KUALA LUMPUR: The local automotive industry is set to transform with heightened competition in the local production and distribution chain in the near term as electric vehicle adoption accelerates, and foreign direct investments (FDIs) increase.

Maybank Investment Bank said post-pandemic, Malaysia has emerged as an increasingly attractive destination for FDIs from global automakers establishing their regional headquarters/electric vehicle hubs. This includes prominent names such as Volvo, Stellantis, Tesla, and Chery.

Automotive industry observer Hezeri Samsuri said with the presence of companies like Tesla and Stellantis choosing Malaysia for their expansion, Malaysia could attract more automotive giants to establish their presence here and use the country as their gateway to the Asean or Asia Pacific markets.

"I would say 2024 is looking pretty rosy for us, especially if the government can offer the right package," he told Business Times.

Malaysia's competitive edge in the semiconductor supply chain positions it favourably for the automakers' transition to EV.

Several carmakers, including Mercedes-Benz, BMW, Porsche, Audi, and Dong Feng, have announced local assembly plans for vehicles targeting both domestic and export markets.

Maybank IB said in its note that the influx of FDIs is expected to have a positive long-term impact on the industry, contingent on the position of auto players in the supply chain.

Maybank IB said while clear winners at present include local consumers and certain auto parts suppliers, local players in the production and distribution chain are expected to see intensified competition in 2024, potentially impacting their margins.

"This consideration takes into account numerous new product launches, including scheduled EV brands/ models throughout the year," Maybank IB said in its note today.

The penetration rate of battery electric vehicles remain low in the local automotive market at one per cent.

Maybank IB said however that the introduction of new EV brands and models is a positive sign, and anticipates that BEV sales in Malaysia will continue to grow exponentially in 2024.

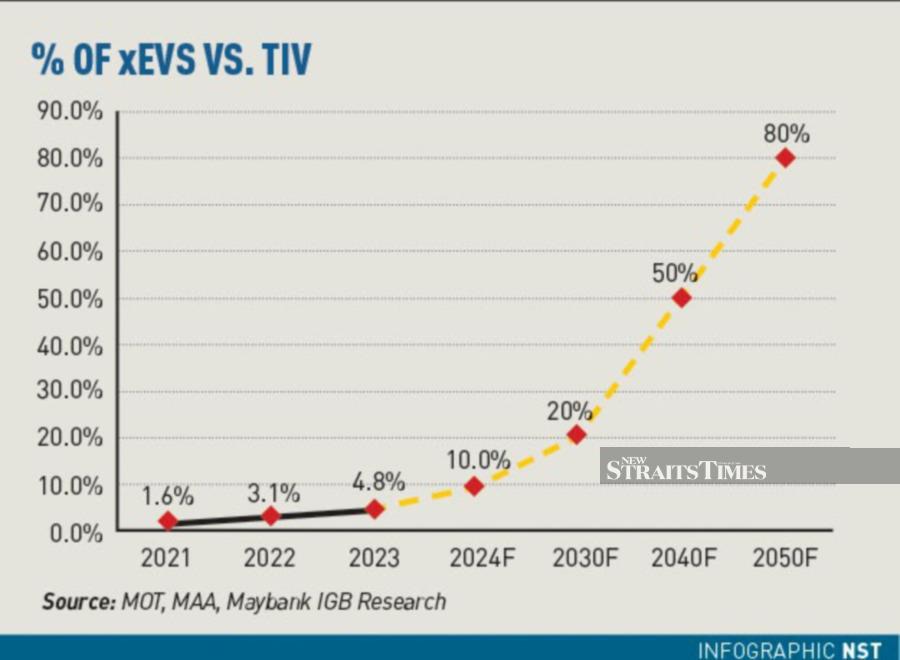

"Our optimism aligns with the national targets revealed by the Minister of Investment, Trade and Industry in late Nov 2023, aiming for 20 per cent/50 per cent/80 per cent of new car sales to be new energy vehicles by 2030/2040/2050 respectively.

The Tesla Model 3 and Model Y, smart #1, BYD Dolphin, Neta V, Hyundai Ioniq 6, and Ora Good Cat are notable launches in 2023.

"We expect the demand growth for xEVs to gain further momentum with upcoming launches in 2024, including the BYD Seal (1Q24), Chery Omoda E5 (1Q24), Dong Feng Nammi 01 (2Q24), Toyota bz4x, and more," Maybank IB said.

It believes the increased presence of EV brands locally is set to have a positive impact on expediting the transition of the entire EV ecosystem.

This is likely to be facilitated through increased partnerships, collaborations, and mergers and acquisitions between EV automakers and infrastructure/component suppliers.

Furthermore, Maybank IB foresees additional policy announcements, including the next installment of the National Automotive Policy (NAP), which is expected to strengthen the policy focus and facilitations for the EV ecosystem in alignment with the National Energy Transition Roadmap (NETR) and the New Industrial Master Plan (NIMP) 2030.

Hezeri emphasised the need to not only offering incentives to car companies but also to consumers, as a robust domestic market enhances the attractiveness of investments.

"Our forte would be our microchip industry and our highly skilled labour, and language. We also have a bigger portion of consumers who have been proven to accept new technology quicker than the other Asean market. "These are all good for a booming EV market, but the government needs to act fast.

Recently, Stellantis Group announced a big investment in EV where Malaysia will be its hub for not only export, but as a distribution hub for its components and spare parts.

"Focus should be given to those who have decided to invest here, so that the companies' objectives can be realised or even beyond their expectation. "As companies need to invest here, Malaysia will also have to invest," he noted.

Meanwhile, Tradeview Capital Sdn Bhd vice president Tan Cheng Wen said the Malaysian Automotive Association (MAA) had forecasted a total industry volume (TIV) of 740,000 for 2024. However, he believes that this may be an optimistic scenario as vehicle ownership will be costlier due to the rationalisation of targeted subsidies, as well as the higher service tax rates which affects maintenance and vehicle repair services.

"Although the current penetration of battery EVs in the market is low, estimated at around one per cent, we believe that the proactive efforts by the government, exemplified by initiatives like the National Electric Transportation Roadmap (NETR), will only be a huge catalyst in expanding the adoption of EVs.

"The NETR aims to achieve a 50 per cent share of TIV for two-wheeled and four-wheeled EVs by 2040. "The upcoming update to the National Automotive Policy will very likely be accommodative to the NETR framework in facilitating and expanding the EV ecosystem," he added.

Nevertheless, Tan said local automotive manufacturers have a target market and niche to serve and cater towards as the majority of EVs are targeted towards the upper middle class and above segments.

He said this can be seen from the price points of the Tesla Model 3, BYD Dolphin and Hyundai Ioniq.

"Subsidy rationalisation is unlikely to affect the B40 and lower M40 groups which are a huge proportion of customers for local automotive manufacturers, and they could also stand to gain from the upcoming Progressive Wage Policy implementation.

"We are looking forward to the relatively affordable EV models that will be introduced by Proton and Perodua to ride on this dominant key trend and serve this segment of consumers," he added.