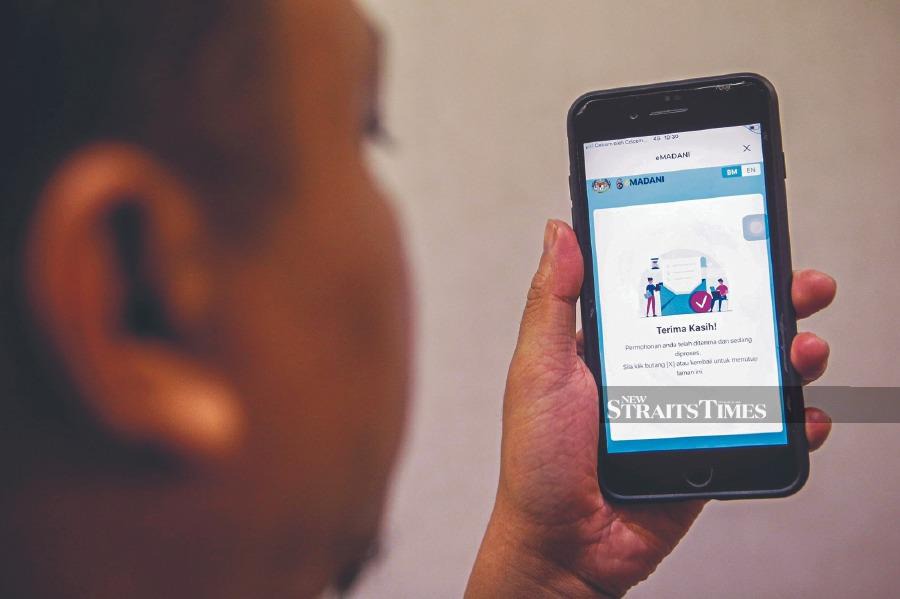

The RM100 e-credit which can be redeemed from Dec 4 until Feb 20 next year cannot be used for peer-to-peer transfers, cash redemption, utility bills, government fees, telco bills, online games, parking, toll payments, or online transactions.

"It will lead to a good economy for certain businesses that can accept the RM100 credit. It would not create a turmoil or a sudden huge demand for certain products and therefore inflation concerns would not rise because the total amount of RM1 billion is very meagre," he noted.

Universiti Kuala Lumpur Business School economic analyst Associate Professor Aimi Zulhazmi Abdul Rashid said the assistance came at the right time to boost the domestic economy as the cash injection of RM1 billion will help to propel the consumer spending in retail segment.

It can also boost the December growth numbers to achieve the targeted full-year growth of 4.2 per cent.

"The gross domestic product for the thirs quarter ending September was 3.3 per cent year-on-year than the second quarter of 2.9 per cent.

"It is also timely as it is distributed to the consumers at the year-end where many retail outlets conducted stock clearance to boost their year end business. As the e-wallet was chosen to distribute the cash handouts, it is indeed a big assistance to the country in digital adoption."

He added that the implementation of distribution via e-wallet encourages the targeted group to move into using digital platforms in their daily transactions.

"The gradual move will actually expedite the country's digital economy transformation and this is not the first time such a method is used to distribute the assistance. This will also help the government to track how and where the people spend the financial assistance, hence providing good feedback on how to improve the program further," he said.

Centre for Market Education chief executive officer Dr Carmelo Ferlito said although the amount that would be credited via participating e-wallets seemed small, the total amount of RM1 billion in government's expenditure at the macro level is apparent.

"Obviously, RM100 at micro-level (individuals) do not bring any real help, but at the macro-level we are talking about RM1 billion expenditure.

"I do not think the problem stands in how money can be spent, but in this dichotomy between the irrelevant micro-impact and the high cost at macro-level," he told Business Times.

Economists, however, said besides the sum, restrictions on the utilisation of the credit had raised eyebrows among the public.

Professor of Economics, Geoffrey Williams from the Malaysian University of Science and Technology said the restrictions were unnecessary.

"The restrictions are more political or driven by moralistic interference to control what people do with the cards. They have little or no economic rationale.

"It would also be better if it could be redeemed for cash or transferred to other e-wallets or accounts so that it could be freely spent, saved or shared with family and friends," he said.

Williams added that the RM1 billion allocated for the credit will have very little overall impact on the economy.

"Although the restrictions mean that it must be all spent in the shops, it is actually a transfer from other spending so it would have been spent in some other way by the government. The net effect is close to zero.

"It will have a disproportionate effect on those retailers who accept the preferred e-wallet vendors. Those that do not accept these specific e-wallets will lose out.

"So it will force retailers towards the preferred e-wallets at the expense of other e-wallet providers," he said, adding that this will reduce competition and harm the overall e-wallet landscape by reducing options to consumers.

The redemption can be done through four main platforms: Maybank MAE, Setel, Shopee Pay and Touch 'n Go eWallet.