KUALA LUMPUR: Mah Sing Group Bhd has acquired 2.49 hectares of land in Taman Desa here for RM108 million.

Mah Sing, in a statement today, said the land will be developed in two phases, with an estimated gross development value (GDV) of RM1.01 billion.

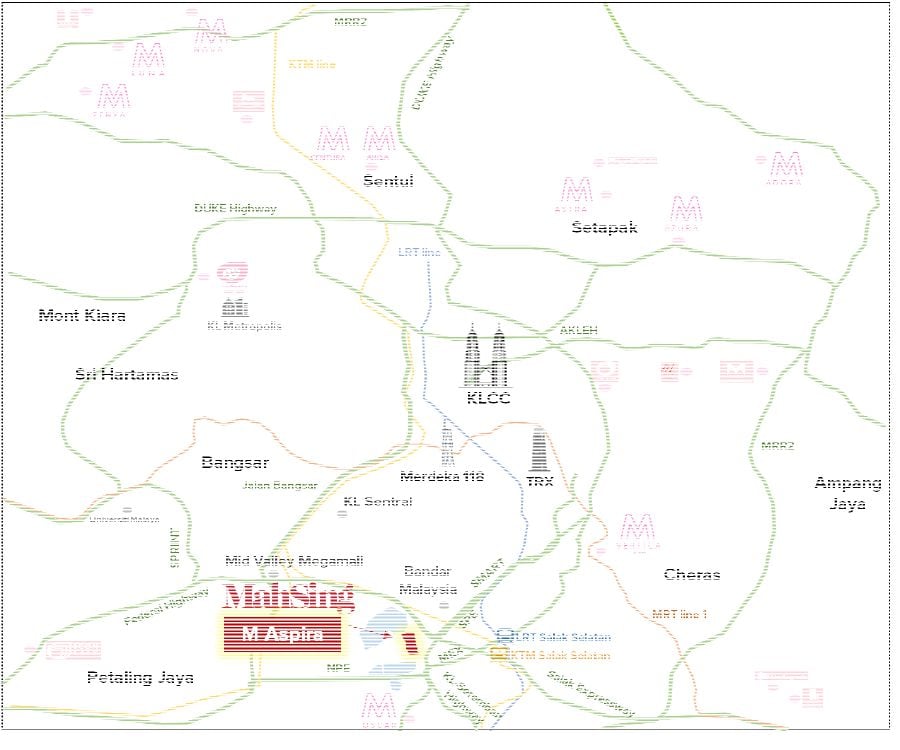

Phase one will feature M Aspira, a mixed-use development comprising about 1,600 residential units on 1.5 hectares, while phase two will include 800 units of Residensi Madani on one hectare.

The development is targeted to open for registration in the third quarter of 2024 (3Q24) and will consist of 1,600 units of serviced apartments with three different layouts.

Buyers will have options of units measuring indicatively 708 sqft, 858 sqft and 1,008-1,011 sqft at indicatively priced from RM448,800.

M Aspira will be designed with all of Mah Sing's hallmark lifestyle concept, security features and modern facilities.

Mah Sing founder and group managing director Tan Sri Leong Hoy Kum said the development aims to attract urbanites and first-time homebuyers as well as foreign buyers, providing the vibrancy of city living with the tranquility of suburban life.

"This is one of the last pieces of development land in this matured location in Kuala Lumpur, and we believe there is strong pent-up demand for the products that we have planned.

"The surrounding neighbourhoods have mainly older residential projects and it is timely for us to offer well-designed homes with good concept and facilities for the up-graders as well as first time home buyers from the surrounding established townships," he added.

According to Leong, the acquisition marks Mah Sing's third land deal in 2024.

The group aim to maintain the momentum and continue acquiring strategic land in Kuala Lumpur, Klang Valley, Johor and Penang.

As of March 31, Mah Sing had a net gearing ratio of 0.06 times and RM966 million in cash and bank balances.

Leong said the group is well-positioned to continue pursuing strategic land acquisitions, prioritising assets capable of delivering efficient returns.

"We are in a very good position; we have the financial prowess to take on more land, be they fast turnaround niche projects, large townships or industrial lands, yet we can comfortably maintain our growth with our existing landbank.

"This is why we have been very selective in the lands we acquire.

"For every piece of land we announce, our business development team would have filtered through numerous deals; we want to make sure we make the best business decision in the interest of our shareholders," he noted.