KUALA LUMPUR: Is Goodyear planning to streamline its global operations by establishing a centralised manufacturing facility in either Vietnam or Indonesia for exporting its products?

According to people close to the company, the tire manufacturer may consider this strategic move driven by cost considerations, as these regions offer more economically feasible production environments.

Reports suggest that Goodyear is exploring operational shutdowns not only in Malaysia but also in several other countries as part of broader cost reduction initiatives.

These countries include Australia, New Zealand, Europe, the Middle East, Africa, and Asia.

Dr. Yeah Kim Leng, an economics professor at Sunway University, believes that Goodyear is likely to seek alternative manufacturing locations such as Indonesia or Vietnam due to their lower cost structures and easier access to raw materials, particularly latex.

This strategic shift is expected to enable the parent company to rationalise and optimise its regional operations, ultimately enhancing profitability and returns on investment, he told Business Times.

"With a much larger population and workforce, labour availability in Vietnam and Indonesia is not an issue compared to foreign labour-dependent Malaysia, rendering the latter less attractive for labour intensive operations.

"As their per capita income is relatively lower, wages and labour costs are also more competitive than in Malaysia," said Yeah.

Yeah said that since Malaysia is no longer competitive in labour intensive industries due to labour shortages and higher wage costs, it has to attract high value, skilled, and technology-intensive manufacturing activities.

He said that for high value manufacturing operations that rely more on capital, technology, and skilled manpower, the country's minimum wage regulation does not affect them.

The primary concern of high-end manufacturing industries is access to skilled labour, productive workforce, and innovative talents that enable them to be internationally competitive, he noted.

Malaysian Institute of Economic Research (MIER) senior research fellow Shankaran Nambiar said since Goodyear has to rationalise, it would make more sense to locate in a country where the cost of business is low.

He added that this basically means the availability of rubber and low cost labour.

However, Nambiar said a good part of it probably has to do with weakening global demand, competition, and the need for rationalisation.

"Goodyear has to deal with its competitors in a tight global market. You can't compete with countries like Vietnam and Indonesia on labour costs and, generally, the cost of doing business.

"People have been criticising the Malaysian Investment Development Authority (MIDA), but this is a company with a 50-year relationship with the country. Surely, they have developed a good relationship with the local agencies and know how to deal with the system.

"It's more a case of the changing structure of business and the right kind of competitiveness that we can offer.

"So there will be a natural gravitation of companies seeking the kinds of advantages that are useful to them," he noted.

Having said that, Nambiar said it is not possible to abruptly pull out of foreign direct investment (FDI) that is not high value-added.

He said Malaysia won't have the kind of FDI it is looking for to fill the gap at short notice.

Nambiar also expects that there will be a sprinkling of companies shifting their locations as part of their optimisation exercises this year and next year.

"It's not just the 550 Goodyear workers who are losing their jobs but many more, because companies associated with Goodyear will also be negatively impacted, and may have to reduce staff," he said.

According to the MIDA, the manufacturing sector recorded RM152 billion (46.1 per cent) of the country's total approved investments in 2023.

This was an 80.3 per cent increase from the RM84.3 billion recorded in 2022.

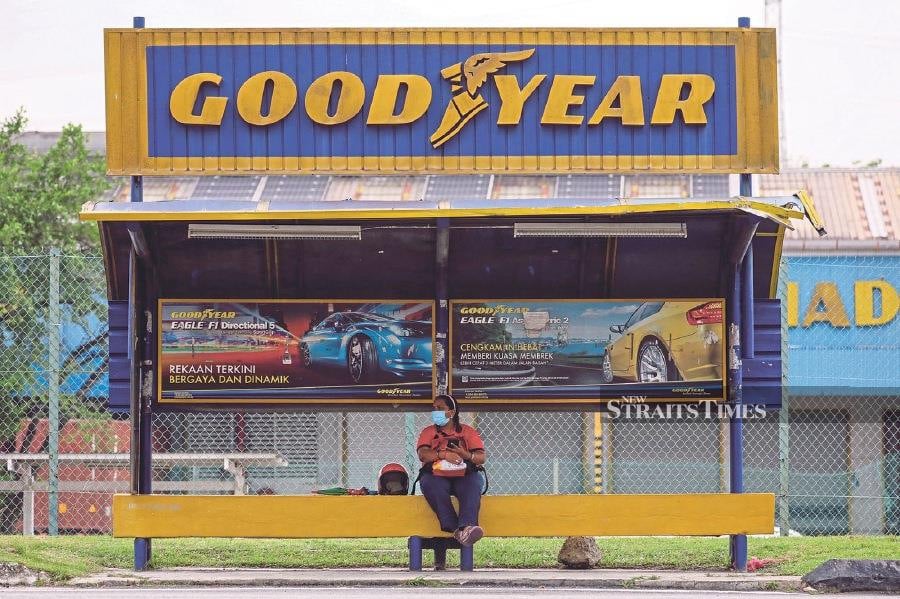

Last week, Goodyear announced its decision to close its facility operations in Shah Alam, affecting approximately 550 of its employees.

Its president for Asia Pacific, Nathaniel Madarang, said this move aligns with the group's transformation programme, Goodyear Forward, aimed at optimising its portfolio and global presence.

He said this programme includes specific actions to deliver annualised cost reductions of US$1 billion by 2025, ensuring the company remains competitive and positioned as an industry leader.