KUALA LUMPUR: Although the auto and auto parts industry in Malaysia is expected to see yet another record-breaking year for total industry volume (TIV), RHB Research continues to maintain its neutral position, citing a lack of catalysts in the industry to sustain sales momentum into 2024.

The research firm said that the future of the industry is still unclear.

RHB is still of the opinion that the industry will probably weaken year over year (YoY).

"We introduce our 2024 TIV forecast of 625,000 units, implying a 14 per cent YoY decline from our 2023 projection of 725,000 units. We are anticipating a softer TIV, as we do not see any compelling factors for 2024 auto sales to book another high," it said in a note today.

The auto and auto parts sectors recorded another robust month in November, with a TIV of 72,000 units sold.

According to the Malaysian Automotive Association (MAA), this brings year-to-date (YTD) TIV to 719,000 units.

The number of units sold was up 12 per cent YoY versus the 11 months to 2023 numbers (11M23).

On a month-on-month (MoM) basis, November saw slightly weaker performances from the major carmakers, led by Toyota, which saw a 6.1 per cent MoM decline.

It was followed by Perodua (-5.3 per cent) and Proton (-2.5 per cent). Honda, meanwhile, recorded a 10 per cent MoM rise.

"YTD, Perodua has sold close to 300,000 units, and we believe it is well on course to surpass its sales goal of 325,000 units for the year," RHB said.

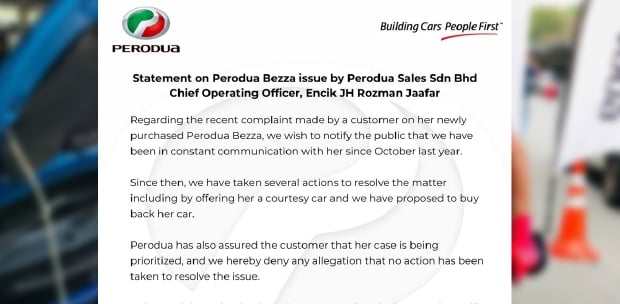

Perodua and Proton delivered 32,000 and 12,000 units in November, bringing their 11M23 numbers to 299,000 and 139,000, up 19 per cent and 14 per cent YoY. These exceed their previous annual 2022 sales figures of 282,000 and 136,000.

Both Perodua and Proton's bestsellers were their cheapest sedans, namely the Bezza and Saga, according to RHB.

"Given the elevated interest rate environment, we believe the trend of favouring cheaper models will continue in 2024 across mass-market marques such as Perodua, Proton, Toyota, and Honda," it said.