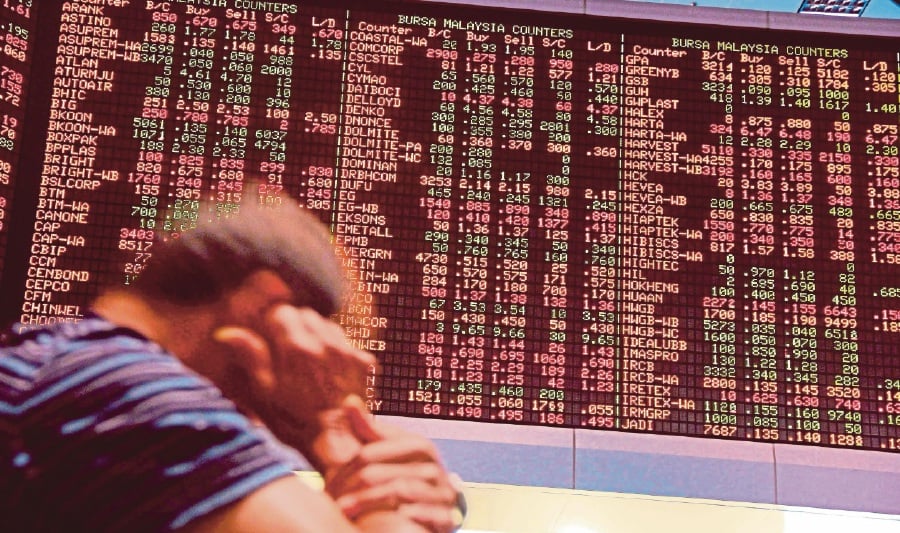

KUALA LUMPUR: Bursa Malaysia has deviated from analysts' early-year projections, as reflected by the lacklustre performance of its benchmark index throughout 2023.

The FBM KLCI ended the last trading day of the year on Friday in negative territory, slipping 0.19 per cent or 2.15 points to 1,454.66.

Bank Muamalat Malaysia Bhd chief economist Mohd Afzanizam Abdul Rashid said the FBM KLCI recorded a 2.5 per cent drop from the beginning of the year until Dec 28.

The lowest level for the year was registered at 1,374.64 points on June 8, while the highest was 1,500.33 points on Jan 20.

Compared to the Asian region, the FBM KLCI is among the indices with negative readings, along with Sngapore's Straits Times Index (-1.09 per cent), Philippine Stock Exchange Index (-0.72 per cent) and SET Thailand (-15.15 per cent.)

"The FBM KLCI has generally been off target compared to analysts' projection in early 2023.

"The foreign participation in the equities market have also been quite low to 19.5 per cent as of October 2023 compared to 20.4 per cent in January 2023 and foreign investors were a net seller amounting to RM2.5 billion in the first 11 months.

"So, overall it was a lacklustre performance in 2023, I would say," he told Business Times.

For 2024, Afzanizam said the prospects for higher FBM KLCI are visible, as the price-earnings (PE) ratio of the main index's constituents currently stood at 15 times, well below the long-term average of 17 times.

On that note, he said the local market is cheap and given that the US Federal Reserve (Fed) is likely to cut rates, there is a high chance that foreign funds might come in next year.

"Furthermore, 2024 will be a year of implementation of key policy reforms such as subsidy rationalisation and the mid to long-term plans such as the NETR and NIMP.

"Key sectors such as the semiconductor, renewable energy and to some degree rubber glove could be the crucial industries that they may want to look at.

"Should the PE ratio move towards 17 times, the FBM KLCI might end 2024 at 1,650 points," he noted.

Tradeview Capital fund manager Neoh Jia Man said based on its internally compiled statistics, the 2023 year-end FBM KLCI targets from 12 sell-side research houses had averaged at 1,661 points.

He said this suggested that analysts were anticipating an 11 per cent return for the year.

"However, the benchmark index ultimately closed lower on the last trading day and for 2023 overall.

"It is clear that Bursa Malaysia has significantly underperformed consensus expectations for the year," he noted.

Neoh attributed this to unforeseen external headwinds such as the aggressive rate hike by the Fed and the sluggish economic conditions in China.

The lack of substantial stimulus measures and the absence of major infrastructure projects rolled out by the government also contributed to the overall disappointment in performance.

Looking ahead, Neoh said while expecting even stronger external headwinds in 2024, the firm remains optimistic about the local market.

Neoh believes that the defensive qualities of the local market position it well to outperform on a relative basis.

"With the Fed widely-anticipated to cut rates in second half of next year, we expect foreign funds to potentially return to emerging markets, thereby benefiting Malaysia.

"Additionally, the potential rollout of several mega-infrastructure projects, including MRT3 and HSR, could play a significant role in reinforcing market confidence.

"Lastly, the impending imposition of a capital gains tax on foreign capital assets, including listed shares, starting from 2024, might prompt local institutions to reallocate some of their foreign asset holdings back to the local market," he added.

Putra Business School economic analyst Associate Professor Dr Ahmed Razman Abdul Latiff said while Bursa posted a negative growth this year, percentage wise, it was lower than 2022.

Even though the country has been registering positive GDP growth for the past two years, Bursa has yet to recover from the pandemic era.

"Nevertheless, it is expected that 2024 will see the local exchange start registering annual positive growth," he noted.

Factors contributing to this positive include increasing foreign direct investment and expected higher gross domestic product growth in 2024.