KUALA LUMPUR: The capital market needs an injection of youth, with only 7 per cent of investors in the stock market under the age of 45 and most remisiers above the age of 50.

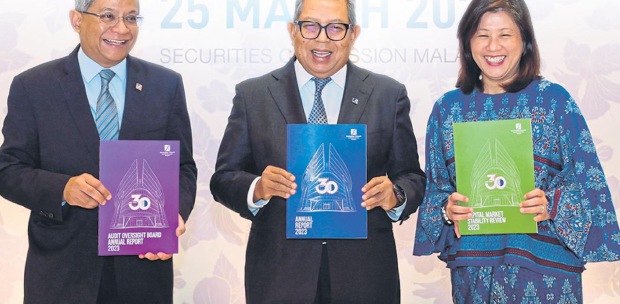

Securities Commission Malaysia (SC) chairman Datuk Seri Dr Awang Adek Hussin said only a fraction of investors in the stock market are below the age of 45, while most of the remisiers within the stockbroking industry were 50 years old and above.

"The capital market industry now badly requires injection of new blood both as employees as well as young investors.

"One worries about the stockbroking industry's future if young people are not attracted to the industry," he said in his opening remarks at the commencement of InvestED Leadership Programme at Asia School of Business.

He also noted that more young people were needed to invest in the capital market to ensure its vibrancy going forward.

"So far investors in the stock market in the age category below 45 years old constitute only seven per cent of the total investors.

"For those between the age of 20 to 30 years, the true young investors, the number must be very small.

"We therefore need young executives to attract young investors. They are more technology savvy and they understand each other better," he said.

The SC has rolled out the first cohort of programme to entice the young into the capital market, with a one-month conprehensive learning module, followed by a six-month on the job training with investED partners from the capital market industry.

The programme's one-month learning module was designed in collaboration with Asia School of Business.

Some 200 fresh graduates will undergo the programme.

As additional efforts to engage collaboration between universities and the capital market industry, Awang Adek announced on behalf of the Association of Stockbroking Companies that stockbroking companies have agreed to introduce an adoption scheme.

Under the scheme, each company adopts a university to plan and work with students and lecturers to promote greater understanding of the capital market. "These efforts will enrich students' learning experience and expose them early to the workings of the capital market while enhancing their employability and reduce their vulnerabilities to financial scams," he added.

Asia School of Business chief executive officer, president and dean Sanjay Sarma said the school's expert faculty will be able to impart cutting edge knowledge about capital market products, services as well as emerging trends to the programme participants.

"The module will be delivered via in-classroom lectures, field trips as well as business hackathons.

"We will also work towards equipping them with the necessary leadership skills to enable them to be effective in their roles within the sponsoring companies," he said. -end-