KUALA LUMPUR: Intensified competition from casinos globally for the premium mass and VIP segment with limited exposure (visitations) may affect Genting Malaysia Bhd's gaming revenue.

Affin Hwang Capital analyst Ng Chi Hoong said the gaming operator might face more competition in retaining their existing premium (VIP and pemium nass) clients, as casinos were now competing for a smaller pool of clients.

"Given that Malaysia has one of the highest gaming taxes in the region, Genting Malaysia might need to sacrifice some margins in order to maintain its competitiveness.

"We estimate that around 25 per cent of the gaming revenue for Genting Malaysia is from the premium segment," he said in a research note today.

Affin Capital believes Genting Malaysia could still be at a disadvantage competing for the premium mass and VIP clients, although the new outdoor theme park can help to improve the group's non-gaming offerings.

"The current gaming tax regime in Malaysia is not as competitive relative to the regional peers. Although Genting Malaysia's exposure to China VIP clients is relatively insignificant, we believe regional casinos would try to lure its existing premium mass and VIP clients with better offers and rebates to help fill the void left by the crackdown," Ng said.

The firm said mass market segment would be the key contributor to Genting Malaysia's gaming revenue, and it should remain intact, mainly driven by the locals.

"Mass market clients also tend to be more loyal, as premium mass and VIP clients could be easily lured away with higher rebates.

"We also believe that Genting Malaysia could take the opportunity in 2022 to do a clean-up of its books to minimise the impact from the higher one-off prosperity tax, which could potentially lead to negative earnings surprises."

Ng said the tax credits from the losses in 2019 and 2020 can be used to offset the tax payment in 2022.

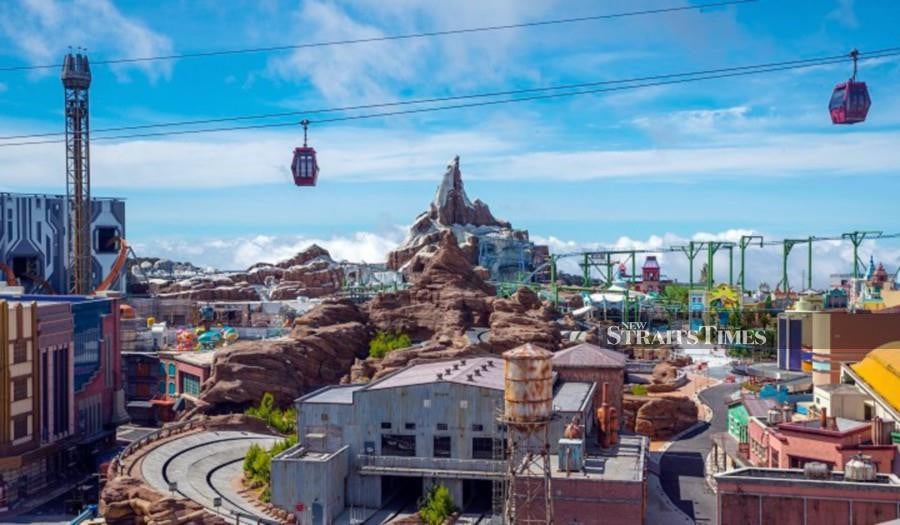

Meanwhile, he said Genting Malaysia's new theme park was likely to open in the first quarter of 2022

"However, we don't expect this to be a re-rating catalyst for the stock, given that most analysts and investors would have already factored in the effect from the opening in their estimates."

He added that the new park could operate at a capped capacity below its 20,000 visitors per day capacity due to social distancing requirement.

"The park would be operating at a loss, based on our forecast. As such, the impact from the increased overall visitation might be limited, but it would help raise the average spend per visitation."

Affin Hwang has maintained a "Hold" call with an unchanged target price of RM3.00.

"There is a high likelihood that Genting Malaysia's results in 2022 could still fall short of expectations, due to increased competition in the premium segment.

"We are also doubtful that the opening of the theme park would be a re-rating catalyst for the stock, given that most analysts and investors would have already imputed the impact of the opening in their numbers by now.

"As the new Covid-19 variant continues to emerge, we believe the overall recovery in 2022 is likely to remain patchy.

"We expect borders for international tourism to reopen in the later part of 2022," it said.